Owning a rental property can be a smart investment, but also comes with risks outside of your control. Rental property insurance is designed to protect landlords from unexpected costs and liability issues. This type of insurance provides financial protection for both the physical rental property and losses related to your rental business.

Rental property insurance, sometimes called landlord insurance, covers damage to your property, liability claims, and loss of rental income from covered incidents. It is essential for all landlords to have, whether you own a single rental home or an entire apartment complex. Rental property insurance gives you peace of mind that your investment is protected.

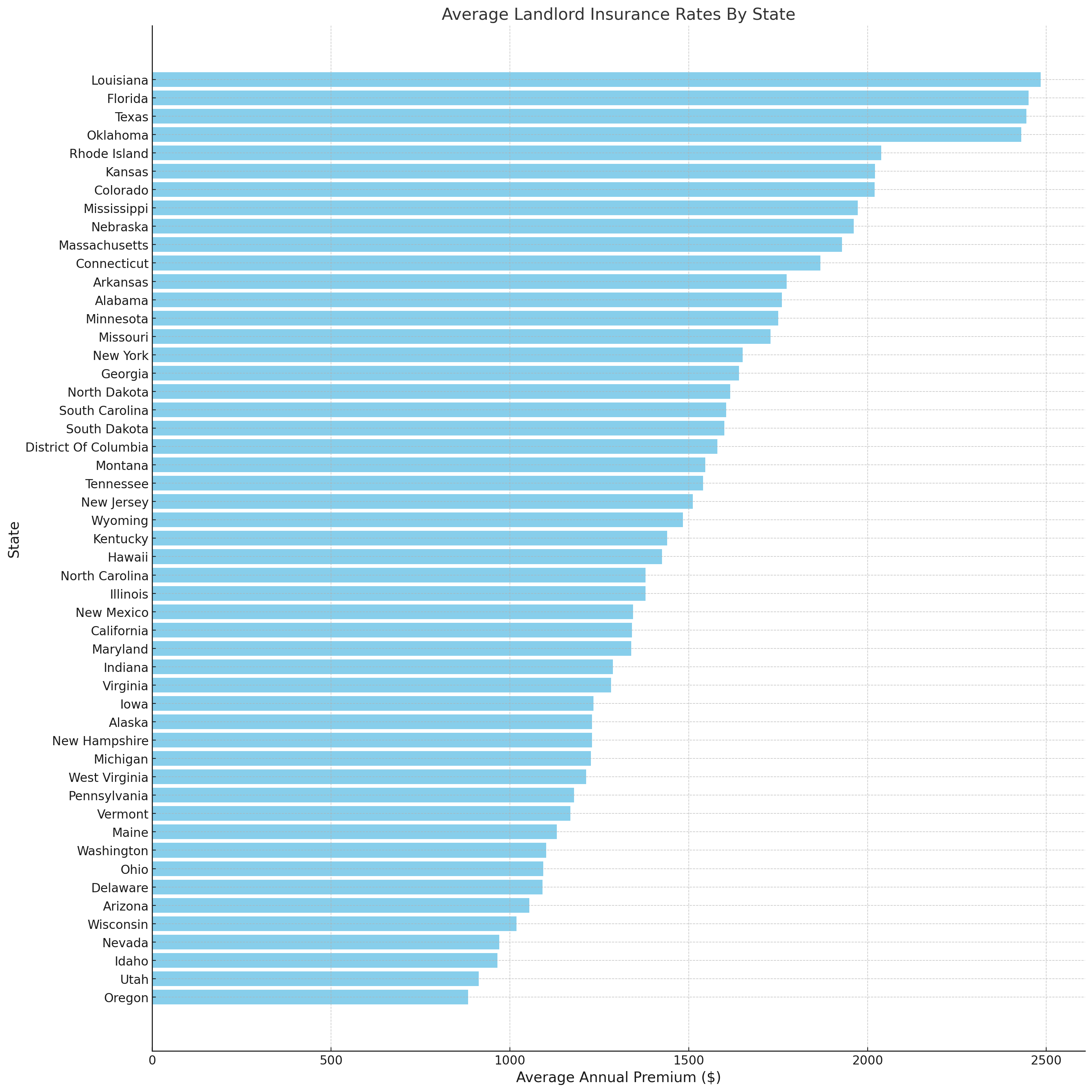

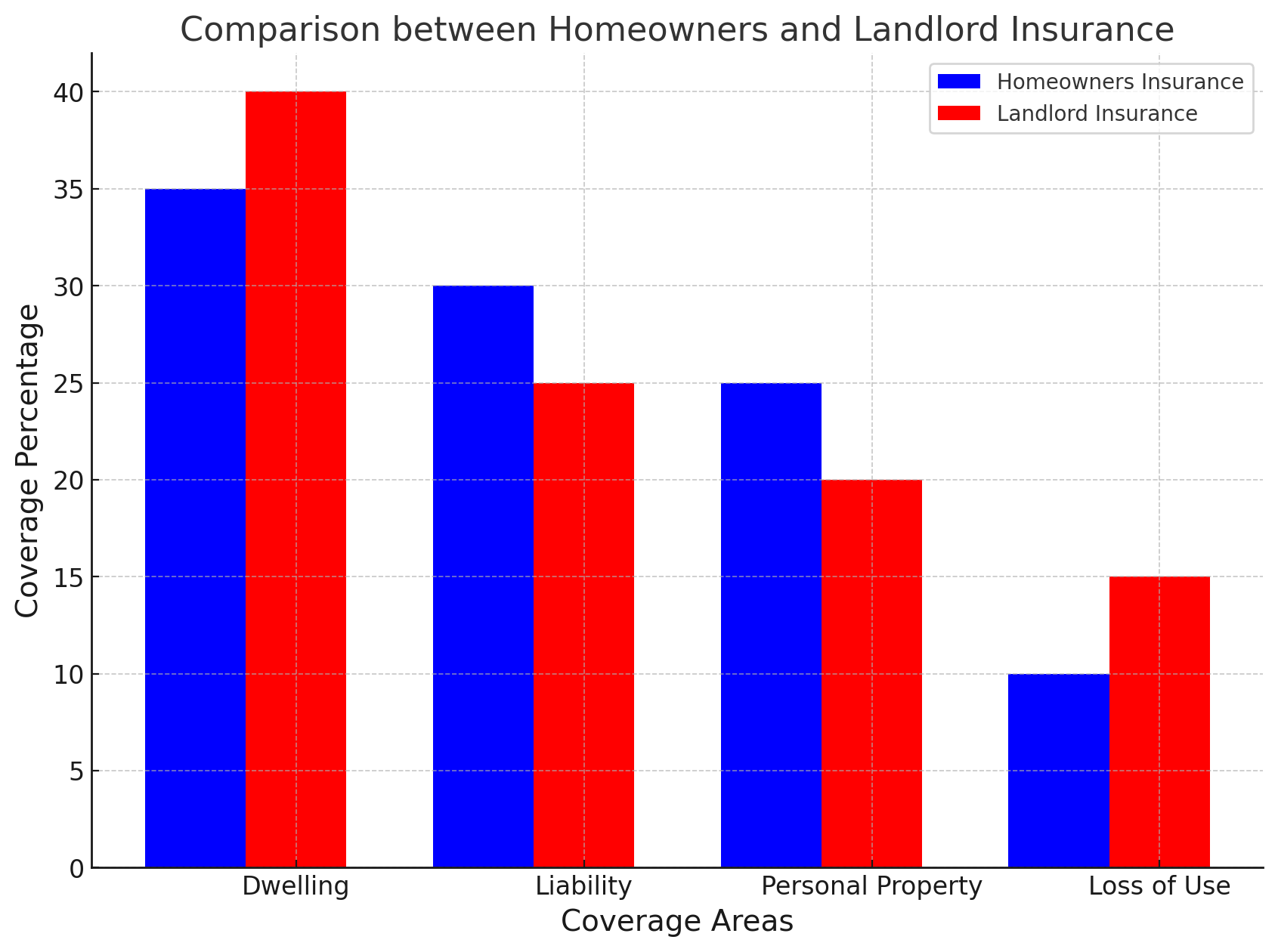

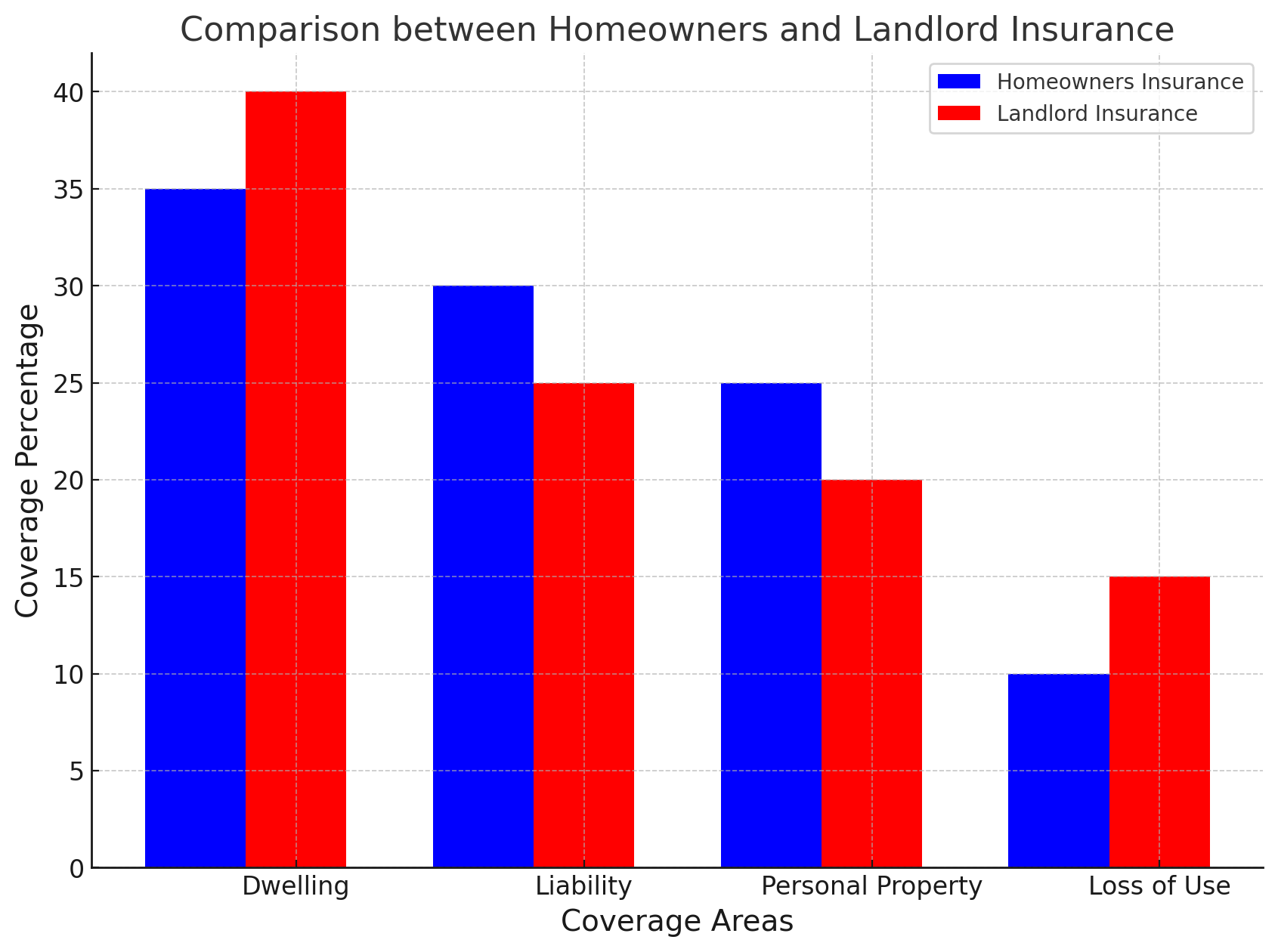

While a standard homeowners insurance policy covers owner-occupied homes, it generally excludes coverage for rented properties. Work with an insurance agent to get quotes for appropriate landlord insurance tailored to your specific rental property.

