Why Regular Gutter Cleaning is Essential

Your home’s gutters play a crucial role in protecting your property from water damage. They channel rainwater away from your roof, walls, and foundation, preventing

Electric vehicles (EVs) are becoming increasingly popular as drivers look for eco-friendly options to reduce their carbon footprint and save money on gas. While EVs provide many benefits, insuring them can be different than insuring a traditional gas-powered car. This in-depth guide will provide you with everything you need to know about electric car insurance to find the right policy at an affordable rate.

Over the last decade, electric vehicles have gone from a niche product to a mainstream option embraced by automakers and drivers alike. There are a few key reasons for the surging popularity of EVs:

According to Argonne National Laboratory, over 73,000 plug-in electric vehicles were sold in the U.S. in May 2022. That’s a 46% increase versus the previous year. Major automakers now offer multiple EV models as consumer interest accelerates.

While insuring an electric vehicle costs more upfront, you can realize significant savings over the total cost of ownership of your EV through reduced maintenance and fuel expenses along with government incentives. Finding the right insurance policy to fit your budget and coverage needs takes some legwork, but the long-term benefits of driving electric make it worthwhile for many consumers.

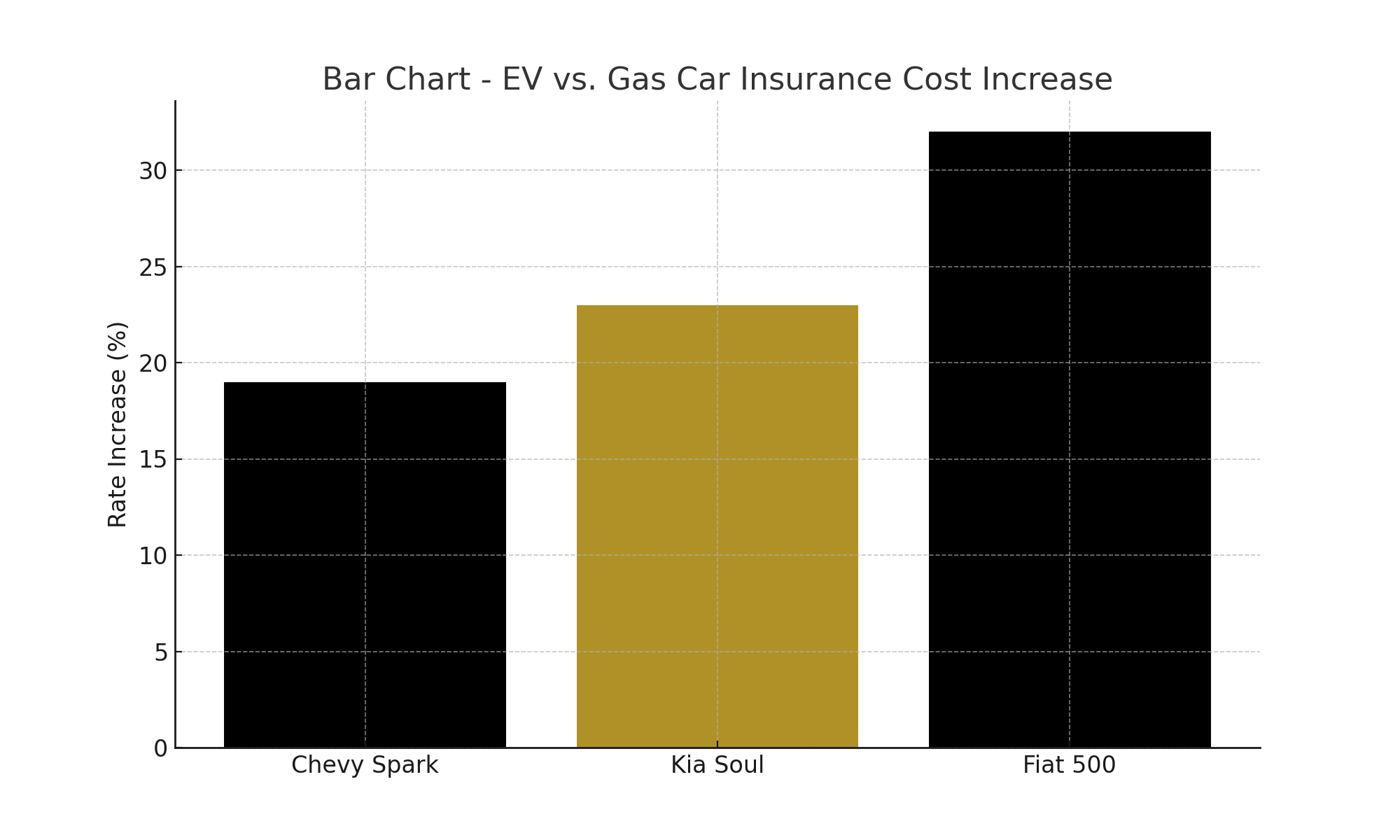

While providing many benefits, insuring an electric vehicle is frequently more expensive than insuring a comparable gas-powered car. There are a few key factors that cause EV insurance premiums to be higher:

