Electric vehicles (EVs) are becoming increasingly popular as drivers look for eco-friendly options to reduce their carbon footprint and save money on gas. While EVs provide many benefits, insuring them can be different than insuring a traditional gas-powered car. This in-depth guide will provide you with everything you need to know about electric car insurance to find the right policy at an affordable rate.

The Rising Popularity of Electric Vehicles

Over the last decade, electric vehicles have gone from a niche product to a mainstream option embraced by automakers and drivers alike. There are a few key reasons for the surging popularity of EVs:

- Improved EV technology: With advancements in battery technology and electric motors, EV driving range and performance now match or exceed many gas-powered cars. Manufacturers like Tesla have helped accelerate innovation in the EV market.

- More affordable EVs: While still pricier than comparable gas cars, electric vehicles are becoming more competitively priced as technology improves and manufacturing scales. The average price for an EV has dropped substantially in recent years.

- Gas savings: With gas prices fluctuating, many drivers are attracted to EVs to save money at the pump. Electricity is a cheaper “fuel” cost than gasoline.

- Environmental benefits: Electric vehicles produce zero direct emissions, which helps combat climate change and reduce pollution. EVs appeal to eco-conscious consumers.

- Government incentives: Federal, state, and local incentives can reduce the upfront cost of buying an EV. These include tax credits, rebates, grants, and special electricity rates for EV charging.

According to Argonne National Laboratory, over 73,000 plug-in electric vehicles were sold in the U.S. in May 2022. That’s a 46% increase versus the previous year. Major automakers now offer multiple EV models as consumer interest accelerates.

Key Takeaways on Electric Car Insurance

- Electric vehicles cost more to insure on average than similar gas models due to higher replacement costs, battery pack repairs, and other factors. However, the gap in premiums is narrowing over time.

- EV insurance follows the same process as gas car insurance. Shop multiple top insurers for quotes and compare rates. Emphasize any safety technologies to agents.

- Inquire about potential discounts like green vehicles, safe drivers, and multi-policy savings to help offset higher electric car insurance costs.

- Tesla owners have access to customized EV insurance from Tesla that includes perks like 24/7 roadside assistance, battery coverage, and usage-based premiums.

- Take advantage of tax incentives, fuel savings, and insurance discounts to maximize the money you save by going electric.

While insuring an electric vehicle costs more upfront, you can realize significant savings over the total cost of ownership of your EV through reduced maintenance and fuel expenses along with government incentives. Finding the right insurance policy to fit your budget and coverage needs takes some legwork, but the long-term benefits of driving electric make it worthwhile for many consumers.