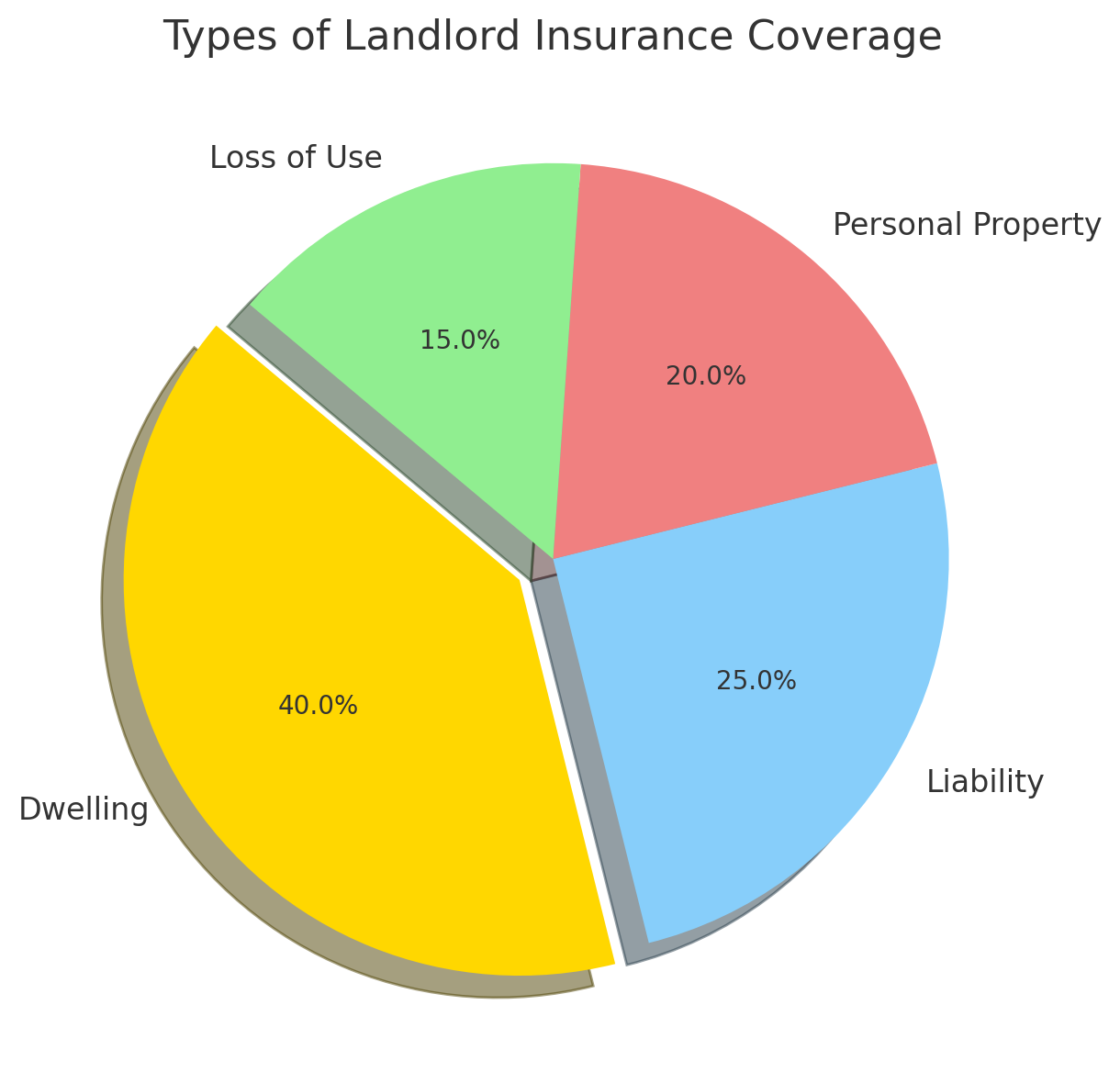

Coverages Included in Rental Property Insurance

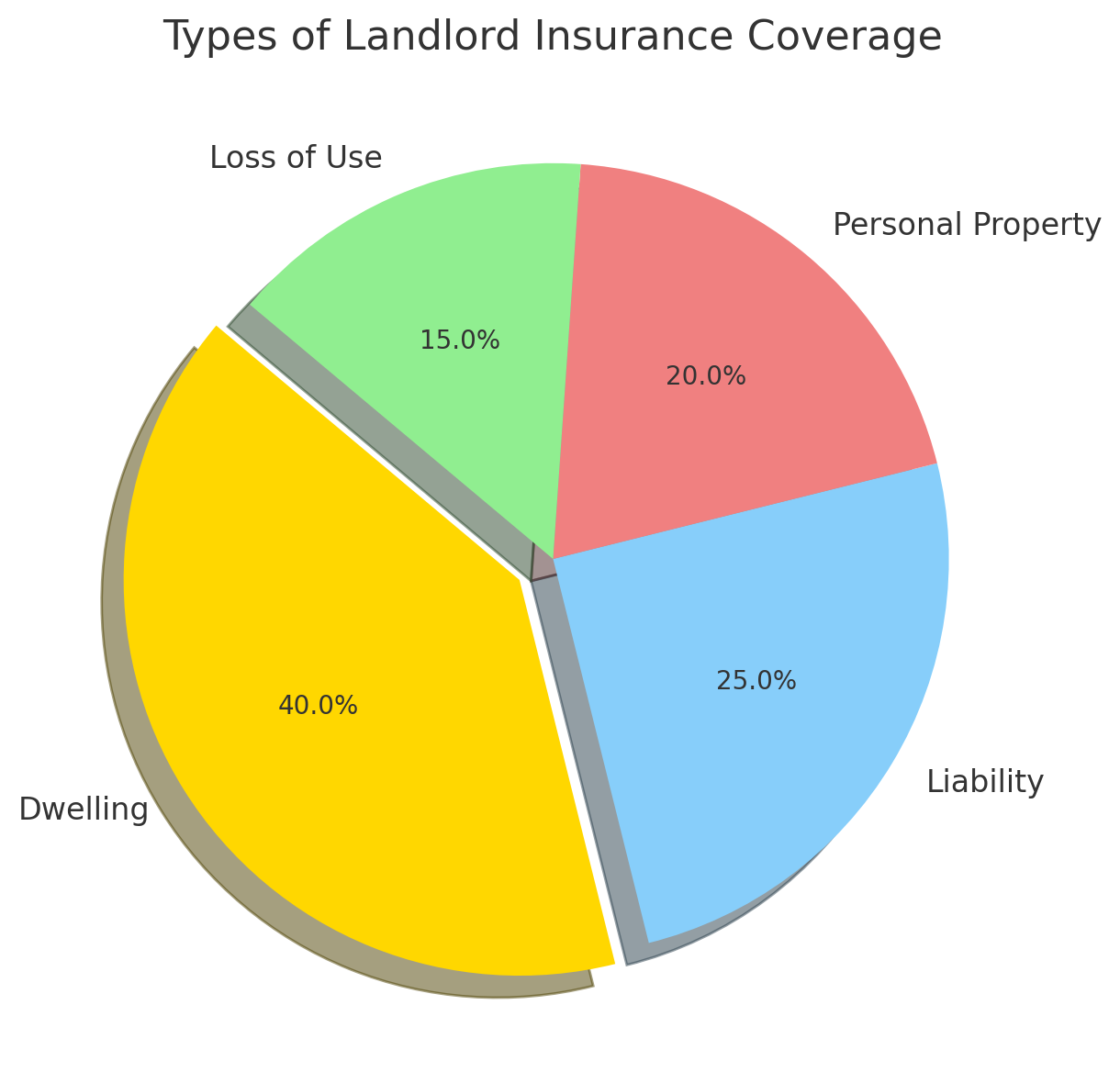

Rental property insurance contains three main types of protection:

Property Damage

This covers damage to the physical rental property itself and structures on the premises. It pays to repair or rebuild your property after incidents like fire, vandalism, theft, wind damage, hail, lightning, smoke, and more. Property damage coverage has a deductible amount you pay before insurance kicks in.

Liability Claims

Liability insurance pays for accidents that happen at your rental property for which tenants try to hold you legally responsible. For example, if a tenant slips on an icy sidewalk and sues for medical bills. It covers both the legal defense costs and any settlement amounts. Liability insurance is essential protection for landlords.

Lost Rental Income

If your rental property becomes uninhabitable due to a covered incident like a fire or storm, this coverage pays for the rental income lost while repairs are being made. It helps replace the revenue stream of your business.

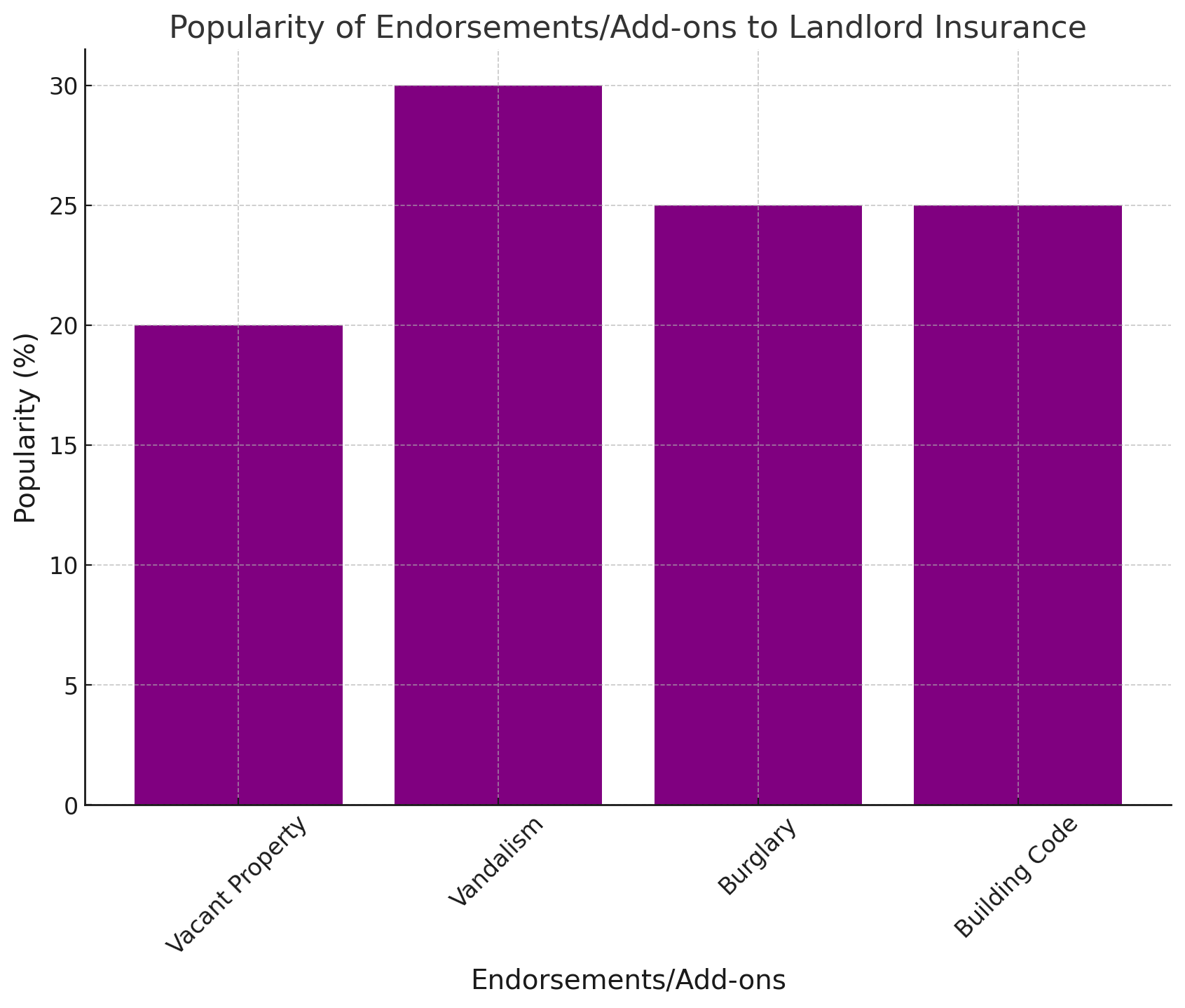

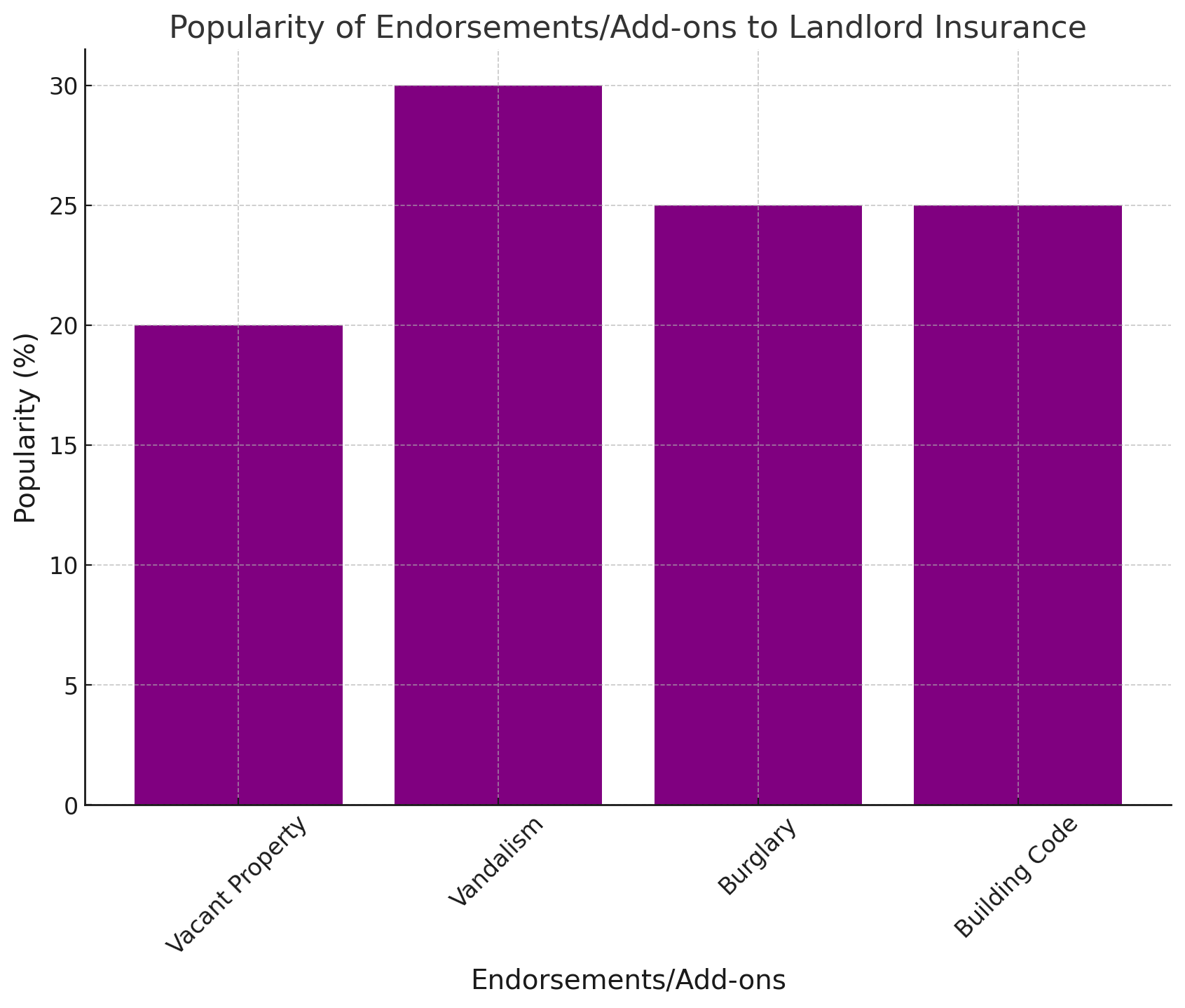

Additional Options for Rental Property Insurance

Standard rental property insurance contains basic coverages, but many providers offer additional options to customize your policy:

- Loss of Rents: Covers lost rental income if you can’t find new tenants after damage.

- Vandalism and Theft: Pays for deliberate property damage or theft by tenants.

- Personal Property Coverage: Protects appliances, furniture, or other items of yours on the rental premises.

Carefully review these optional add-ons with your insurance agent to construct a policy meeting your specific needs and risk tolerance.

Choosing Rental Property Insurance

When selecting rental property insurance, shop around to find the best value:

- Compare Providers: Get quotes from several highly-rated insurers to compare coverage options and prices.

- Bundle Policies: You may get a discount by bundling rental property insurance with other policies like auto or homeowners.

- Get Quotes: Work with agents to get personalized quotes accounting for your unique situation. Match coverages and limits across providers.

Choosing the right rental property insurance takes research, but pays off by securing your investment from the unexpected issues that can arise with tenants and properties. Protect your hard-earned rental business by securing landlord insurance tailored to your needs.

Key Takeaways on Rental Property Insurance

- Rental property insurance provides essential protection for landlords against damage, liability, and lost income. It is designed specifically to cover risks associated with rented properties.

- Standard policies include coverage for property damage, liability claims against the landlord, and loss of rental income during repairs after a covered incident.

- Additional options are available such as protection for vandalism, theft, loss of rents beyond repairs, and personal property owned by the landlord on the premises.