In order to offset the potential for very high-cost claims, insurers charge more for electric vehicle policies. However, as EVs become more commonplace, insurance pricing trends closer to gas vehicles.

Table 1: Factors Influencing Electric Car Insurance Costs

Factor | Impact on Insurance Rates |

Vehicle Price | More expensive EVs cost more to insure due to higher replacement cost |

Repair Costs | Specialized EV repairs and battery replacements raise insurer claim costs |

Driver Record | Good drivers pay less, high-risk drivers pay more regardless of vehicle |

Vehicle Size | Larger EVs like SUVs tend to have higher insurance rates |

Safety Features | Advanced driver aids can lower insurance costs |

Driving Habits | Mileage, speeding, distracted driving affect premiums |

Garaging Location | Insurance costs more in high-crime areas or regions prone to weather risks |

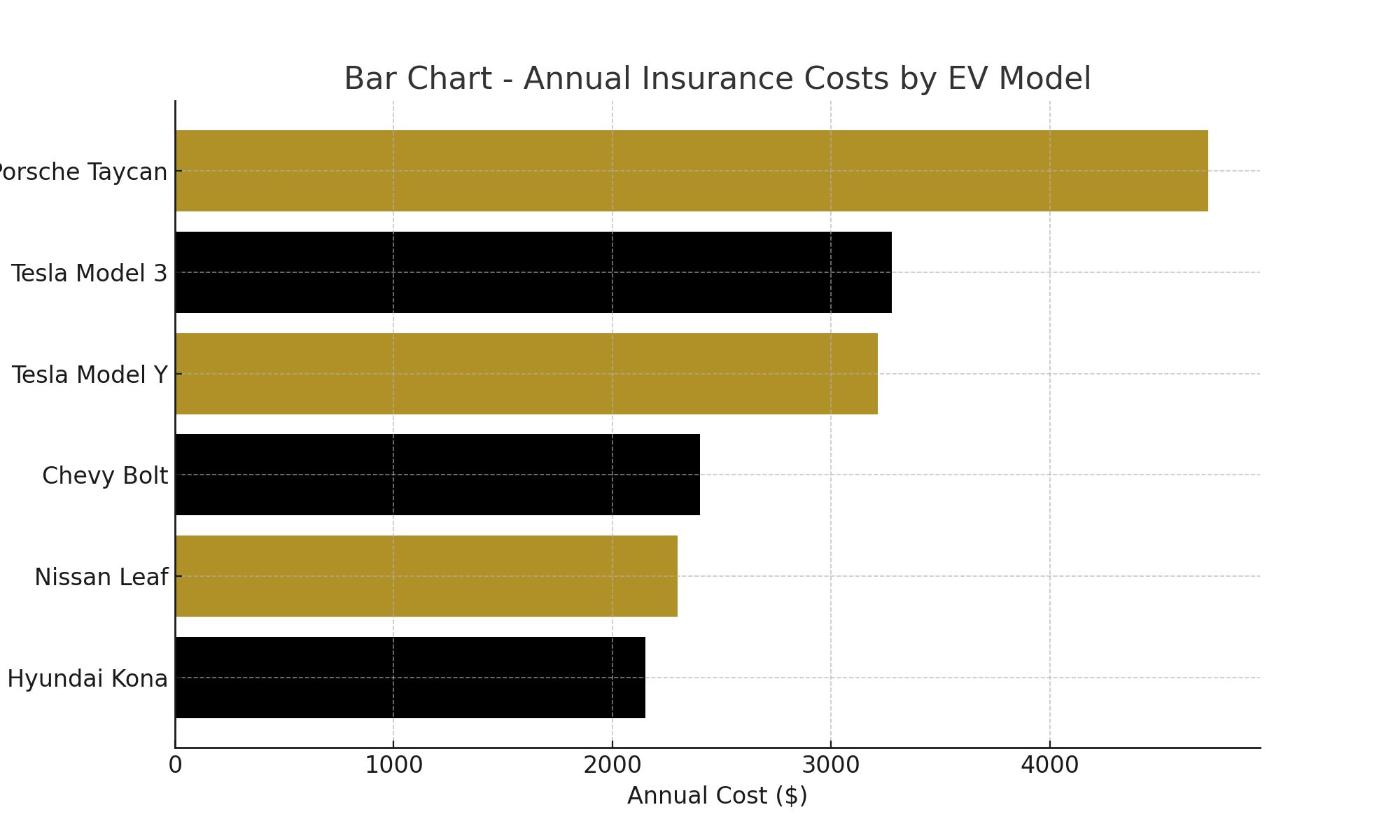

To compare average insurance costs, we’ll look at rates for some of the best-selling electric vehicle models:

The large variation in average insurance costs highlights the significant impact of vehicle prices on EV insurance rates. More expensive EVs cost substantially more to insure due to their high value.

Getting insurance for an electric vehicle is fortunately straightforward in most cases. Here are some tips for finding the right policy:

Taking the time to shop around and compare electric vehicle policies can yield significant savings while still providing adequate protection. Be sure to reassess your coverage needs as you transition to an EV.

