The Vital Role of Annual Visits for Seniors on Medicare

As we age, prioritizing our health becomes increasingly crucial. For seniors enrolled in Medicare, annual visits hold immense significance in maintaining well-being and detecting health

Real estate investment can be an excellent way to generate passive income and build long-term wealth if you have the proper risk management strategies in place. Having the right real estate investor insurance is crucial for protecting your rental properties, investment assets, and liability risks in Connecticut. This blog post will explore everything you need to know about getting tailored investment property insurance for your specific needs.

There are a few key types of insurance policies that real estate investors, landlords, and property managers in Connecticut should consider:

Every real estate investment comes with its own unique risks and exposures. The location, building type, amenities, tenant mix, and management approach all impact the insurance coverage needs. Working with an experienced insurance broker in Connecticut familiar with real estate investors is invaluable for structuring tailored policies. You want to ensure you have sufficient liability insurance and property damage coverage limits while not overpaying for unneeded protections.

There are several techniques real estate investors can use to optimize their insurance costs in Connecticut:

The right insurance advisor will walk you through all the available options to find the optimal balance of protection and affordability.

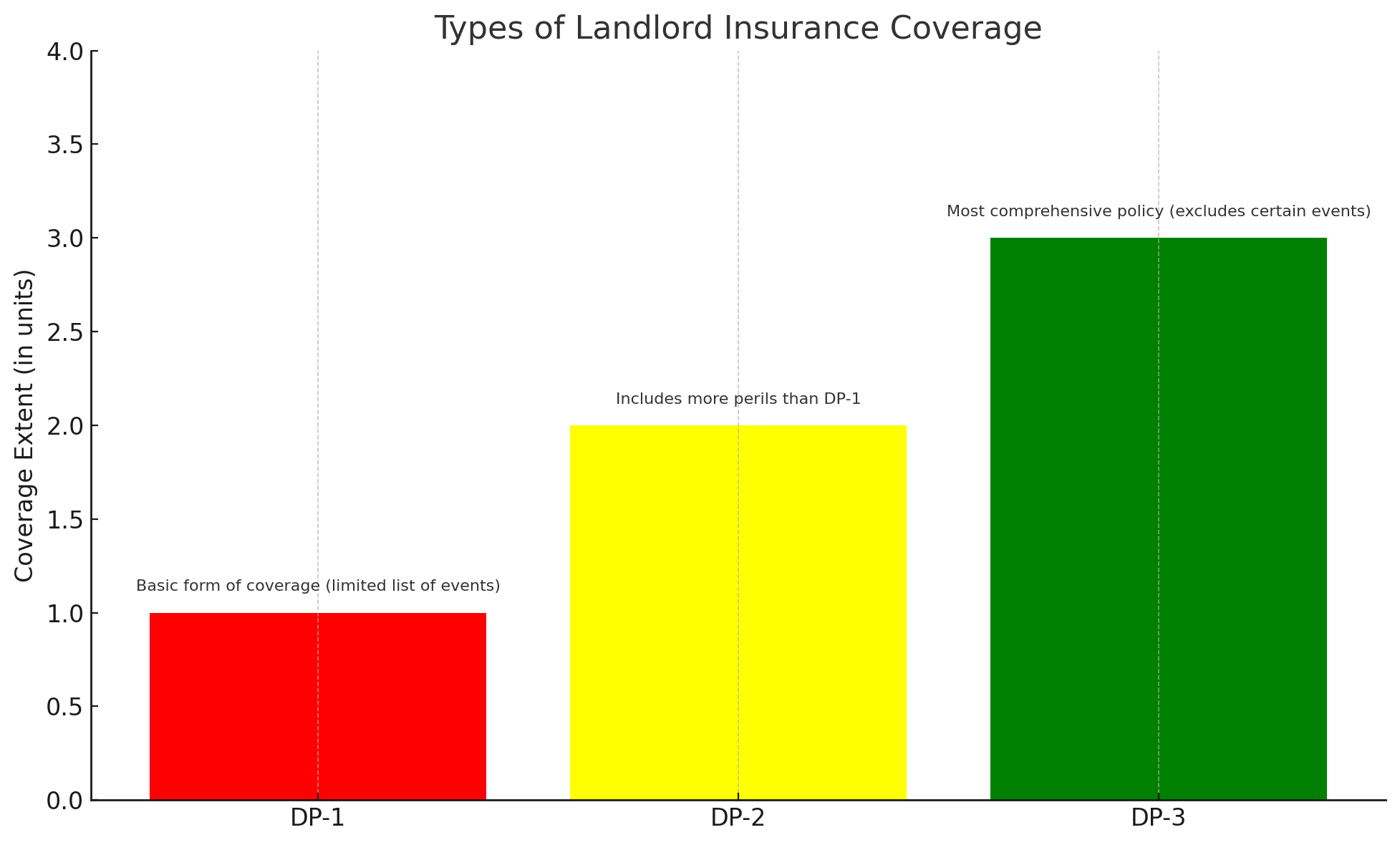

When building your real estate investment insurance portfolio in Connecticut, there are a few key policy types to consider:

Landlord insurance, sometimes called rental property insurance, is essential for protecting your assets against covered losses when renting out properties. Key inclusions are:

Typical limits are $300,000 to $500,000 for dwelling protection and $100,000 for liability. Higher limits may be recommended for large apartment buildings or portfolios.

For investment properties that are being renovated or are unoccupied, vacant property insurance fills an important gap. Empty buildings are seen as a higher risk by insurers. This policy covers:

Vacant dwelling coverage typically costs more than standard policies but is essential during turnover periods.

Larger real estate holdings like apartment complexes may need a commercial policy for sufficient protection. Key features include:

Commercial policies come at a greater cost but offer enhanced coverage for bigger real estate investments.

For substantial assets, umbrella insurance provides additional liability coverage above regular policies. It adds an extra layer of protection in case of:

Umbrella coverage often starts at $1 million, but higher limits are readily available. This provides peace of mind against unforeseen lawsuits or liability gaps.

Structuring comprehensive real estate investment insurance means understanding the key coverages to protect against common risks:

All property policies will cover rebuilding, repairs, and replacements when damage occurs due to events like:

With broad dwelling coverage, most catastrophes and disasters are covered perils.

Liability insurance within property policies covers costs if someone gets injured on the premises and the owner is found legally responsible. This includes:

Typical liability limits of $100,000 to $300,000 or higher apply based on the policy selected.

If damage from a covered event renders the property uninhabitable, loss of rent payments are covered for the repair period. This helps replace lost income relied upon.

The liability portion of the policy pays for legal defense costs and settlements if you are sued for covered circumstances. This protection is invaluable.

Though excluded in some policies, water backup coverage for sewer/drain overflow and sump pump failure is recommended. Resulting mold damage and remediation is often covered.