- Policies can be tailored based on the type of rental property, such as condos, single-family homes, or apartment buildings. All have unique considerations.

- Landlords should proactively mitigate risks through tenant screening, regular inspections, lease enforcement, and requiring renters insurance. This helps avoid major issues.

- If damage occurs, take detailed documentation and submit claims properly to receive reimbursement for repairs and temporary loss of rental income during vacancies.

- Finding the right rental property insurance requires comparing multiple provider quotes for optimal coverage and premium savings. Work with an experienced, trusted insurance agent to ensure you get the right policy in place.

Rental Property Insurance for Different Types of Properties

Rental property insurance covers various types of rented residences. Policies can be customized based on whether you own rental homes, apartment buildings, condo units, or other types of properties.

Rental Homes

Insuring a single-family rental home is common for individual investors. A rental dwelling policy tailored for landlord coverage on a house, townhouse, duplex, or other standalone structure provides protection.

Key coverages for rental homes include:

- Property damage from perils like fire, storms, vandalism

- Liability for injuries on the premises

- Loss of rental income during repairs

- Optional coverages like theft, water backup, loss of rents

Carefully review the policy with your agent to ensure it meets your needs as a landlord. Also, inspect the home closely and discuss any existing conditions that may impact coverage.

Condo Units

If you own a condominium unit that you rent out, a rental condo unit owner’s policy is appropriate. It covers your unit, improvements, and furnishings against damage.

Rental condo insurance commonly contains:

- Property damage coverage for your unit, flooring, counters, appliances

- Liability protection if renters are injured

- Loss assessment coverage for condo association fees

- Loss of rental income if uninhabitable

- Personal property coverage for belongings

Condo associations also maintain master policies covering the building. Coordinate your unit policy with the association’s insurance for full protection.

Apartment Buildings

Insuring an entire apartment complex involves higher liability risks and property values. A specialized commercial policy designed for apartments contains:

- Blanket building and business property coverage

- Liability limits up to $1 million or more

- Loss of rental income on multiple units

- Optional coverages like equipment breakdown, theft, employee dishonesty

Speak to an agent experienced in commercial policies to craft appropriate insurance for your apartment investment. Maintain detailed documentation on the building, units, and commercial leases.