Why Electric Cars Can Cost More to Insure

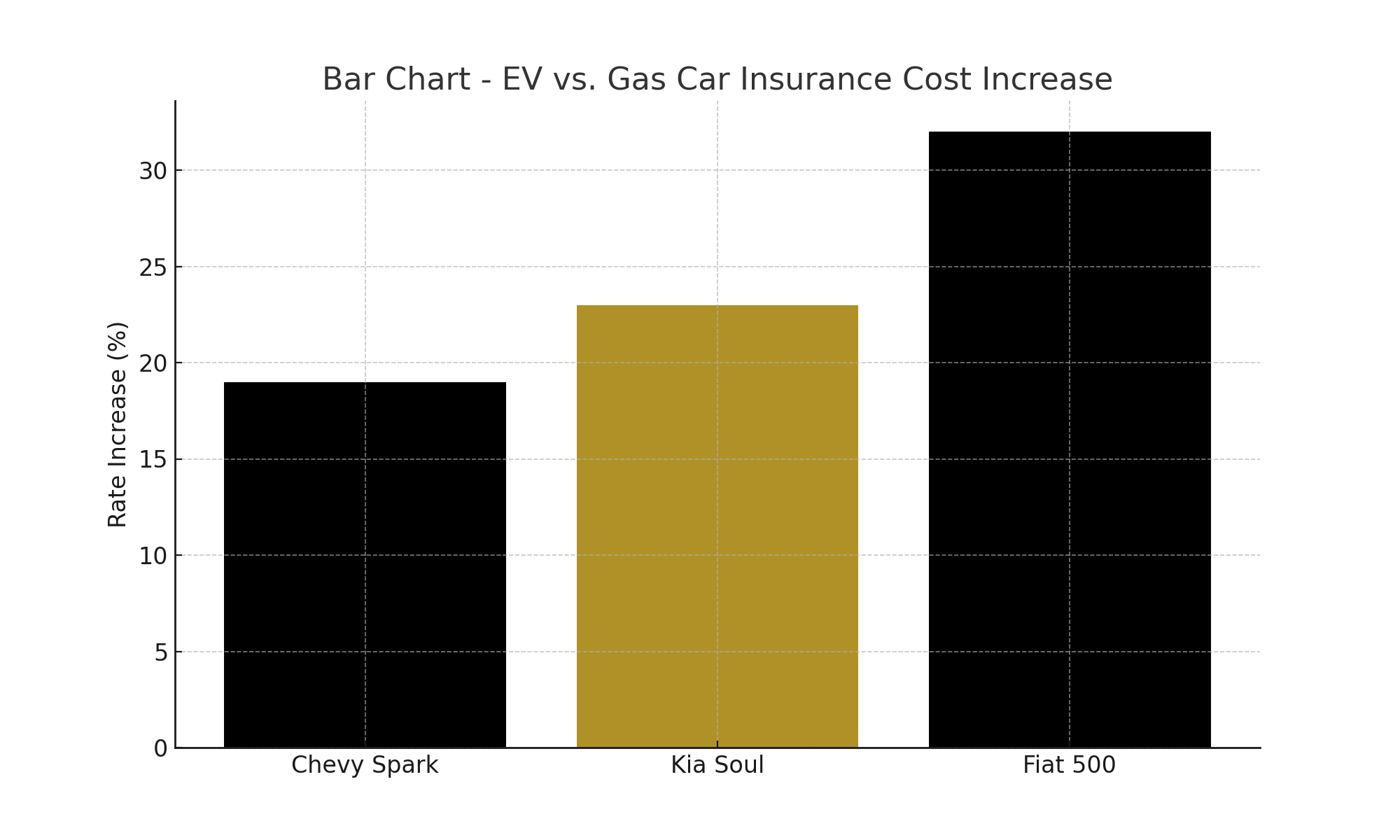

While providing many benefits, insuring an electric vehicle is frequently more expensive than insuring a comparable gas-powered car. There are a few key factors that cause EV insurance premiums to be higher:

- Expensive replacement cost: The sticker price of an electric vehicle is usually higher than a similar gas model. For example, a 2022 Nissan Leaf has an MSRP starting around $28,000 while a comparable Nissan Versa starts around $16,000. Due to the higher replacement cost, insurance rates are also higher.

- Battery pack repairs: EV battery packs can be very expensive to replace if damaged in an accident. Replacing a battery pack often costs between $5,000 to $15,000, which is reflected in insurance claim payouts.

- Specialized repair requirements: Many auto repair shops are not equipped to service electric vehicles, which may limit options for insurance-paid repairs after an accident. Labor rates at EV specialty shops tend to be higher as well.

- Rapidly evolving technology: Insurers tend to be cautious with covering rapidly advancing technologies like EV systems. The long-term repair and replacement costs are still emerging.

- Higher injury claims: Some research indicates electric vehicles may have higher injury claim rates in accidents due to their instant torque and quiet operation. Higher injury claims lead to higher premiums.

In order to offset the potential for very high-cost claims, insurers charge more for electric vehicle policies. However, as EVs become more commonplace, insurance pricing trends closer to gas vehicles.

Table 1: Factors Influencing Electric Car Insurance Costs

Factor | Impact on Insurance Rates |

Vehicle Price | More expensive EVs cost more to insure due to higher replacement cost |

Repair Costs | Specialized EV repairs and battery replacements raise insurer claim costs |

Driver Record | Good drivers pay less, high-risk drivers pay more regardless of vehicle |

Vehicle Size | Larger EVs like SUVs tend to have higher insurance rates |

Safety Features | Advanced driver aids can lower insurance costs |

Driving Habits | Mileage, speeding, distracted driving affect premiums |

Garaging Location | Insurance costs more in high-crime areas or regions prone to weather risks |

