How Employees Can Help Reduce Cybersecurity Risks

Many small businesses conduct themselves directly online. Having employees who are not properly trained in cybersecurity can increase the risk of a cyberattacks. Adequate cybersecurity

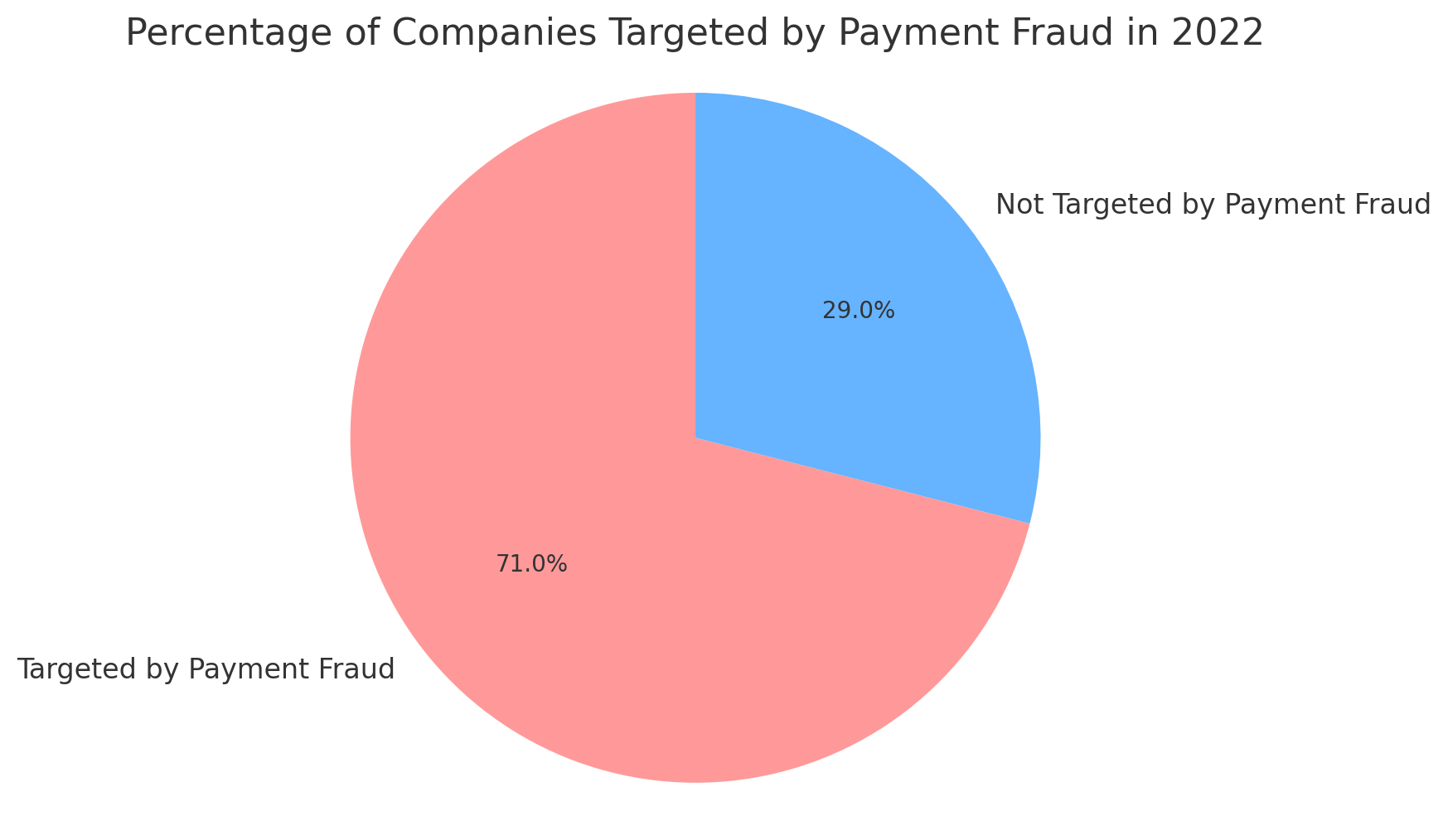

Crime can happen anywhere, even at the best-run companies. From petty theft to sophisticated cyber scams, criminal activity poses a serious threat to every organization’s financial health and reputation. According to the Association of Certified Fraud Examiners (ACFE), businesses worldwide lose approximately 5% of annual revenues to fraud. For small and mid-sized companies especially, a single large loss can be catastrophic.