Get Quotes for Your Specific Property

Work with an insurance agent to get quotes for the exact type of rental property you own – whether a single-family rental home, an entire apartment complex, or anything in between.

Ask about all available discounts to reduce your premium. For example, protection devices like smoke alarms and security systems may reduce costs. Also, bundle policies and choose higher deductibles where possible.

Ensuring you have the right landlord insurance starts with understanding the coverages available for your specific rental situation.

Common Coverages in Rental Property Insurance Policies

Coverage | What It Covers |

Property damage | Repairs the physical dwelling after covered incidents |

Liability | Costs if tenants are injured on the premises |

Loss of rents | Reimburses lost rental income during repairs |

Vandalism | Damage by tenants |

Theft | Theft of landlord’s personal property |

Fair rental value | Covers extra costs to temporarily relocate tenants |

Protecting Rental Investments as a Landlord

Beyond having the right insurance, landlords can take proactive steps to reduce risks, limit liabilities, and protect their rental property investments.

Tenant Screening

Thoroughly screening tenants before signing a lease helps avoid major issues down the road. Key steps include:

- Background check for prior evictions, criminal history

- Credit check to confirm financial responsibility

- Income verification to ensure they can afford rent

- Rental history to check past landlord references

Taking time on the front end to vet tenants carefully protects you from problems like missed rent, property damage, and legal disputes.

Security Deposits

Require a security deposit equal to at least one month’s rent. This provides a buffer in case of damages or unpaid rent at move-out. Clearly outline conditions for fully or partially withholding the deposit in the lease agreement.

Send tenants a detailed move-out inspection report and return any unused portion of the deposit in a timely manner. Comply with all state laws related to security deposits.

Renters Insurance Requirements

Require tenants to carry a renters insurance policy. This protects their possessions so they don’t file claims against your rental property insurance.

Check that they maintain active renters insurance annually. Purchase a policy on their behalf if they fail to comply to ensure adequate coverage.

Regular Inspections

Conduct periodic inspections of rental units at least annually. Check for unauthorized occupants, pets, or property alterations.

Promptly address any issues like leaks, faulty appliances, overgrown landscaping, or other maintenance needs noticed during inspections. This helps avoid major damage and liability claims.

Proactively managing risks allows landlords to stay on top of issues before they spiral out of control. Protect your investment by implementing good tenant vetting, lease terms, unit inspections, and ongoing communication practices.

Submitting Claims with Rental Property Insurance

If an incident causes damage to your rental property, promptly submit an insurance claim to start the recovery process. Follow these best practices when filing landlord insurance claims:

Documenting Damages

Take detailed photos and video of the damage right away as evidence for your claim. Also save any related invoices, police reports, temporary housing receipts, and other documentation.

Provide complete and accurate descriptions on the claim form. Include damage details and timelines. Getting key details right on the initial claim is essential.

Recovering Lost Rents

Calculate the amount of lost rental income using lease agreements and records of any paid days the unit was unoccupied. Submit copies of this documentation with the claim.

Provide evidence like repair invoices and inspection reports showing when the property was uninhabitable. Track all lost income until the unit is fit for a new tenant.

Working With Contractors

Do not begin repairs or contract work until approved by the adjuster. Submit all repair invoices and descriptions of completed work for reimbursement.

For large claims, you may receive periodic payments as work is completed, rather than one lump payment. Keep the claims adjuster updated on the repair status.

Communicating With the Adjuster

Respond promptly to all requests from the claims adjuster assigned to your case. Ask questions if any proposed settlements or coverage determinations are unclear.

Be upfront about any pre-existing damages or ongoing issues, as the insurer may investigate the full history of the property. Provide photos and inspection reports as needed.

Carefully following best practices for submitting landlord insurance claims helps ensure you receive full compensation for covered losses. Consult your agent if you need guidance filing a claim after a major incident or loss.

