Mental Health Awareness Month: Prioritize the Mind, Support the Heart

May is Mental Health Awareness Month, a time to reflect on the importance of emotional well-being and the invisible battles many face daily. At Branco

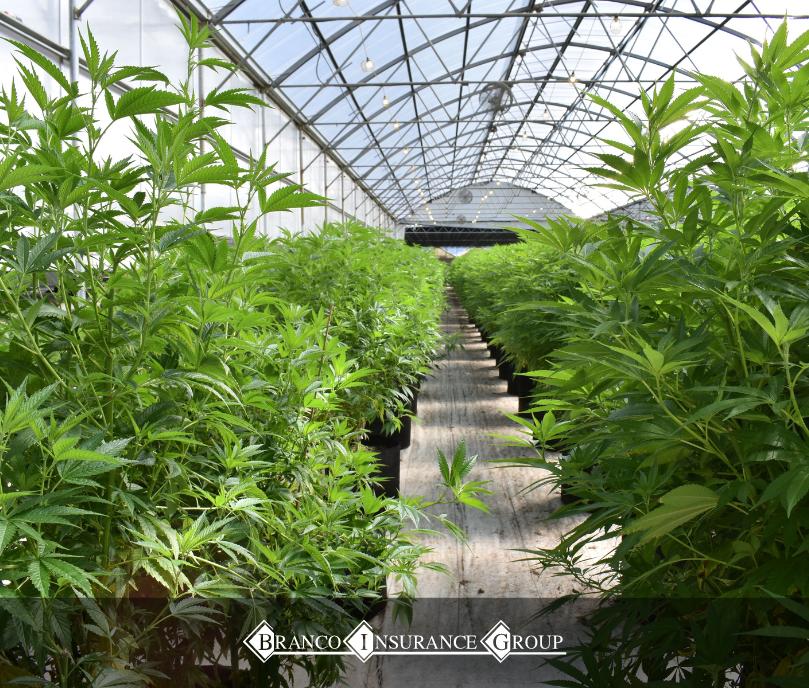

As cannabis becomes legalized in more states, the need for cannabis insurance grows. But what is cannabis insurance, and what do you need to know about it?

Cannabis insurance is a type of insurance that covers businesses that deal with cannabis. This includes dispensaries, growers, and processors. Insurance can help protect businesses from risks such as theft, property damage, and liability.

It would help to keep a few things in mind when seeking cannabis insurance. First, make sure that the policy covers the specific risks that your business faces. Next, be sure to read the fine print carefully. Policies can vary widely, so it’s essential to understand what you’re getting into.

Finally, be sure to work with an agent who understands cannabis insurance. Not all agents are familiar with this type of coverage, so it’s crucial to find one who knows the ins and outs of this market.

You may have heard of cannabis insurance, but what exactly is it? Cannabis insurance is a type of insurance that covers businesses in the cannabis industry. This can include growers, dispensaries, manufacturers, and distributors. Cannabis insurance can cover various things, including product liability, crop loss, and business interruption.

If you’re in the business of growing, selling or distributing cannabis, then you need to have cannabis insurance in place. This is because the risks associated with the cannabis industry are unique and often not covered by traditional business insurance policies. Without cannabis insurance, you could be left high and dry if something goes wrong.

The answer is most likely yes if you are in the cannabis industry. Cannabis businesses are considered high-risk by most insurance companies, so it is vital to have adequate coverage. Without insurance, you could be left financially responsible for any damages or injuries resulting from your business activities. This could ruin your business and put you in financial ruin. Don’t let that happen—get insured!

Cannabis insurance can cover various things depending on your business’s needs. Some common types of coverage include:

These are just a few examples of the available coverage types. Be sure to speak with an insurance agent to determine what type of coverage is right for your business.

As the legal cannabis industry continues to grow, so too does the need for cannabinoid businesses to have adequate insurance coverage. Cannabis insurance helps protect businesses from a wide range of risks, including product liability, crop loss, security breaches, and employee theft. If you’re in the business of growing, selling or distributing cannabis, make sure you have the right policy in place to protect your business—and your bottom line.

There are a few key benefits of having cannabis insurance for your business:

As we mentioned above, whether or not you need cannabis insurance depends on a few factors. First, you should consider the size and scope of your business. If you have a small operation with limited assets, you may not need as much coverage as a more extensive operation with more employees and products. Second, you should consider the risks associated with your business. If you are growing and selling cannabis products, you will likely need more coverage than if you are providing consulting services to cannabis businesses.

In conclusion, there are many benefits to having cannabis insurance for your business. However, whether or not you need coverage will depend on the size and scope of your operation and the risks associated with your business.

You’ve done your research, found the perfect location, and have started to build out your dream dispensary. But before you can open your doors to customers, there’s one more important step – securing insurance. Cannabis businesses are considered high-risk, so insurance companies often charge higher premiums for coverage. So, how much does cannabis insurance cost?