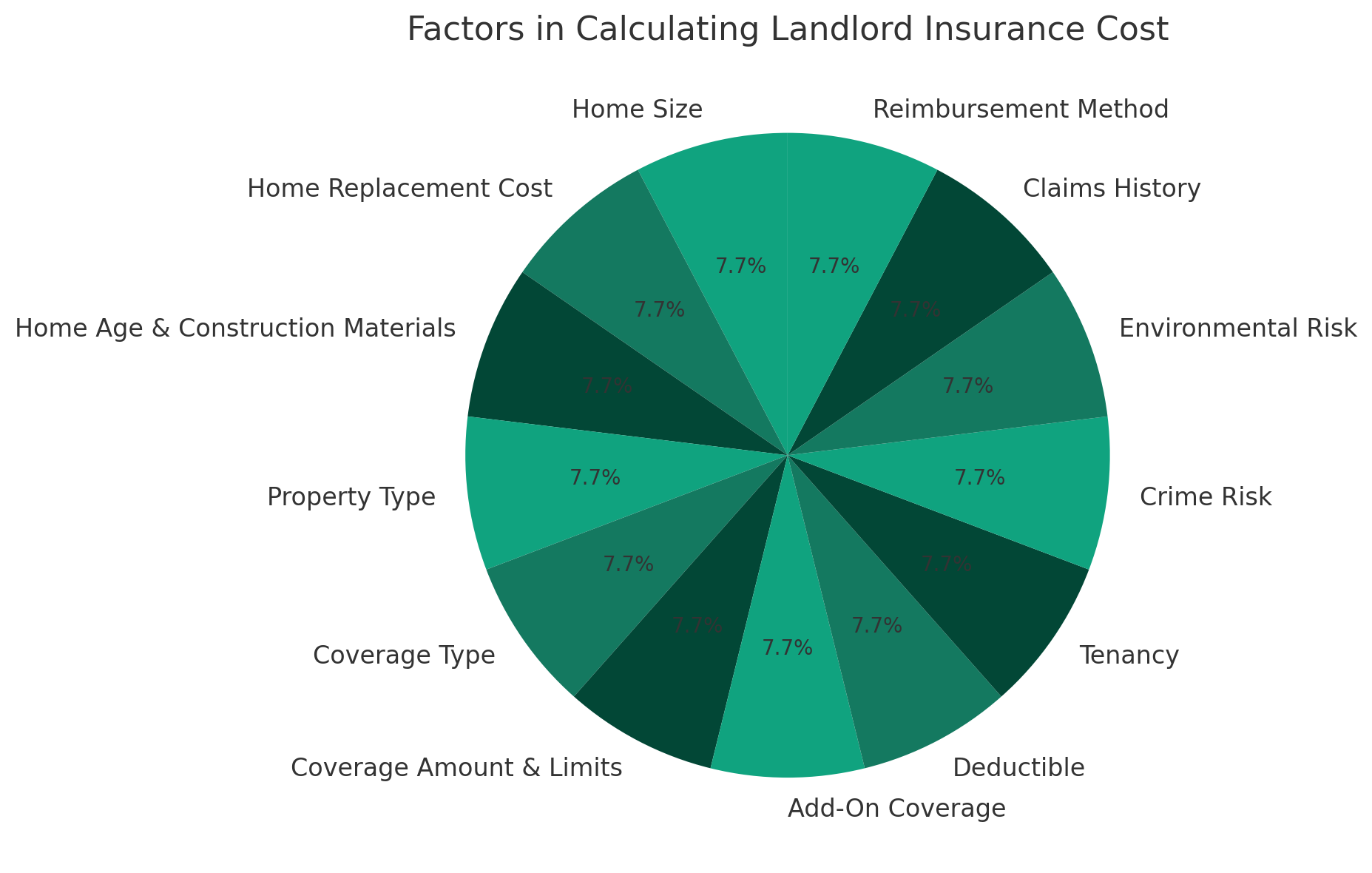

When shopping for Connecticut real estate investment insurance, there are several important factors that impact the policy premiums quoted. Being aware of these allows you to make informed decisions and potentially optimize costs.

Key characteristics about the insured property itself influence premiums:

More risk exposure means higher premiums. Newer buildings in lower-risk areas command better rates.

You can control costs with ideal deductible and coverage limit selection:

Work with your insurance broker to model different scenarios.

Proactive steps to minimize hazards help demonstrate lower underwriting risks:

High-risk properties see higher premiums. Reducing risk lowers costs.

Bundling all your insurance together brings multi-policy discounts:

Choosing the right insurance agent or broker for your real estate investments makes a major difference in securing optimal coverage. Look for an expert who provides:

Seeking out specialists with extensive experience insuring landlords and rental properties is advised. Indicators include:

Their expertise translates into tailored policies.

The ideal broker has access to bundle landlord insurance across policies from A-rated insurance carriers like:

This allows for crafting a customized bundled solution.

An insurance brokerage invested in your needs provides:

Their guidance is invaluable for customizing protection.

In the event of a loss, great agents provide:

This takes the hassle out of getting repairs covered quickly.

To secure the best real estate investment insurance fit and pricing, proactive risk management is key. Steps to take include:

Keeping properties well-maintained reduces risks.

These steps make properties less enticing targets for thieves and vandals.

Careful tenant selection reduces non-payment and property damage risks.

Strict rent collection and eviction process cuts delinquencies.

Identifying and addressing risks is key to optimizing insurance protection.

In the event your Connecticut rental property suffers covered damage, be sure to follow these best practices when filing your real estate investment insurance claim:

Photos help claims processors fully understand the extent of damage.

Quick notice starts the review and approval process sooner.

Mitigating additional damage may allow for more coverage.

Submit documentation to maximize reimbursement.

Cooperating fully facilitates faster payout.

If a liability claim arises from a tenant or third-party injury on your Connecticut rental property, be sure to follow these guidelines:

This facilitates the claims investigation process.

Thorough documentation will assist in determining liability.

Insurers need full cooperation to process claims properly.

Insurers have processes to reach fair settlements.

Discretion ensures the best resolution.