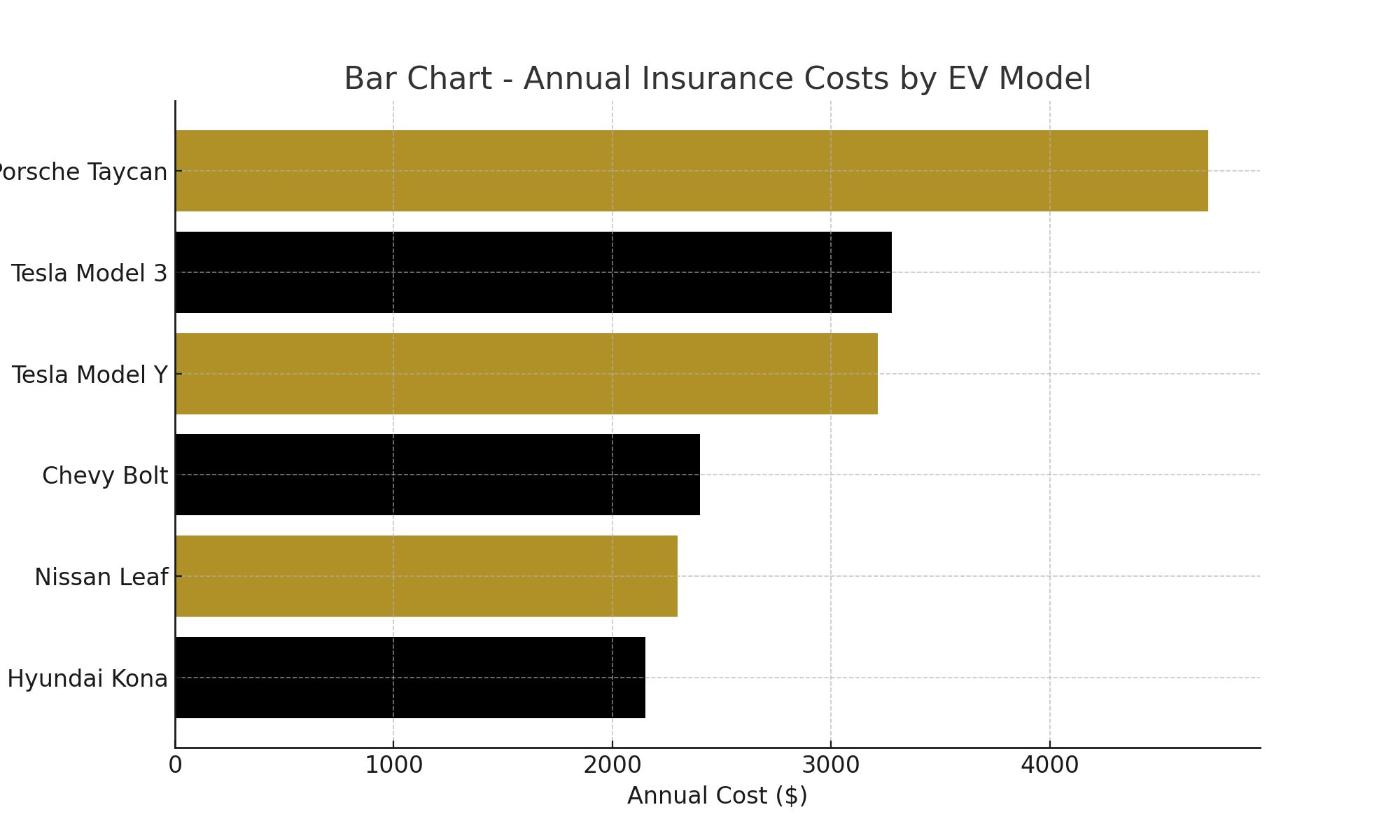

Average Insurance Costs for Popular Electric Models

To compare average insurance costs, we’ll look at rates for some of the best-selling electric vehicle models:

