Purchasing the right insurance is a crucial step for any startup, but it can often get overlooked by busy founders focused on product-market fit and funding rounds. This comprehensive guide outlines the essential coverages startups need, how much they cost, and tips for choosing insurance providers tailored to the unique risks facing young tech companies and entrepreneurs.

Key Takeaways

- Get insured early: Don’t delay purchasing coverage to create longevity and attract investors

- Work with specialized brokers: Agents with startup expertise tailor optimal packages

- Prioritize essential policies first: Start with property, bodily injury, professional, cyber, D&O

- Bundle policies to save: BOPs, management liability, and tech packages provide discounts

- Compare insurance quotes: Prices/coverage vary widely, don’t overpay

- Partnering with the right startup-focused broker provides founders peace of mind and financial safeguards to enable innovation

Why Insurance Matters for Startups

Launching a startup involves calculated risks, but exposing your personal assets or the future of your company to potential lawsuits or liability claims doesn’t need to be one of them. The right insurance coverages help founders transfer many risks away from the business through affordable monthly premiums.

Here are some key reasons obtaining startup insurance should be a priority:

- Attract investors: Demonstrating business acumen by having insurance shows investors you take company longevity and downside risks seriously. Institutional investors may even require certain policies like D&O insurance as a condition of receiving funding.

- Gain client trust: Certificates of insurance provide credibility to prospective clients that your business can financially cover any mistakes without legal issues escalating to impact them.

- Protect personal assets: Without corporate liability protection, the personal assets of founding members can be pursued in lawsuits. Insurance helps limit personal exposure.

- Safeguard the company’s future: Lawsuits, cyber incidents, accidents, and other covered events could financially sink startups without insurance to transfer the risks.

- Focus on growth: Time and money drained by uncovered incidents stifle innovation and distract from building your company. Proper insurance lets you focus on the future, not litigation.

Essential Insurance Policies for Startups

While risks certainly vary across companies, these core insurance policies protect against the most common startup exposures.

General Liability Insurance

- Covers 3rd-party bodily injuries, property damage, personal and advertising injury claims