Crime insurance provides an affordable way for companies to protect against potentially devastating losses from crime. This comprehensive guide will explain everything business owners need to know about securing the right crime policy to safeguard their assets and operations from both internal and external risks.

Commercial crime insurance, sometimes called fidelity coverage, is a type of business insurance that protects companies from direct losses resulting from criminal activity. It covers financial losses from crimes such as:

Crime policies cover losses resulting from crimes perpetrated both by employees and third parties. They protect money, securities, inventory, equipment, and other business property.

Crime insurance fills an important gap since most commercial property and liability policies explicitly exclude losses from criminal acts. It pays out when criminals – whether inside or outside the company – steal or damage the insured’s own assets.

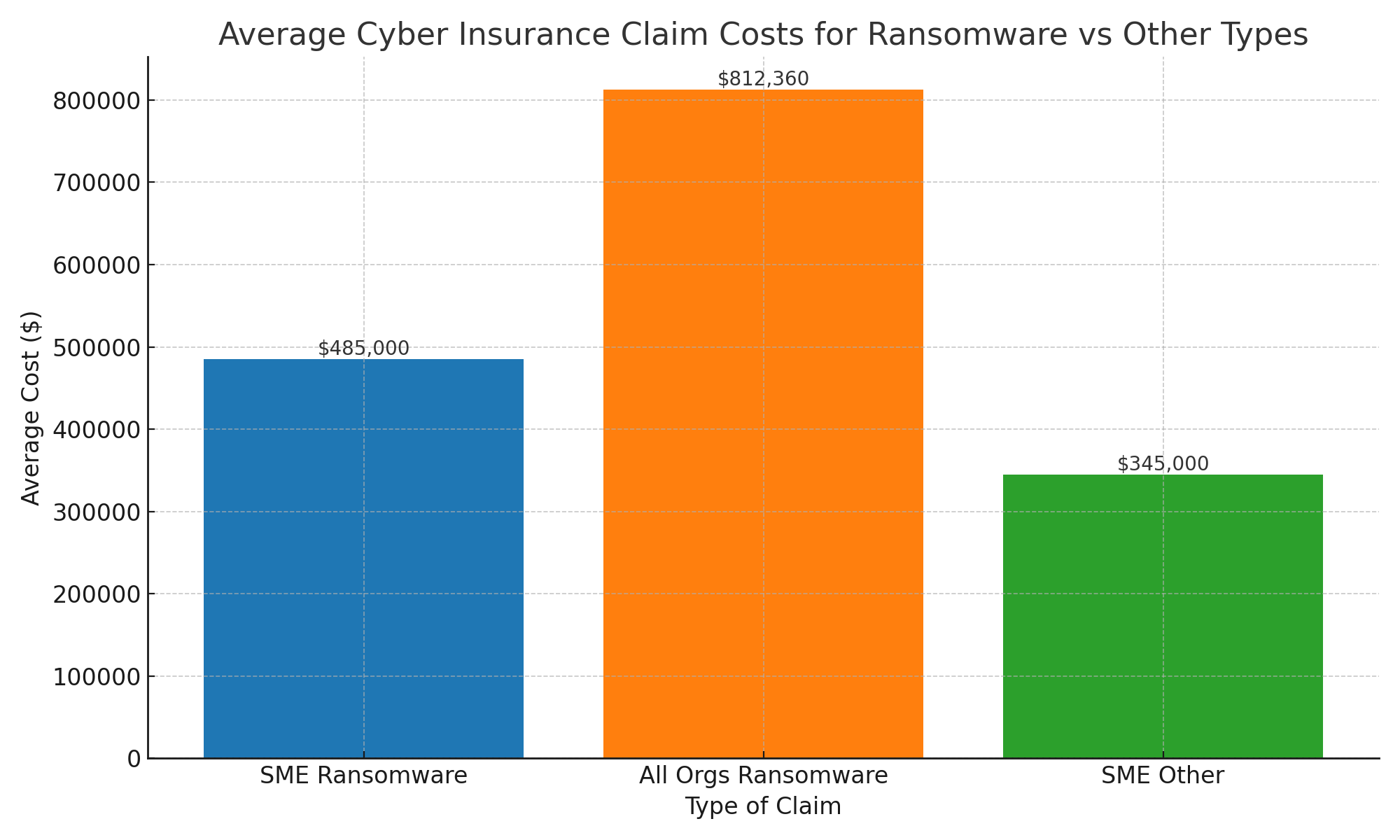

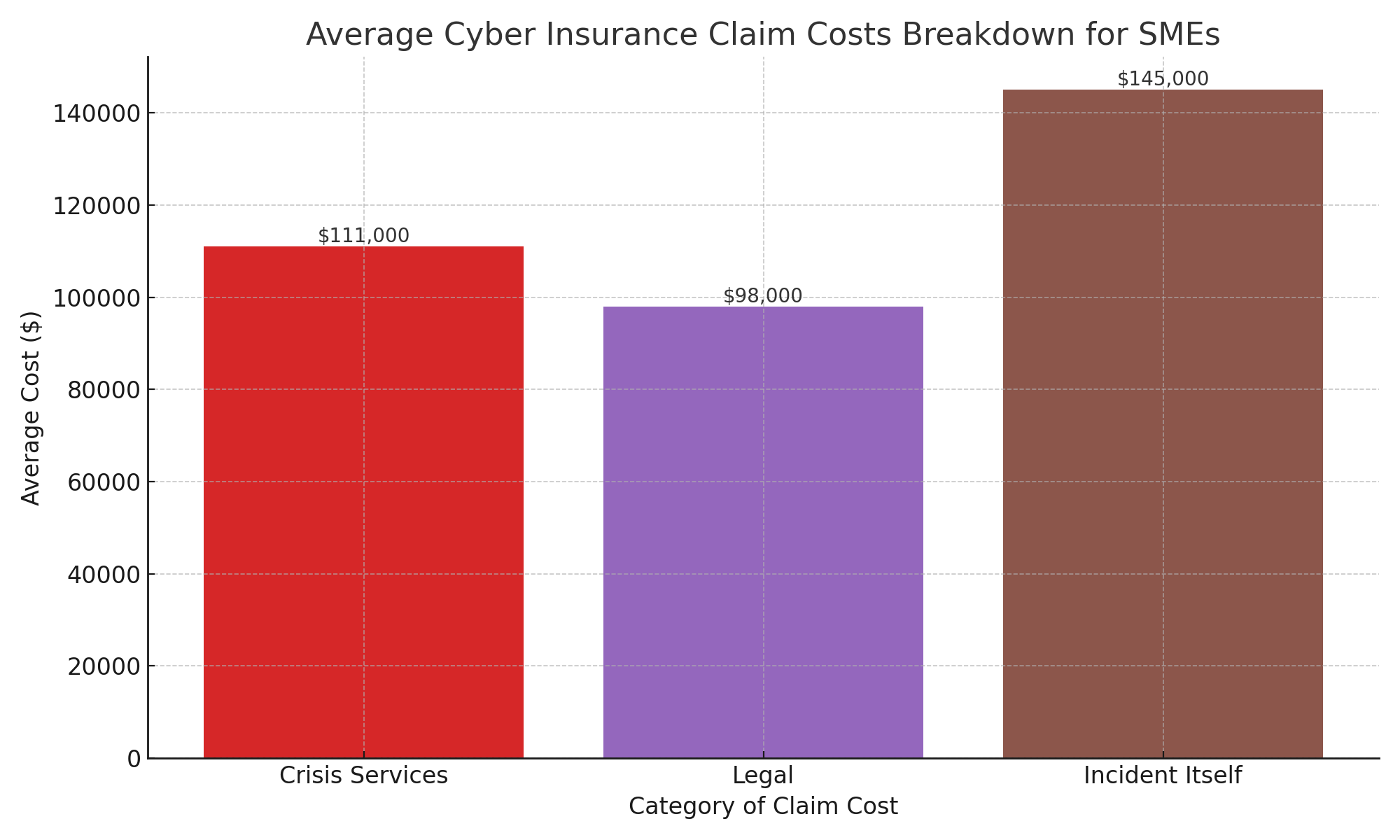

Whereas cyber insurance focuses on data breaches and network security incidents, crime coverage zeroes in on direct financial theft and fraud. Crime and cyber policies complement each other to offer comprehensive protection.

The scale of losses suffered by victim companies can be staggering. According to the ACFE’s 2020 Global Fraud Study, the median loss from a single corporate fraud scheme was $125,000. For small businesses with modest revenues, a loss of that magnitude can be utterly devastating.

Even with rigorous internal controls, experienced management, and trusted employees, organizations of all sizes remain vulnerable to crime:

For these reasons, experts strongly recommend small and mid-sized businesses secure crime coverage to mitigate their exposure. Crime insurance represents a straightforward, cost-effective way to transfer the risk of catastrophic loss.

Crime policies vary between insurance carriers, but most offer a suite of coverages for the major types of criminal acts that cause financial loss. Here are some of the key coverages to look for in a commercial crime policy:

Also called employee dishonesty coverage, this insures against loss from theft of money, inventory, equipment, data, or other property by workers. It covers many types of criminal employee behavior including:

Coverage usually applies to all employees, including managers, temporary workers, and remote employees. Policies differ on whether they cover theft by independent contractors or volunteers as standard or optional add-ons.

Table 1: Breakdown of Average Claim Costs by Crime Type

Crime Type | Direct Loss | Legal Defense | Settlements | Total Average Claim |

Employee Theft | $100,000 | $30,000 | $20,000 | $150,000 |

Robbery | $5,000 | $1,000 | $1,000 | $7,000 |

Check Forgery | $10,000 | $12,000 | $2,000 | $24,000 |

Cyber Crime | $150,000 | $40,000 | $10,000 | $200,000 |

This covers the loss of money and other property stolen by non-employees from inside the insured’s premises during business hours. For example, robbery or shoplifting by customers, vendors, or other visitors.

Also called messenger coverage, this insures against theft of money and property when employees are conducting business away from the main insured location. For example, theft from a company vehicle, salesperson’s car, or employee’s home office.

This covers financial losses due to forged checks, payment orders, invoices, contracts, or other financial documents. Forged signatures, endorsements, and counterfeit paperwork are commonly used in external fraud schemes.

This insures against theft of money or securities from the company resulting from computer hacking or fraudulent electronic communications such as:

Funds transfer fraud and cyber scams cost victim companies billions annually. This coverage is essential for protecting financial accounts in the digital age.

This covers unauthorized use of company credit cards or credit card numbers, including physical theft of cards and electronic theft of account data. It may cover merchant chargebacks for fraudulent transactions.

This pays certain costs resulting from identity theft targeting the business, such as expenses to restore credit, replace documents, or correct public records. It does not cover direct financial losses from identity fraud.

Policies may offer limited coverage for investigative costs to establish the existence and amount of covered losses. This may include forensic accounting, IT forensics, or attorney fees.

Crime insurance policies contain important exclusions and limitations to understand. Some key exclusions found in many policies include:

Crime policies also contain special limits and waiting periods that apply for certain types of losses. It’s essential to read the full policy document and disclosures to be aware of all limitations. An insurance broker can explain the fine print to help make sure you have the coverage your business needs.