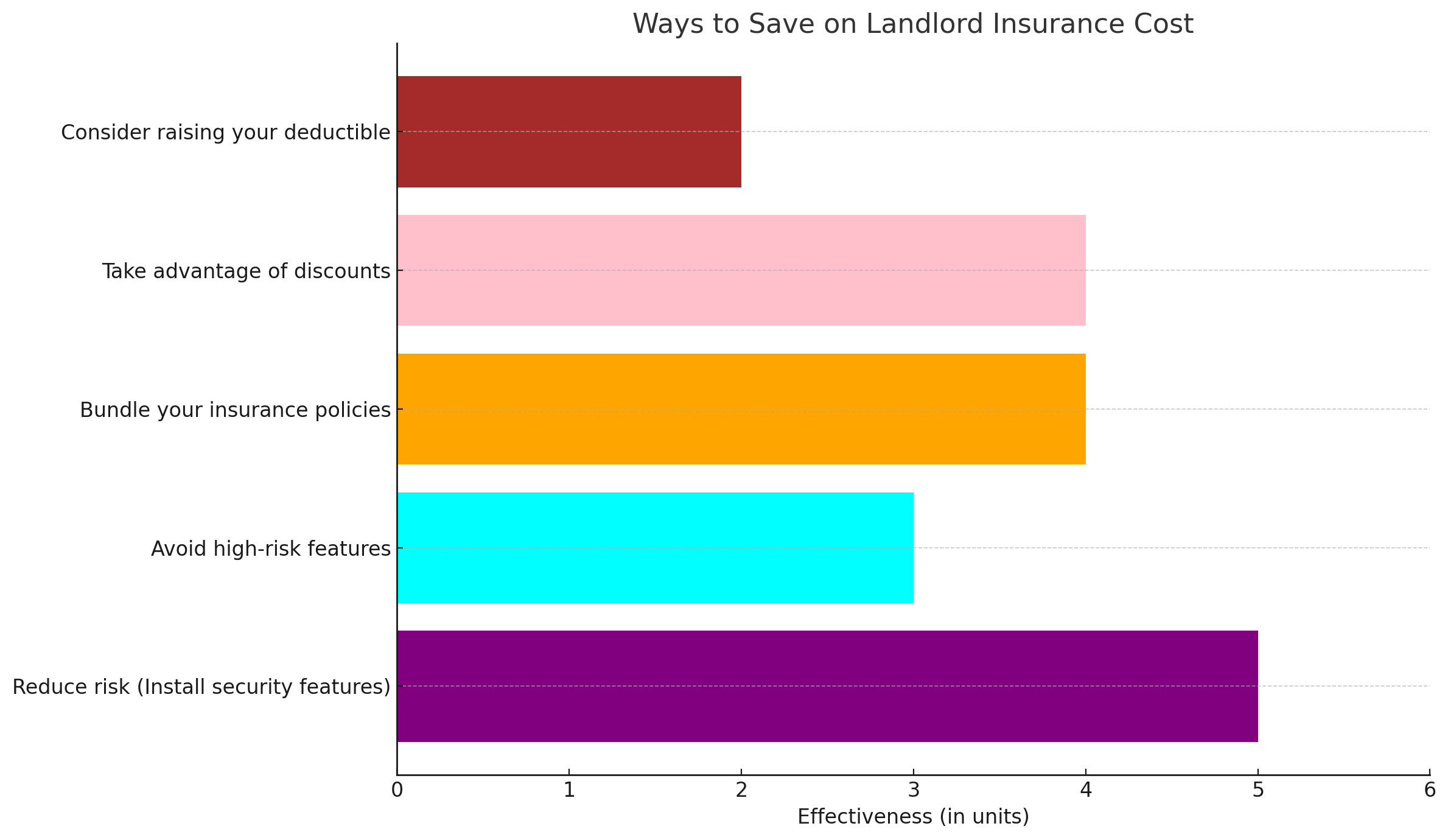

Finding ways to optimize insurance costs for your real estate investments while still getting sufficient protection is wise. There are several techniques to potentially lower your landlord insurance premiums.

Installing safety features that go above and beyond minimum requirements can pay dividends in premium savings. Consider fire alarms, carbon monoxide detectors, surveillance camera systems, and burglar alarms. Also, ensure adequate lighting, both indoor and outdoor. The more proactive security features you have in place, the more insurers may reward it with discounts for demonstrating your commitment to risk mitigation.

Improving physical security like doors, windows, and locks also helps reduce risks. While lighting and alarms provide passive protection, take a look at your door, window, and lock security as well. Solid core doors with strong deadbolts and Jimmy-proof window locks make it harder for intruders to enter. Trimming back any exterior vegetation covering doors or windows takes away hiding spots. The more resistance you present to break-ins and vandalism, the lower the underwriting risk insurers will assess.