- Typically required by commercial leases and client contracts

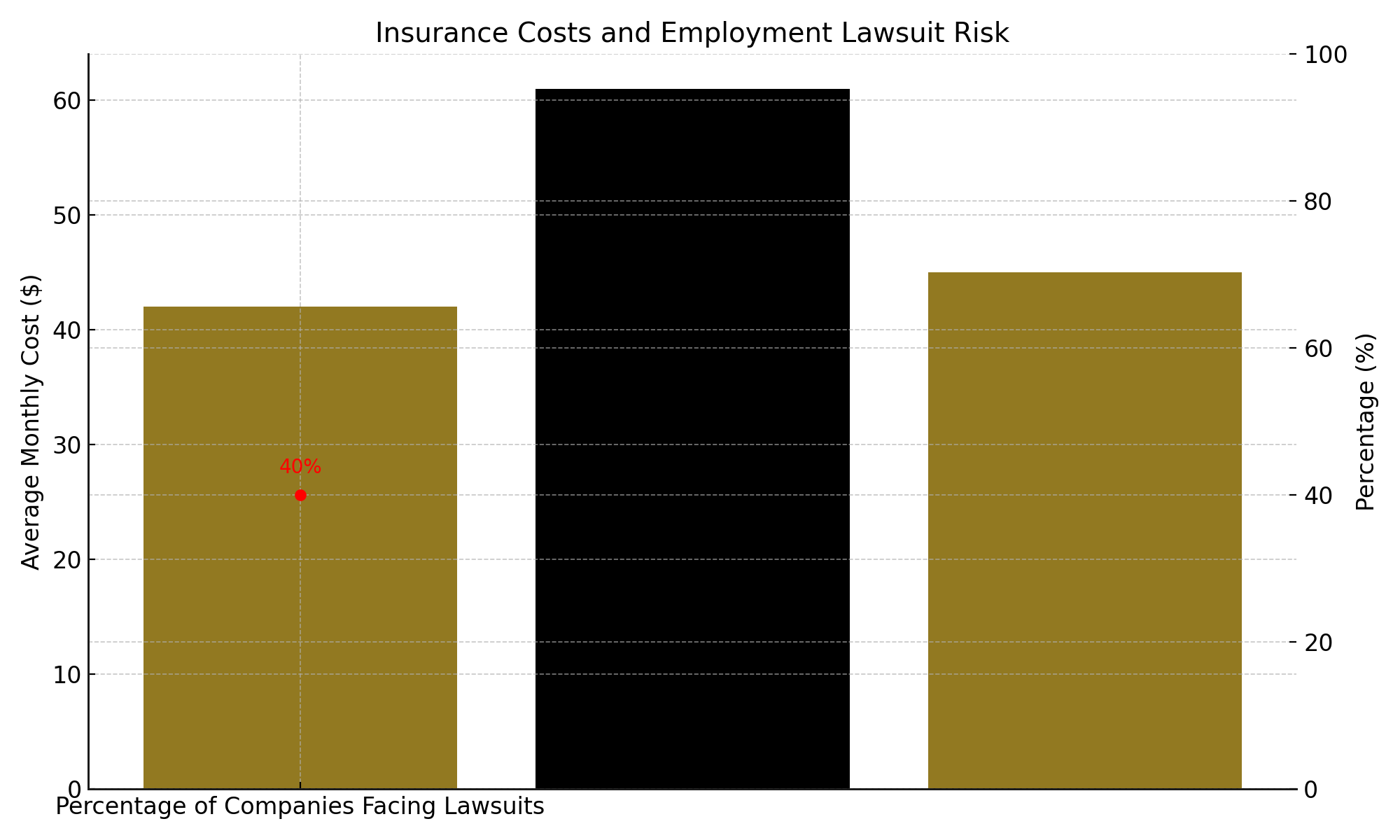

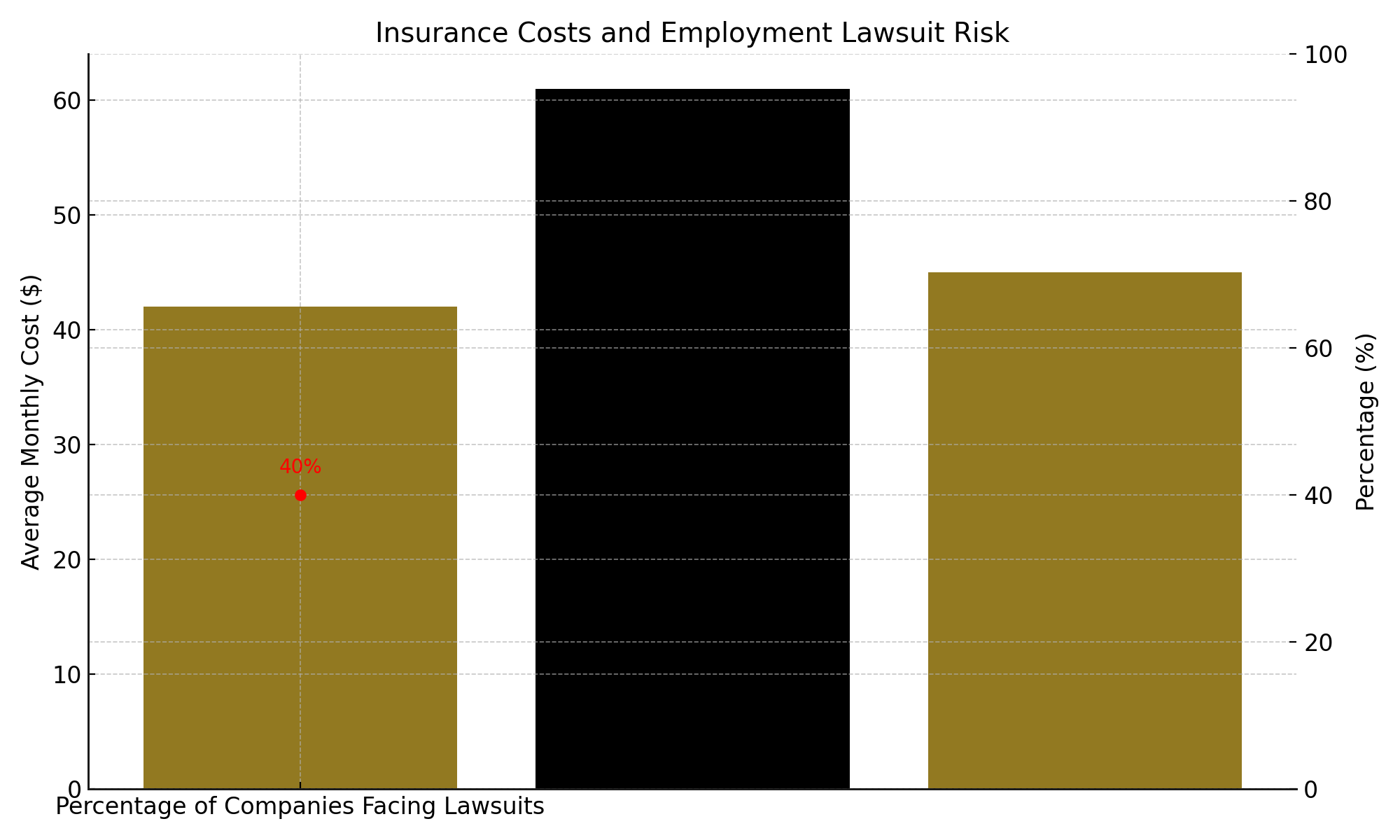

- Cost: $42 per month on average

This fundamental coverage protects against premises liability, product liability, copyright infringement, reputational harm from reviews, and more. For example, if a client slipped and suffered an injury at your office.

Errors & Omissions (E&O) Insurance

- Also called “tech E&O” or “cyber E&O”

- Protects against claims of failing to deliver client products/services properly

- Cost: $61 per month on average

If your startup sells software or provides consulting services, this coverage is crucial. It responds to lawsuits alleging your professional advice or products caused financial harm due to negligence, errors, misleading statements, or failure to safeguard client data properly.