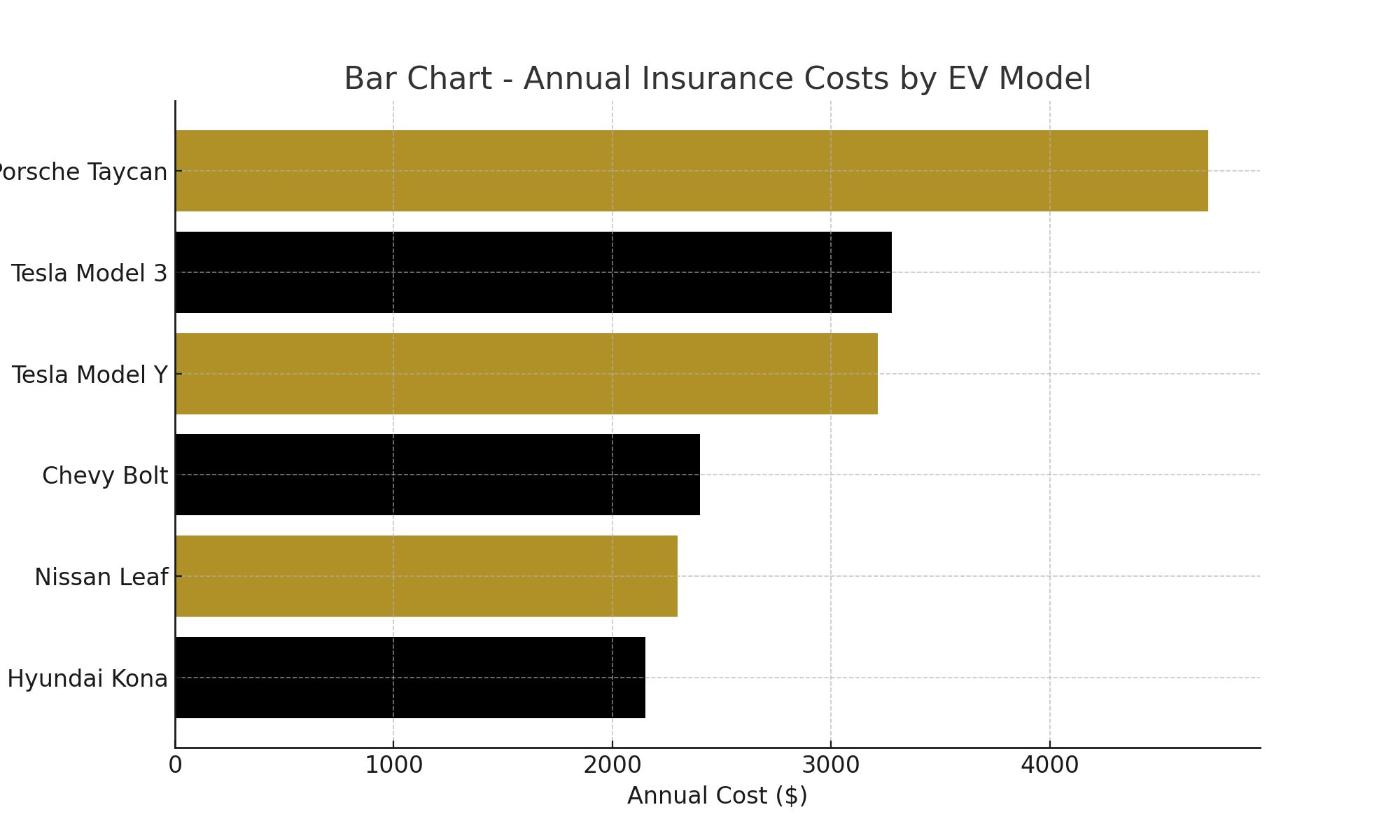

- Nissan Leaf: The 2022 Nissan Leaf starts around $28,000 MSRP. Average annual insurance for a Leaf is around $1,800 for full coverage according to Bankrate, slightly under the national average of $2,014.

- Chevrolet Bolt: With a starting MSRP of about $32,000, the Chevy Bolt has an average insurance cost of approximately $2,000 per year for full coverage. This is very close to the national average insurance rate.

- Tesla Model 3: The popular Tesla Model 3 has a current starting price of about $47,000. Average yearly insurance runs around $2,500 for full coverage based on Bankrate data.

- Tesla Model X: The larger Tesla SUV has an MSRP starting around $120,000, leading to steep insurance costs. Average yearly rates for a Model X are over $4,300 for full coverage.

The large variation in average insurance costs highlights the significant impact of vehicle prices on EV insurance rates. More expensive EVs cost substantially more to insure due to their high value.

