Tips to Prevent Medicare Fraud

Con artists may try to get your Medicare Number or personal information so they can steal your identity and commit Medicare fraud. Medicare fraud results

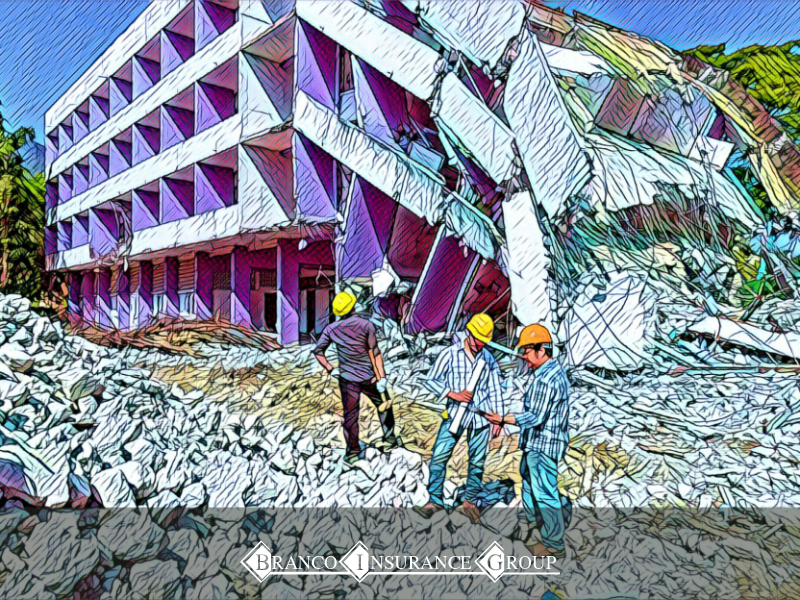

Are you planning a construction project? If so, then you need to get builder’s risk insurance. Builder’s risk insurance is an essential type of coverage that can protect your investment in the event of any unforeseen delays or damages during the building process. In this blog post, we will discuss everything you need to know about obtaining builder’s risk insurance and how it can help protect your project from loss or damage. We’ll also explain why it’s vital to have this kind of coverage before starting a construction project.

When starting a construction project, it’s vital to consider Builder’s Risk Insurance. It offers protection against property damage during the course of a project and will provide coverage if something goes wrong.

Builder’s risk insurance is a type of property insurance that protects buildings under construction or renovation from physical loss or damage. It covers materials, equipment, and supplies onsite and in transit; however, it does not cover damage caused by workers’ negligence. The policy typically remains in effect until the completion of the job, but may be extended for a specified period after that.

Any company involved in the construction process should have builder’s risk coverage. This includes contractors, subcontractors, developers, lenders, and even owners who invest their money into a new build or renovation project. It is also vital for companies that lease space from other businesses as they may be held liable for any damages caused during the course of their lease agreement.

For those involved in the construction process, having builder’s risk coverage is essential for both financial and legal reasons. Not only does it provide peace of mind that you won’t have to foot the bill for unexpected expenses due to theft or natural disasters, but it can also help protect against liability claims made by third parties who were injured while onsite at your property during construction. Investing in builder’s risk insurance will ensure that your project runs smoothly without any unexpected surprises along the way!

For any construction project, builder’s risk insurance is a must. It protects the investment of both the contractor and building owner during the build and before completion. When an accident happens, or damage occurs, it’s essential to have a safety net in place.

The cost of replacing lost materials due to theft or natural disasters can quickly add up and eat away at profits if you don’t have proper coverage in place. Builder’s risk insurance can help protect your investment in a new build by covering losses like theft, fire, windstorms, and other natural disasters while also providing liability coverage for third-party damages due to injury or property damage caused by your employees during the build process. Additionally, builder’s risk insurance can help protect against potential future lawsuits from disgruntled clients unhappy with their finished product. Without proper coverage in place, you could be held liable for any damages that occur during your work on their project—even after completion!