- Covers costs related to data breaches, hacking incidents, cyber extortion threats, and tech outage claims

- Highly recommended for startups handling sensitive customer information

- Cost: Bundled with tech E&O for simplicity

Hackers and cyber extortionists actively target startups to steal funds and data. Having robust first- and third-party digital liability coverage is essential to survive these incidents.

- Protects board members and executives from liability claims

- Covers defense costs and settlements/judgments

- Often required by investors before receiving startup funding

- Cost: Bundled in packages for simplicity

Shareholders, investors, competitors, vendors, and employees can all potentially sue startup directors and officers over their business decisions alleging mismanagement or negligence. D&O insurance is the only asset shield for these individuals.

Table 1: Comprehensive Breakdown of Startup Insurance Policies

Stage | Risks/Exposures | Recommended Policies | What It Covers | Estimated Cost |

Pre-launch | Personal assets at risk, founder/investor lawsuits | Directors & Officers (D&O) Insurance | Lawsuits against directors and officers alleging mismanagement or negligence | $1,500 annually |

Early Traction | Client lawsuits, failure to deliver services, professional mistakes | Errors & Omissions Insurance | Lawsuits from customers related to work quality, missed deadlines, negligent advice | $100 – $300 monthly |

First Office | Commercial property damage, equipment theft | Commercial Property Insurance | Damage to office space, furnishings, computers, equipment, and other business property | $100 – $500 monthly |

First Hires | Workplace injuries, employment lawsuits | Employment Practices Liability Insurance | Claims of discrimination, sexual harassment, wrongful termination | $50+ monthly |

Post-Funding | Increased cyber risks, crime exposures, growth risks | Cyber Liability Insurance | Data breaches, hacking incidents, cyber extortion threats | $100+ monthly |

Additional Startup Insurance Policies

While the policies above cover the most common startup risks, additional insurance should be considered for certain situations:

- Employment Practices Liability Insurance: Protects against employee lawsuits alleging discrimination, harassment, wrongful termination, or other HR violations.

- Commercial Property Insurance: Covers damaged or stolen office equipment at a startup’s place of business.

- Workers Compensation Insurance: Required by law in most states once startups hire their first employees. It covers lost wages and medical costs due to workplace injuries.

- Commercial Auto Insurance: Legally required for company-owned vehicles driven for business purposes.

How Much Does Startup Insurance Cost?

The average monthly costs for key startup policies are:

- General Liability Insurance – $42

- Tech Errors & Omissions – $61

- Workers Compensation – $45

- Directors & Officers Insurance – Bundled into packages

Of course, costs vary widely based on your startup’s size, location, and industry risk profile. However, allocating even 1-3% of your annual revenue to insurance can pay dividends by letting you focus on innovation rather than litigation threats.

Table 2: Startup Insurance Cost Estimates by Company Stage

Stage | Est. Revenue | Recommended Insurance Investment | Est. Total Insurance Costs |

Pre-Seed | Under $50K | 1-2% of Revenue | $500 – $1,000 annually |

Seed Funded | $50K – $500K | 1-3% of Revenue | $1,000 – $15,000 annually |

Series A | $500K – $5M | 1-5% of Revenue | $5,000 – $250,000 annually |

Series B+ | Over $5M | 1-6% of Revenue | $50,000+ annually |

Tips for Purchasing Startup Insurance

Here are a few tips to make getting properly insured smooth and cost-effective:

Work with specialized agents/brokers: The best startup insurance brokers have worked with hundreds of emerging tech companies and understand the unique risks. They can tailor broader packages efficiently.

Ask about discounts for risk mitigation: Some insurers offer discounted premiums if startups implement formal cyber security and employee conduct safeguards.

Bundle multiple policies: Bundling similar policies together or with health/benefits plans can lead to policy discounts. A good agent helps coordinate this.

Compare quotes: Be wary of only getting one insurance quote. Responsible comparison shopping for the same or better protection can minimize costs.

Table 3: Policy Bundling Opportunities for Startup Insurance

Bundle | Combined Policies | Average Savings |

Tech Package | Cyber Liability, Tech E&O | 10-20% |

Management Liability | Directors & Officers, Employment Practices Liability | 15%+ |

Business Owner’s Policy (BOP) | General Liability, Commercial Property, Business Interruption | 10-30% |

Final Thoughts

As an independent insurance agency serving Connecticut for over 12 years, Branco Insurance Group has the experience to find the right insurance solutions for startups and small businesses. Whether you need general liability, professional liability, cyber insurance, or customized packages, our agents take the time to understand your company’s specific risks and growth plans so we can tailor coverage accordingly. We represent over 25 top-rated insurers to fit your budget at every stage.

If you’re a young company needing guidance on insurance requirements, risk management planning, or attracting investors, let’s have a consultation. We can outline options to safely transfer risk away from your startup’s future so you can focus on sustaining innovation. Our past clients confirm working with Branco gives entrepreneurs like you peace of mind and financial safeguards to enable that next big breakthrough. Contact us today to see how we can help.