Table 2: Bundling Discounts from Major Insurance Providers

Company | Auto Discount | Home Discount | Total Potential Savings |

Geico | Up to 15% | Up to 15% | Up to 30% |

Allstate | Up to 30% | Up to 25% | Up to 55% |

State Farm | Up to 35% | Up to 35% | Up to 70% |

Progressive | Up to 35% | Up to 35% | Up to 70% |

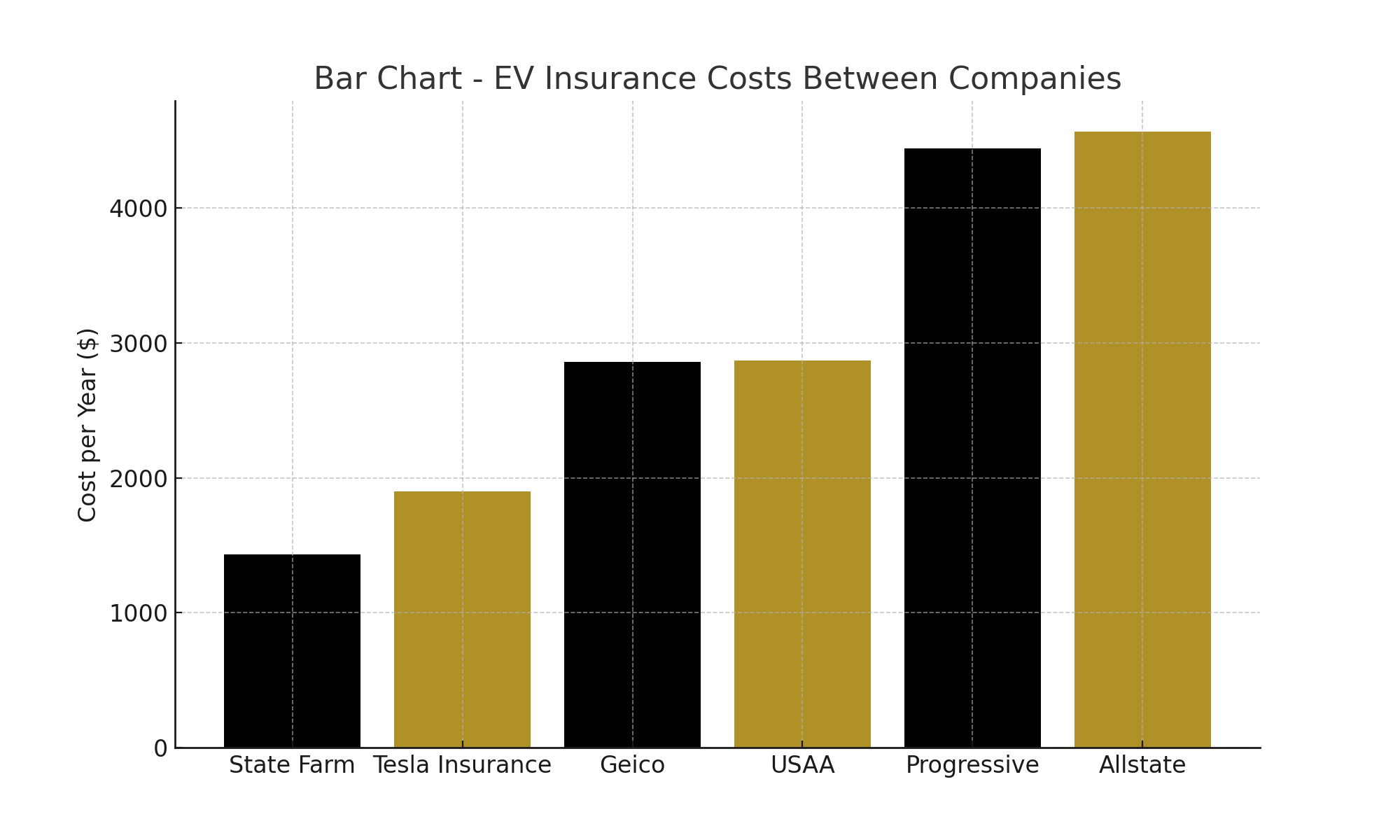

As a pioneering force in electric vehicles, Tesla provides their own specialized insurance products for Tesla drivers. Here are some unique features of Tesla’s insurance offering:

For Tesla owners, the automaker’s EV insurance provides specialized protection designed specifically around their vehicles. Tesla’s usage-based rates also reward safe driving habits with lower premiums. However, Tesla insurance may not be the most affordable option for all drivers.

Beyond shopping around for the best electric car insurance policy, there are additional ways EV owners can save on their premiums:

Finding the right balance between adequately protecting your electric vehicle asset and keeping costs in check takes some work. But a bit of effort can yield hundreds of dollars in EV insurance savings each policy term.

Table 3: Electric Car Incentives and Savings by State

State | Rebates | Tax Credits | Special Rates | HOV Access | Total Potential Savings |

California | Up to $4,500 | Up to $750 | Yes | Yes | Up to $7,500 |

Colorado | Up to $5,000 | – | – | Yes | Up to $6,500 |

Florida | – | – | – | Allowed | Varies |

New York | Up to $2,000 | Up to $500 | Yes | – | Up to $4,000 |

Transitioning to an electric vehicle can be exciting yet daunting when it comes to insurance. While EVs offer many money-saving and eco-friendly benefits, insuring them properly is critical to protect your investment in case of an accident.

At Branco Insurance Group, we specialize in providing customized insurance solutions for hybrid and electric vehicle owners. Our agents understand the nuances of insuring these newer vehicles – from higher replacement values to costlier specialized repairs. We’ve helped countless drivers make the switch to electric with peace of mind by structuring policies to meet their specific needs and budgets.

If you recently purchased or leased an EV, give us a call to discuss your coverage options. We’ll make sure you have the right liability limits, deductibles, and add-ons like battery replacement coverage. And we’ll identify any discounts you may be eligible for, like a green vehicle, safe driver, and multi-policy savings.