It’s also important to note that most traditional business insurance policies do not cover the risks associated with a construction job — so if something were to happen after you had already completed the job, but before completion of the project itself (such as an unexpected hail storm), you may be on the hook without adequate protection in place! This is where builder’s risk insurance steps in—it helps bridge that gap and provide coverage when other policies might fall short. Furthermore, because these policies are tailored specifically for each job, they often come with higher levels of protection than traditional business policies typically afford — so it’s worth looking into for larger projects requiring more specialized coverage options!

Builder’s risk coverage is essential because it provides financial protection in case something goes wrong during your construction project. Without this type of insurance, you could be left picking up the pieces financially if any unexpected costs were associated with property damage due to theft or weather-related events such as windstorms or hail storms. It can also help protect against liability claims by third parties injured while onsite at your property during construction.

Builder’s risk insurance is essential to any construction company’s portfolio and should not be overlooked when planning your next big project! It provides much-needed coverage in case something goes wrong during the build process and offers peace of mind knowing that your investments are well protected should something unexpected happen after completion. Make sure to look into different policy options available to you so that you can find one that best fits your needs and budget! Investing in quality builder’s risk insurance means investing in peace of mind – so don’t wait until disaster strikes; get covered today!

Builder’s risk coverage is a type of insurance policy that protects against physical damages to buildings, materials, and equipment during the construction process. It can also provide coverage for the contractor if additional costs arise due to those damages or delays caused by them. This type of coverage is vital for construction companies, as it can help protect their investments from potential losses and delays. Let’s take a look at how builder’s risk coverage works.

Builder’s risk insurance policies are designed to protect against financial losses resulting from damage or destruction to property during construction. The policy typically covers all phases of the construction project, from start to finish. It may include coverage for theft, vandalism, fire, water damage, weather damage, and other disasters that could affect the project’s progress. The amount of coverage is usually based on the project’s estimated value at any given time. In most cases, builder’s risk insurance only covers damages that occur while work is in progress; once a project has been completed, it no longer qualifies for coverage under this type of policy.

Builder’s risk insurance is an essential part of any construction company’s financial planning process and can help protect both businesses and individuals from potential losses resulting from unforeseen circumstances such as weather events or theft during the course of a building project. With its wide range of coverage options and quick turnaround times for claims processing, builder’s risk policies offer an excellent way for businesses and individuals alike to reduce their financial risks associated with building projects. By understanding how this form of insurance works and what it covers, you’ll be better equipped to make informed decisions when purchasing builder’s risk insurance for your next construction project!

One of the biggest benefits of having builder’s risk insurance is that it helps protect your investments in a project from losses due to unexpected events. For example, if a storm damages part of your construction site or some of your equipment and supplies are stolen, you can file a claim with your insurer for compensation for any repair or replacement costs you incur. Without this type of coverage, you would have to bear these costs out-of-pocket.

Another benefit of having builder’s risk insurance is that it can help protect you from liability risks. If someone were to get injured on your construction site—whether it be an employee or someone visiting—you could be held liable for any medical expenses they incur as well as lost wages if they cannot work while they recover. With builder’s risk insurance coverage in place, you can rest assured knowing that you are protected in the event something like this were to happen.

Finally, having builder’s risk insurance can provide peace of mind during the construction process because you know that should anything happen that causes delays or additional costs beyond what was originally planned for. Your insurer will help shoulder some of those costs so that you don’t have to bear them entirely on your own. This means less stress and worry about unexpected expenses eating into profits at the end of a job.

Builder’s risk insurance is an essential part of any construction project because it provides protection against financial losses due to unforeseen events like storms and theft, as well as liabilities such as injuries occurring onsite. Having this type of coverage in place gives peace of mind knowing that should something happen during the course of a build that leads to delays or unexpected costs beyond what was planned for, there will be support available to help cover some (or even all) these additional costs so that profitability isn’t affected too greatly at the end of a job. Construction companies interested in protecting their projects should consider investing in builder’s risk insurance coverage today!

Builder’s Risk Insurance (also known as Course of Construction Insurance) is a type of property insurance that helps protect a structure while it is being built. It covers any damage to the structure throughout the course of construction, including theft or vandalism. However, there are certain exclusions in every policy that you should be aware of before purchasing one.

Most Builder’s Risk Insurance policies do not cover damage caused by earthquakes, floods, or nuclear accidents. This is because these types of disasters are difficult to predict and can cause immense destruction. To obtain coverage for these scenarios, you may need to purchase additional insurance.