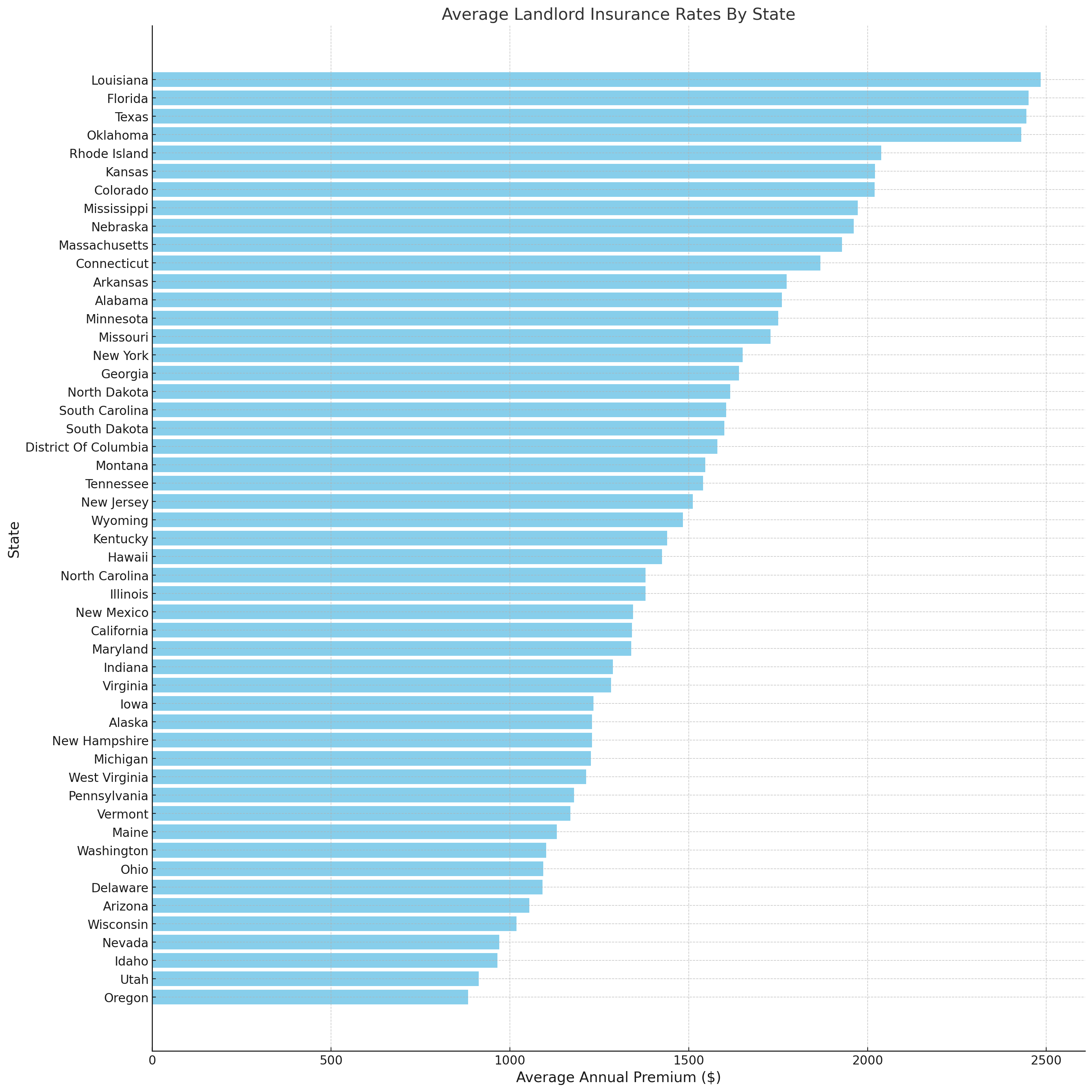

Factors Impacting Rental Property Insurance Costs

Factor | How It Impacts Cost |

Location | Properties in riskier areas cost more to insure |

Age of building | Older buildings often have higher premiums |

Claims history | Frequent past claims drive up costs |

Protection devices | Smoke alarms, and security systems reduce rates |

Deductible amount | Higher deductibles lower the premium |

Submitting Claims with Rental Property Insurance

Dealing with property damage or loss can be stressful for landlords. But promptly taking the right steps when filing an insurance claim helps ensure you receive fair compensation. Having clear documentation and open communication with your insurer facilitates the process.

A few key best practices include:

- Thoroughly documenting damages

- Tracking lost rental income

- Following insurer protocols

Documenting Damages

When damage occurs, immediately take detailed photographs and video as evidence for the claim. Save related documents like police reports, invoices, inspection reports, and temporary housing receipts.

Provide complete and accurate details on the claim form. Include specifics on when, where, and how the damage occurred. Getting these facts right from the start helps avoid issues.

Recovering Lost Rents

Calculate lost rents using the leases and records showing any days the unit was vacant and unpaid after the incident. Submit copies of this documentation along with evidence like repair invoices that establish when the property was uninhabitable.

Continue tracking lost rental income until the unit is repaired and fit for a new tenant. Lost income claims may be paid out in installments.

Working With Contractors

Do not initiate repairs or contract work until approved by the claims adjuster, and submit all invoices for reimbursement. For large claims, you may receive periodic payments as repairs are completed, rather than one lump sum.

Keep the claims adjuster informed on the repair status. Respond promptly to any requests and questions.

Communicating With the Adjuster

Be responsive to all inquiries from the claims adjuster overseeing your case. Ask for clarification if any proposed claim resolutions are unclear before agreeing.

If past damages or ongoing issues are relevant, disclose and provide supporting evidence like inspection reports. Transparency avoids problems.

Carefully following best practices when filing landlord insurance claims helps the process go smoothly and ensures you are fully compensated for covered losses. Consult your agent if you need guidance submitting a major claim.

Reducing Risks and Costs as a Landlord

Implementing effective risk management strategies allows landlords to reduce their chances of major losses while also controlling their insurance premiums. Focusing on prevention and diligent property management pays dividends over time.

Several key areas provide opportunities to lower risks:

- Performing regular property inspections

- Quickly addressing maintenance issues

- Enforcing lease terms consistently

Regular Inspections

Conducting thorough inspections of rental units at least annually reduces the likelihood of unnoticed damage occurring. Catch and repair minor maintenance issues before they evolve into major insurance claims.

Inspections also allow landlords to identify any unauthorized occupants, pets, or property alterations in violation of lease terms. Promptly addressing problems avoids bigger headaches.

Maintenance Requests

Respond quickly to any repair requests or issues reported by tenants, such as electrical problems, plumbing leaks, or appliance malfunctions. Addressing small problems early prevents more extensive deterioration and damage over time.

Inform tenants of the preferred process for submitting maintenance requests. Make it easy for them to report issues.

Following Lease Terms

Enforce all clauses and requirements in your lease agreements consistently across all tenants. This includes policies regarding late payments, occupancy limits, pets, smoking, and more.

Selectively enforcing some rules but not others can increase risks and create liability issues if violations occur. Hold every tenant accountable to the same standards.

Incentivizing Safety

Offer current tenants incentives like reduced rent if they meet specific safety goals, such as properly maintaining smoke detectors, removing trip dangers, and keeping the unit secured.

Rewarding mindful tenants reduces risks and shows you care about more than just collecting payments.

A proactive approach to risk management requires time investment upfront, but pays long-term dividends by avoiding claims and controlling premiums.

Tips for Reducing Risks as a Landlord

Risk Area | Mitigation Strategies |

Tenants | Thoroughly screen all applicants |

Property Damage | Conduct regular inspections and maintenance |

Liability | Require renters insurance policies |

Nonpayment | Collect security deposits |

Lease violations | Enforce all lease terms consistently |

Becoming a Successful Landlord

Owning rental property can be a rewarding investment if managed properly. Beyond having the right insurance, landlords can take steps to maximize success and achieve their goals as property investors.

Several best practices include:

- Monitoring the local rental market

- Joining landlord communities

- Providing great tenant experiences

Rental Market Analysis

Conduct an in-depth market analysis when first getting started as a landlord, and update it annually. Examine factors like average rents, occupancy rates, supply dynamics, and demand drivers in your area.

This allows you to set optimal rental rates, target the right tenant demographics, invest in high-potential properties, and adapt as market conditions evolve.

Landlord Communities

Join local landlord associations, online forums, and social media groups to connect with other property investors in your area.

Learning from more experienced landlords helps avoid reinventing the wheel. Discuss challenges, legal compliance, screening tools, maintenance tips, insurance options, and other best practices.