The short answer is that it depends on a number of factors, including the type of business you have, your location, and the amount of coverage you need. For example, a dispensary in a state with strict cannabis regulations will likely pay more for insurance than a dispensary in a state with more relaxed laws. Similarly, a business that sells cannabis products will have different insurance needs than a business that cultivates or manufactures cannabis.

Licensed cannabis insurance agents can give you a more accurate estimate of your insurance costs. They will be able to assess your specific needs and find the most comprehensive coverage at the best possible price.

Cannabis businesses are considered high-risk by most insurance companies, which often results in higher premiums for coverage. However, the exact cost of insurance will vary depending on factors such as the type of business you have, your location, and the amount of coverage you need. To get the best rate on cannabis insurance, working with a licensed agent specializing in this type of coverage is essential.

As a cannabis business owner, you know insurance is a must. Not only is it required by law in some states, but it also protects your business from any potential risks. But what happens if you need to file a claim? In this blog post, we’ll walk you through the process of filing a claim with your cannabis insurance policy.

The first thing you need to do is gather all of the relevant information. This includes the date of the incident, the time it occurred, any witnesses, and any evidence you have (photos, videos, etc.). Once you have all of this information, you’ll need to contact your insurance company and let them know that you’d like to file a claim.

The next step is to fill out the necessary paperwork. Your insurance company will likely have an online form that you’ll need to fill out. Be sure to include all relevant information so your claim can be processed quickly and efficiently.

Once you’ve submitted your claim, all you can do is wait. The insurance company will investigate the incident and determine whether or not your claim is valid. If it is, they will begin reimbursing you for any damages or losses incurred. If not, then they will deny your claim, and you’ll have to pursue other options.

Filing a claim with your cannabis insurance policy doesn’t have to be complicated or stressful. Just be sure to gather all of the relevant information, contact your insurance company, and fill out the necessary paperwork. Then all you can do is wait for a decision from the insurance company. If your claim is approved, then you’ll be reimbursed for any damages or losses incurred. If not, then you’ll need to explore other options.

While the cannabis industry is growing and evolving, it’s still considered high risk by most insurance carriers. This means that finding adequate coverage can be difficult and expensive. However, the risks of not being insured are even more remarkable. Here are some of the potential risks you face if you choose to operate your cannabis business without insurance:

The risks of not having cannabis insurance are significant. If you’re considering starting a cannabis business, ensure you understand the importance of adequate coverage. It could mean the difference between success and failure.

The cannabis business is a risky one. There are regulatory risks and the potential for product liability, crop loss, and even theft. And because the industry is still relatively new, insurance companies are still trying to figure out the best way to protect cannabis businesses. Here’s a look at some of the risks faced by cannabis businesses and how insurance can help mitigate those risks.

The cannabis industry is highly regulated, which means that there are a lot of things that can go wrong. There are many ways to run afoul of the law, from zoning issues to licensing problems. And if you do, you could face hefty fines or even have your business shut down. That’s why having a good relationship with an experienced cannabis attorney is so essential. They can help you navigate the complex web of laws and regulations that govern the industry.

Cannabis products can be dangerous, and you could be held liable if something goes wrong. That’s why it’s vital to ensure that your products are safe and that you have adequate product liability insurance in place. Product liability insurance will protect you if someone is injured by one of your products.

Cannabis crops are susceptible to various problems, from pests to diseases. And if your crop is lost or damaged, it could jeopardize your business. That’s why it’s vital to have crop insurance in place. Crop insurance will reimburse you for any losses incurred due to problems with your crop.

Cannabis businesses are often targets for thieves. Whether it’s stealing plants or products, theft is a real risk in the cannabis industry. That’s why it’s crucial to have adequate security in place and ensure that your insurance policy covers theft.

The cannabis business is risky, but there are ways to mitigate those risks. By working with an experienced cannabis attorney and having adequate insurance in place, you can protect your business from some of the most common risks faced by cannabis businesses.

Cannabis insurance is integral to running a safe and successful cannabis business. Understanding what it is, what it covers, and how much it costs will help you make the best decision for your business. Remember the process of properly filing a claim with your policy if something goes wrong. And finally, remember that owning a cannabis business without insurance coverage can be risky- so make sure you’re protected! Do you have a better idea of what cannabis insurance you need? If not, contact our cannabis insurance experts at Branco Insurance Group. We would be happy to help answer any questions you may have about insuring your cannabis business.

May is Mental Health Awareness Month, a time to reflect on the importance of emotional well-being and the invisible battles many face daily. At Branco

Two of Naugatuck’s long-standing insurance professionals have joined forces. Beginning on April 14th, the Healy-Lynn Insurance Agency has become a division of Branco Insurance Group.