In addition, some Builders Risk Insurance policies do not cover acts of negligence on behalf of contractors or subcontractors hired for the job. If it can be proven that the contractor was negligent in his duties and this negligence led to damages on the site, then those damages may not be covered under the policy. It is essential to carefully vet any contractors you hire and ensure they understand their responsibility when working on your project.

Also, Your work vehicles won’t receive protection from a builders risk policy, leaving commercial auto insurance as the only avenue for coverage in case of any damages.

Finally, most Builder’s Risk Insurance policies do not cover damage due to war or terrorism. When evaluating your policy, it is essential to keep this in mind and determine if you need additional coverage for these scenarios.

Another factor to consider when buying Builder’s Risk Insurance is moral hazard exclusions, which are limitations placed on the policy based on how much risk an insured party has taken concerning their project. For example, if a contractor has neglected safety protocols or allowed workmen onto the site without proper training or protective gear, then their insurer may deny any claims made related to such negligence — even if they were included in the initial coverage terms. Moral hazard exclusions can vary from one insurer to another, so it’s essential to read through them thoroughly before signing up for a policy.

Builder’s Risk Insurance can provide peace of mind knowing that your insurance provider will cover any damage incurred during construction; however, it is essential to understand what types of exclusions exist in your specific policy before signing up for coverage. Common exclusions include earthquake and flood damage and moral hazards like negligence and recklessness on behalf of workers hired for the job. By understanding what kinds of risks are excluded from your policy, you can make an informed decision about whether or not Builder’s Risk Insurance is right for you and your project needs.

Building projects are expensive endeavors. Every construction company needs to consider the risks that come along with these projects, and whether they should be covered by insurance or not. If they choose to go without insurance coverage, what is the cost of a building project?

The cost of builders’ risks insurance depends on several factors such as the size of the project and its location. Typically speaking, however, a builder’s risk policy will cost somewhere between 1% – 5% of the total value of the project (not including land). For example, if you are building a $1 million dollar home then your builder’s risk policy would likely cost you around $10-20K for one year’s worth of coverage. The policy can be renewed annually as needed until your project is finished.

Forgoing builder’s risk coverage means taking on greater financial responsibility for any unforeseen damages or losses during your building project. Without this type of protection in place, you could be liable for up to 100% of repair costs related to weather damage or theft during your buildout period—which could add up quickly depending on how much work needs to be done in order to fix whatever issue arises. Additionally, there is also the potential loss of income/profit if your building project is delayed due to issues related to damages that occur while uninsured—costing you time and money since you won’t be able to recoup those losses from an insurer like you would if you had proper coverage in place when something unexpected occurred during your buildout period.

It is crucial for every construction company to consider their options when it comes time to start a new building project – should they purchase builders’ risks insurance or not? As we have seen here today, there are both costs associated with having this type of coverage in place AND going without it altogether – so it is critical that each organization does their research before making any decisions regarding which route they want to take when beginning their next big endeavor! Ultimately, this kind of protection can provide peace of mind knowing that any costly surprises that arise during your buildout period will (for the most part) be taken care of if insurables occur, thanks to a solid builders’ risks policy!

Now that you have a better understanding of Builder’s Risk Insurance, what it is, why you need it, and how it works, you can make an informed decision on whether or not to obtain coverage for your next building project. There are several benefits to having Builder’s Risk Insurance, including peace of mind and protection from loss due to many different perils. It is essential to be aware of the exclusions in a Builder’s Risk policy so that you can tailor the coverage to fit your needs best. The cost of obtaining Builder’s Risk Insurance is much less than that of not having insurance if something goes wrong during your building project. If you still have questions, our Builder’s Risk Coverage experts at Branco Insurance Group are here to help. Reach out to us today for a free consultation, and we’d be happy to provide you with the best coverage for your unique needs. We will be glad to get you all squared away before your next building project.

Con artists may try to get your Medicare Number or personal information so they can steal your identity and commit Medicare fraud. Medicare fraud results

Summer is a fun time for humans and pets, but the rising temperatures can pose risks to our furry friends. Here are some essential tips