How to Get Insurance for an Electric Vehicle

Getting insurance for an electric vehicle is fortunately straightforward in most cases. Here are some tips for finding the right policy:

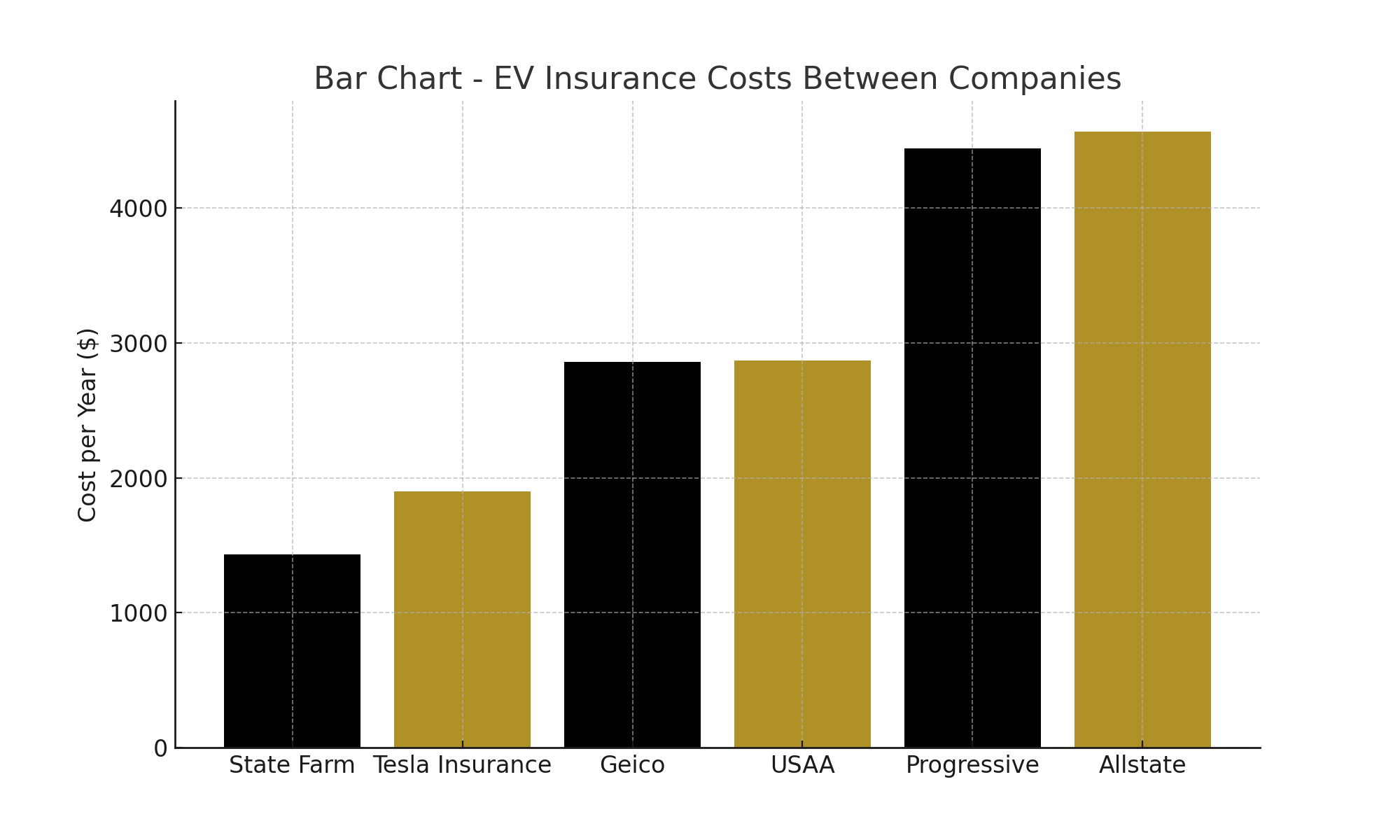

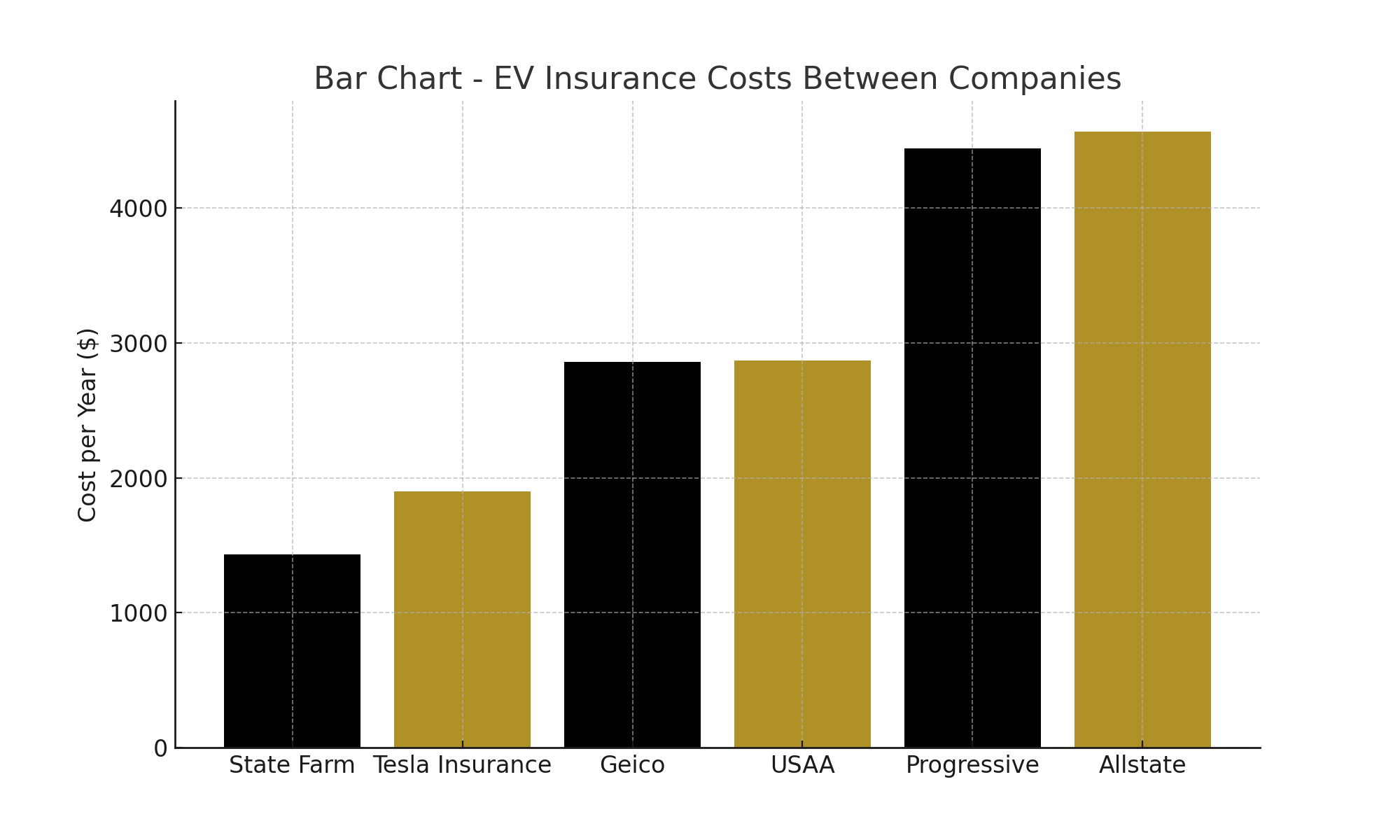

- Check major insurers: Most large insurance providers like State Farm, Allstate, and Geico offer electric vehicle policies. Start your search by getting quotes from major national carriers.

- Compare specialized insurers: Some insurance companies specialize in EV coverage. Compare quotes from providers like Clearcover who focus exclusively on electric vehicles.

- Highlight safety features: Today’s EVs offer advanced safety technologies standard, like automatic emergency braking. This can help lower your rates. Discuss all safety features with agents.

- Ask about discounts: Inquire with insurers about any electric vehicle discounts they offer. This could help offset the higher premium costs of EVs.

- Consider bundled policies: You may be able to save by bundling your EV insurance with homeowner’s or renter’s insurance from the same provider. Ask each agent about bundling options.

- Review policy limits/deductibles: Make sure liability limits are sufficient for an expensive EV. Also, set optimal deductibles to balance premium costs with out-of-pocket accident expenses.

- Compare quotes: Get quotes from at least 3-5 providers before choosing a policy for your electric car. Rates can vary greatly between insurance companies.

Taking the time to shop around and compare electric vehicle policies can yield significant savings while still providing adequate protection. Be sure to reassess your coverage needs as you transition to an EV.