Making regular maintenance a priority for your properties helps avoid damage from deferred upkeep and reduces risks. Conduct thorough inspections at least annually, checking for leaks, weather sealing, exposed wiring, or anything that could cause or worsen a covered loss. Service HVAC systems and appliances regularly as manufacturer recommendations advise. Address any emerging issues immediately, no matter how minor they seem. Well-cared-for real estate demonstrates smarter risks deserving of lower premiums.

Increasing your deductible amount can also provide savings. Most insurers offer discounted pricing if you accept a higher deductible, such as $1,000 or $2,500 instead of $500. While this means greater out-of-pocket costs in the event of a claim, it could potentially reduce your premiums by 10% or more. Evaluate if you can afford the higher initial payout to enjoy lower regular payments, while still keeping it at an amount you could comfortably cover if needed.

Bundling policies together is another way to reduce costs. Insurers provide multi-policy discounts when you insure both your home and rental properties with them. Adding more investments to your portfolio policy as your real estate business grows saves money. You can also bundle landlord insurance with an umbrella policy for additional savings. Ask your agent about packaging policies for the maximum discounts.

Trying to manage your Connecticut real estate investment insurance needs entirely on your own can be challenging. Working with a qualified insurance professional provides key advantages:

Gaining insights from experience should not be underestimated. An established agent or broker who specializes in policies for landlords and rental properties has likely handled hundreds of investments over their career. They have deep expertise on the local real estate market, risks, carriers, and regulations. Their guidance and recommendations carry far more weight than researching on your own.

An experienced professional can also ensure you have sufficient coverage in place and avoid gaps. They will dive into your portfolio, locations, building types, and assets. Coverage needs for a single-family rental versus a 200-unit apartment complex vary greatly. Industry veterans translate their years in the field into properly customized policies for clients.

A good broker will educate you and explain policy options, exclusions, limits, and other key details in plain language. Complex terminology and clauses hard for laymen to decipher should be clarified so you understand what is and is not covered. They want you as an informed consumer of insurance products.

Independent agents have existing relationships with multiple top-rated insurance carriers. This allows them to shop your risk profile and negotiate optimal rates. With an expert in your corner, you have an advocate to find you the best landlord insurance fit at competitive pricing.

Should you ever need to file a claim, professionals excel in smoothly guiding you through the process. They work to provide the best claims experience possible, while you focus on your real estate business. Their expertise removes headaches and frustration when settling losses.

There are clear advantages to having a deeply experienced insurance pro looking out for your best interests. Don’t leave your valuable assets at risk – partner with one today.

Structuring the proper real estate investment insurance coverage is crucial to protecting your assets and managing risk exposure. While insurance can seem complicated for landlords initially, this guide has outlined the key policy types to consider, coverages provided, factors impacting premiums, proactive risk management techniques, claims handling best practices, and the benefits of working with a qualified insurance professional.

With smart planning using these tips, Connecticut real estate investors can secure tailored landlord insurance at optimal cost. Your rental properties, financial future, and peace of mind depend on making well-informed insurance decisions for your needs. Partner with an expert broker to review your current policies or create a comprehensive risk management strategy if just getting started. Investing in the right insurance provides asset protection that allows confident investing in rentals.

If you have any additional questions about real estate investment insurance in CT or if you are ready for a quote, contact our experts at Branco Insurance Group. We are ready to help you today!