Great Tenant Experiences

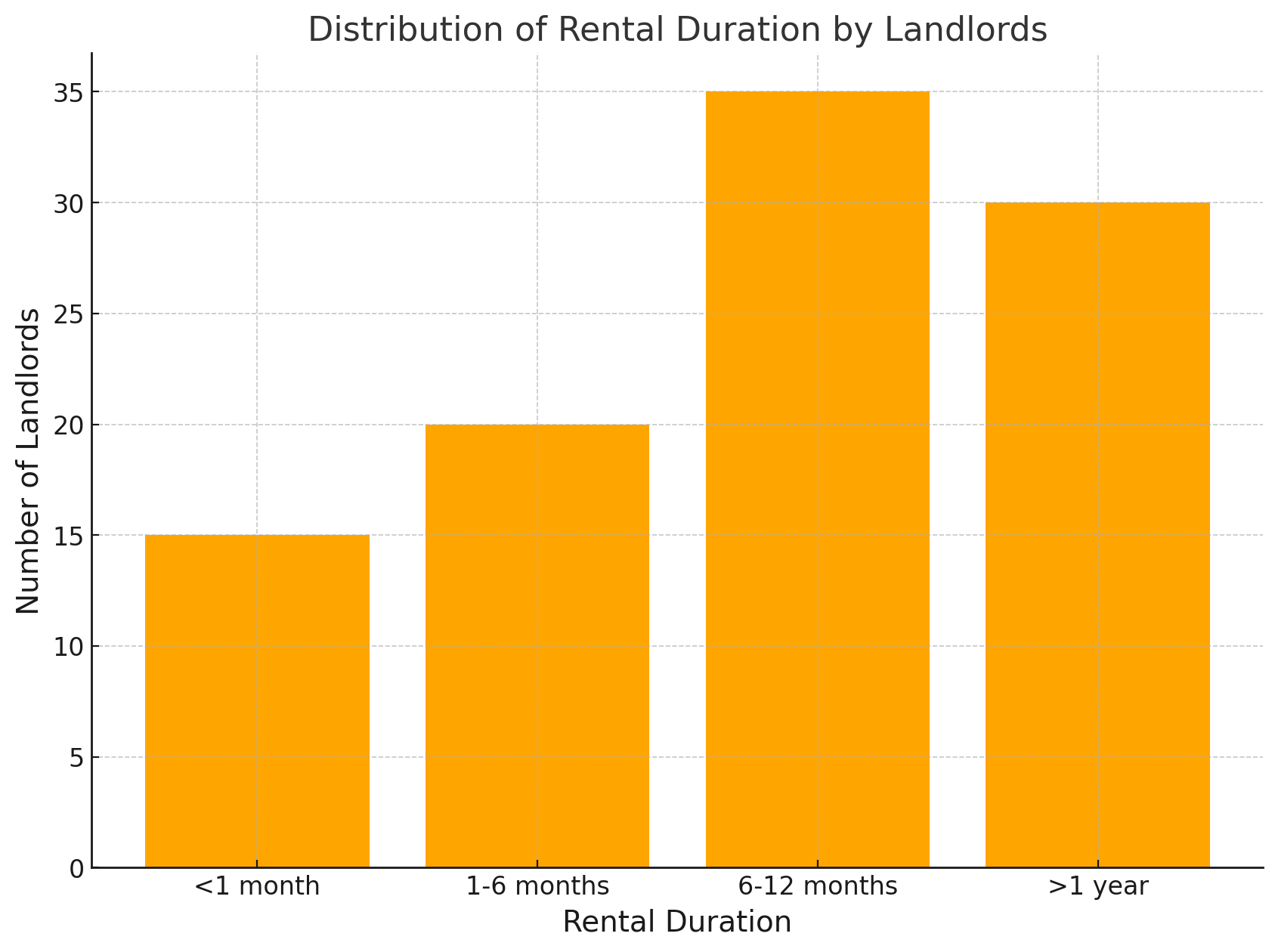

Providing an excellent overall leasing experience may lead to longer tenant tenure, faster re-leasing if vacated, and positive reviews.

Be responsive to maintenance requests, provide 24/7 contact options for emergencies, and use technology like online rent payment systems to demonstrate professionalism.

Lease Renewal Incentives

Offer incentives like reduced rents or waived fees if tenants renew their existing lease, avoiding the turnover costs of finding new renters. First-time incentives can also attract top prospects when vacancies arise.

Responsible long-term tenants are valuable. Reward them for renewing and referring responsible friends or family.

Implementing sound business practices allows landlords to maximize returns, operate efficiently, and enhance tenant satisfaction. Managing properties strategically leads to sustainable success.

Marketing and Managing Rental Properties

Attracting qualified tenants and keeping units full requires effective marketing and property management strategies. Landlords should focus on highlighting property features and establishing efficient operations.

Several key practices include:

- Creating detailed listings

- Maintaining an online presence

- Responding promptly to inquiries

Detailed Listings

Craft rental listings with ample details and high-quality photos to convey the property accurately to prospective tenants searching online.

Highlight amenities, recent upgrades like new appliances, outdoor spaces, parking options, and details like utilities included. Video walkthroughs bring properties to life.

Online Presence

Establish profiles on rental listing platforms like Zillow, Trulia, and Apartments.com. Create a property website with photos, tours, and listing details.

Promote listings on social media channels. Being present across various online platforms expands reach and awareness.

Responsive Communication

Reply promptly to all rental inquiries with the requested information. Use email templates to efficiently cover common questions.

Set clear expectations on communication methods and response timelines. This demonstrates professionalism and reliability.

Streamlined Applications

Use standardized, online rental applications requiring all required information upfront. This reduces back-and-forth and speeds lease signing.

Carefully screen applicants according to defined criteria. Use a background check service for consistency.

Defined Processes

Document all property management processes like advertising, applications, maintenance requests, inspections, and more.

Review processes annually and implement technology to automate manual tasks where possible. Well-defined procedures allow efficient scaling of the business.

With the right mix of marketing, communication, and operational processes in place, landlords can attract top tenants, maximize occupancy rates, and effectively manage their portfolios.

Get Expert Guidance Securing Rental Property Insurance

As a landlord, protecting your rental property investment with the right insurance coverage provides essential peace of mind. Navigating the various options can feel overwhelming. At Branco Insurance Group, our experienced agents are here to simplify the process.

We represent top-rated insurers and can help you compare landlord policies to find one tailored to your specific needs and budget. Whether you own a single-family rental home, an entire apartment complex, or various rental properties, we make insuring them easy.

Our experts carefully evaluate your risks and make personalized recommendations so you have adequate coverage in place. We know insurer discounts available for security systems, multiple policies, and more to help you save. We walk you through submitting claims if the unfortunate need arises.

Don’t leave your hard-earned rental investment vulnerable. The team at Branco Insurance Group is your partner in securing the right protection. Contact us today to discuss your needs and get landlord insurance quotes. We are committed to finding coverage that fits your rental situation so you can focus on filling vacancies, pleasing tenants, and growing your property portfolio.