Table 2: Bundling Discounts from Major Insurance Providers

Company | Auto Discount | Home Discount | Total Potential Savings |

Geico | Up to 15% | Up to 15% | Up to 30% |

Allstate | Up to 30% | Up to 25% | Up to 55% |

State Farm | Up to 35% | Up to 35% | Up to 70% |

Progressive | Up to 35% | Up to 35% | Up to 70% |

Unique Insurance Options for Tesla Owners

As a pioneering force in electric vehicles, Tesla provides their own specialized insurance products for Tesla drivers. Here are some unique features of Tesla’s insurance offering:

- Customized for Teslas: Coverage options and premiums are tailored specifically for Tesla models based on real-world data for repair costs, claims frequency, etc.

- Usage-based rates: Tesla insurance uses data from your vehicle to factor driving habits into your personalized premium. Rates are adjusted monthly based on your driving behaviors.

- EV extras included: Tesla insurance bundles add-ons like battery replacement, EV charging equipment, and loss of use coverage during repairs. Other insurers charge extra for these coverages.

- 24/7 roadside assistance: Tesla insurance includes 24-hour roadside assistance with services like towing, battery charging, tire changes, and lock-out help. Tesla personnel handle all Tesla-related roadside needs.

- Only for Teslas: Drivers must own a Tesla vehicle to qualify for Tesla insurance. Tesla coverage is not available for other non-Tesla EVs.

- Select states only: Tesla insurance is currently limited to California, Texas, Illinois, and a handful of other states. Availability is expanding over time.

For Tesla owners, the automaker’s EV insurance provides specialized protection designed specifically around their vehicles. Tesla’s usage-based rates also reward safe driving habits with lower premiums. However, Tesla insurance may not be the most affordable option for all drivers.

Other Ways to Save on Electric Vehicle Insurance

Beyond shopping around for the best electric car insurance policy, there are additional ways EV owners can save on their premiums:

- Maximize discounts: Take advantage of any discounts offered by insurers, like multi-policy, safe driver, good student, new vehicle, and green car discounts.

- Boost safety features: Adding aftermarket safety devices like backup cameras and VIN etching for theft deterrence can qualify you for insurance discounts.

- Reduce mileage: Consider pay-per-mile insurance or a low mileage discount if your electric vehicle will be driven fewer than average miles per year.

- Drop collision/comprehensive: Drivers on a tight budget may be able to remove collision and comprehensive coverage and just carry state minimum liability limits.

- Raise deductibles: Accepting higher deductibles in exchange for lower premiums makes sense if you have significant savings set aside for out-of-pocket accident repairs.

- Improve credit score: Maintaining a good credit score can significantly lower your electric car insurance rates in most states where credit factors into underwriting.

- Review updates annually: Revisit your EV policy each renewal period to account for discounts, improved driving records, usage changes, and other ways to save.

Finding the right balance between adequately protecting your electric vehicle asset and keeping costs in check takes some work. But a bit of effort can yield hundreds of dollars in EV insurance savings each policy term.

Table 3: Electric Car Incentives and Savings by State

State | Rebates | Tax Credits | Special Rates | HOV Access | Total Potential Savings |

California | Up to $4,500 | Up to $750 | Yes | Yes | Up to $7,500 |

Colorado | Up to $5,000 | – | – | Yes | Up to $6,500 |

Florida | – | – | – | Allowed | Varies |

New York | Up to $2,000 | Up to $500 | Yes | – | Up to $4,000 |

Don’t Get Shocked – Insure Your EV Properly

Transitioning to an electric vehicle can be exciting yet daunting when it comes to insurance. While EVs offer many money-saving and eco-friendly benefits, insuring them properly is critical to protect your investment in case of an accident.

At Branco Insurance Group, we specialize in providing customized insurance solutions for hybrid and electric vehicle owners. Our agents understand the nuances of insuring these newer vehicles – from higher replacement values to costlier specialized repairs. We’ve helped countless drivers make the switch to electric with peace of mind by structuring policies to meet their specific needs and budgets.

If you recently purchased or leased an EV, give us a call to discuss your coverage options. We’ll make sure you have the right liability limits, deductibles, and add-ons like battery replacement coverage. And we’ll identify any discounts you may be eligible for, like a green vehicle, safe driver, and multi-policy savings.

With Branco Insurance Group as your partner, you can enjoy your electric vehicle knowing you’ve got a policy tailored to provide exceptional protection. We’ll even regularly review your policy to account for any changes over time. Go electric with confidence by contacting our experts today to make sure your EV is properly insured.