According to specialists at Embroker Insurance Services, rates for crime insurance typically range from 0.5% to 2% of total insured value. In other words, $1,000 to $4,000 in annual premiums per $100,000 of coverage. Exact premiums depend on these factors:

Ask insurers about policy discounts and bundle crime with other business insurance plans to maximize savings. Comparing quotes from multiple A-rated providers ensures you find the best value.

Table 2: Crime Policy Premium Example for Mid-Sized Company

Coverage | Limit | Base Premium | Discounts/Surcharges | Final Premium |

Employee Theft | $250,000 | $1,500 | -$200 (security system) | $1,300 |

Forgery | $50,000 | $750 | +$100 (claims history) | $850 |

Cyber Crime | $100,000 | $1,000 | -$150 (IT audits) | $850 |

Total | $400,000 | $3,250 | -$250 | $3,000 |

If your business suffers a loss from crime, a smooth insurance claims process depends on three key factors:

Work closely with your insurance broker and legal counsel to successfully demonstrate your claim after a crime loss.

Beyond getting the right insurance, businesses can take proactive steps to reduce the chance of crime incidents and minimize potential losses:

If a significant crime loss does occur, notify law enforcement and insurers promptly. Work with forensic specialists to investigate, quantify damages, restore compromised systems, and implement new risk controls to prevent repetition.

No company is immune to crime. But with proper precautions and the right insurance partner, businesses can defend against potentially devastating criminal acts threatening their finances and future. Crime insurance brings peace of mind that your livelihood is protected even in the worst scenarios.

Table 3: Crime Policy Structuring Recommendations

Revenue | Locations | Prior Claims | Recommendation |

<$1M | Single | No | Endorse BOP |

$2M | Few | Yes | Standalone policy |

$5M+ | Multiple | No | Endorse D&O + Umbrella |

Crime presents a constant danger that can disrupt businesses and destroy livelihoods. But with the right commercial crime policy, companies can defend themselves against internal and external threats targeting their finances.

Crime insurance provides an affordable way to transfer the risk of potentially catastrophic losses from theft, fraud, cyber crimes, and other criminal acts. Comprehensive protection safeguards your hard-earned assets and ensures your company’s future is never jeopardized by unforeseen crime.

For small and mid-sized businesses especially, securing this essential coverage is a smart investment. Crime policies customizable to your specific risk profile and budget are available from leading insurers.

At Branco Insurance Group, our experienced agents make it fast and easy to get covered. We work with top-rated insurers to find you the optimal crime insurance solution at the best value.

Contact us today for a free quote assessment. We’ll review your current policies, risks, and needs to advise if a crime policy makes sense. There’s no obligation to buy.

Don’t leave your company exposed. With customized crime insurance from Branco Insurance Group, you can be confident your finances are shielded from harm. Request a quote now to start the conversation.

Crime insurance, also known as commercial crime coverage or fidelity insurance, covers a business against losses from criminal activity such as:

Crime policies protect money, securities, equipment, and other valuable business property when stolen by employees or third parties. They fill gaps left by commercial property insurance.

Yes, fidelity and crime insurance are different names for the same type of coverage. Both terms refer to insurance policies that protect businesses from losses resulting from criminal acts like employee theft, forgery, robbery, and cyber crimes.

These policies may also be called commercial crime coverage, employee dishonesty insurance, or fidelity bonds. But all these terms fundamentally refer to coverage against crime losses.

The main difference lies in what direct losses are covered:

Crime policies cover internal and external theft of tangible assets. Cyber policies address digital threats like hacking, viruses, and disclosure of private data.

The two policies complement each other for comprehensive protection.

Insurers calculate crime insurance premiums based on factors like:

Higher revenue businesses pay more in premiums as they have greater exposure. Stronger security and financial oversight typically earn discounts on rates.

Many small businesses conduct themselves directly online. Having employees who are not properly trained in cybersecurity can increase the risk of a cyberattacks. Adequate cybersecurity

Because seasonal changes affect your vehicle in a multitude of ways, it’s important to prepare for the transition from summer to fall. You’ll want to