With Branco Insurance Group as your partner, you can enjoy your electric vehicle knowing you’ve got a policy tailored to provide exceptional protection. We’ll even regularly review your policy to account for any changes over time. Go electric with confidence by contacting our experts today to make sure your EV is properly insured.

On average, insuring an electric vehicle costs about $100 more per year compared to a similar gas-powered vehicle. However, exact costs vary significantly based on your specific EV model, age, driving history, and other factors. High-end Tesla models can cost several thousand more per year to insure than mainstream electric cars.

No, standard auto insurance policies that cover gas vehicles also apply to electric cars. Liability, collision, comprehensive, and other common coverages are included. EV-specific add-ons like battery coverage may need to be added separately. Tesla offers customized EV insurance.

Yes, the advanced technology and batteries in electric vehicles tend to be more expensive to repair and replace than the mechanical components in gas-powered cars. Labor rates may also be higher at specialty EV repair facilities. Total repair bills run 50-75% higher on average.

The replacement cost for an EV battery pack ranges from $5,000 on the low end up to $15,000 or more on high-end luxury electric vehicles. Battery replacement can be one of the most expensive repair procedures for electric cars.

Yes, many insurers offer an "alternative vehicle" or "green vehicle" discount to hybrid and electric vehicle owners. These range from 5-10% typically. Ask each agent about discounts available for your EV model.

Bundling your electric vehicle policy with other insurance from the same provider can potentially save you 10-15% on your auto premium. Compare bundled quotes when shopping for the best value.

Your home’s gutters play a crucial role in protecting your property from water damage. They channel rainwater away from your roof, walls, and foundation, preventing

As a homeowner, protecting your investment goes beyond the structure of your home. It also includes safeguarding essential systems and addressing potential risks. Two valuable