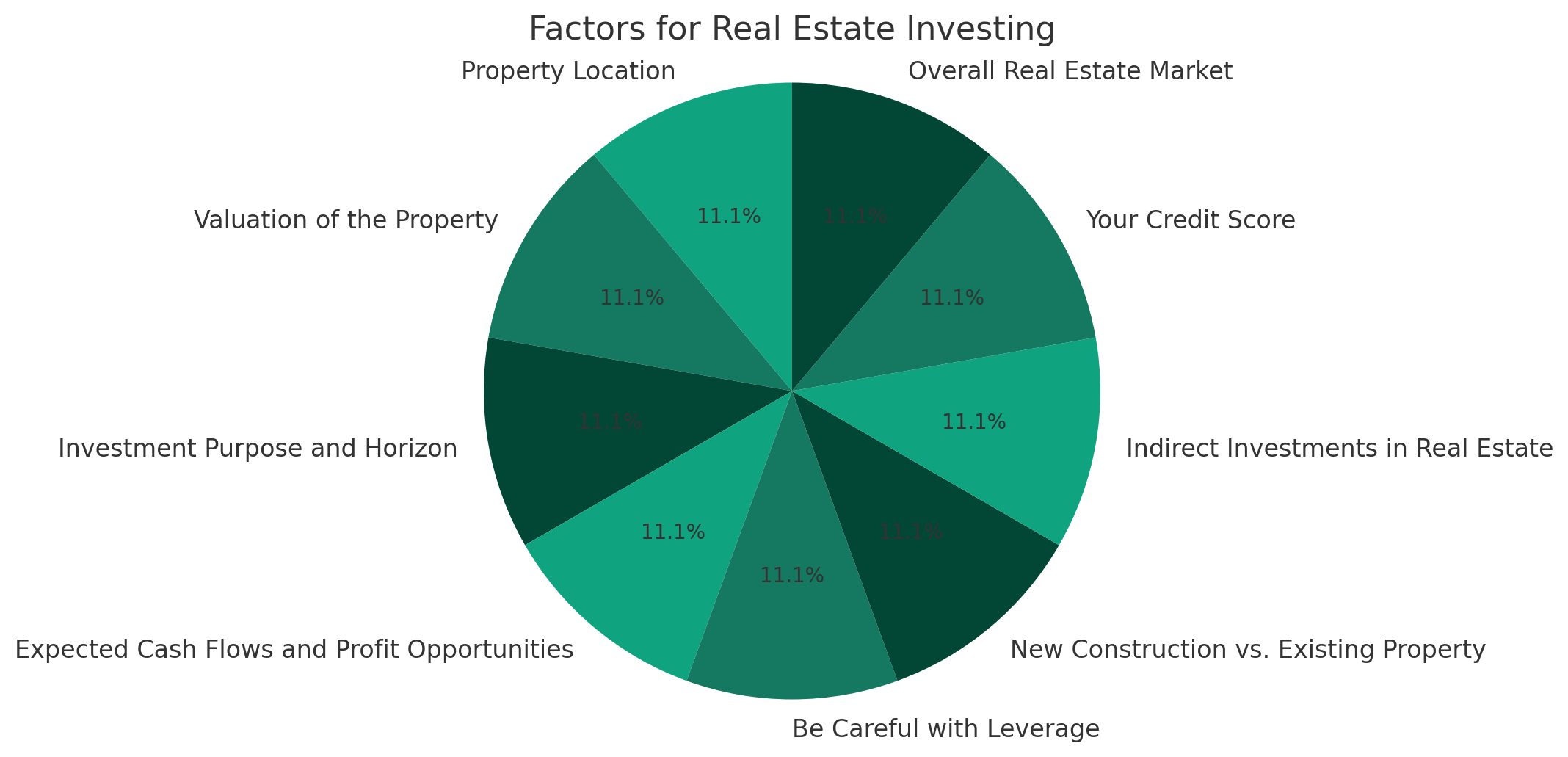

When investing in rental properties in Connecticut, there are a few tips to follow for safer real estate investing:

Perform thorough due diligence on properties and neighborhoods before purchasing. Review market trends, rents, expenses, and look for hidden issues. Start with more affordable investment properties as you build experience. Screen tenants very carefully and use detailed lease agreements that outline expectations and policies. Also, obtain sufficient real estate investment insurance coverage to protect your assets against risks like accidents, disasters, lawsuits and lost rental income. Implement preventative measures as well like security systems and regular maintenance. Additionally, build a diversified portfolio across different property types and locations instead of concentrating your holdings. Finally, partner with an experienced Connecticut real estate broker and property manager to leverage their expertise.

Real estate can generally be considered a safer long-term investment in Connecticut if smart practices are followed:

Conduct extensive research on the Connecticut real estate markets, price trends, and property valuations to invest wisely. Look for quality rental properties priced below market value when possible to allow for appreciation. Make sure to obtain proper landlord insurance coverage for protection against risks like property damage, liability claims, and loss of rent. Manage properties proactively using security features and regular maintenance and upkeep. Also, develop reserves for potential vacancies, maintenance costs, and emergency repairs that will arise. Utilize professional property management as well for handling tenant screening, rent collection, compliance, and relations. Finally, maintain adequate financing on investment properties with fixed-rate mortgages instead of variable rates.

Real estate investment insurance refers to specialized insurance policies designed to protect rental properties, landlords, and real estate investors. Key insurance options to consider include:

Insurance provides crucial protection for real estate investors against accidents, lawsuits, natural disasters, theft, and more. It helps safeguard rental income and asset value.

Insurance companies invest portions of their large investment portfolios into real estate for a few key reasons:

Real estate is attractive to institutional investors like insurers for its durable returns. It makes up around 3-5% of the average insurance company's investment mix.

There are several important benefits that real estate investment insurance provides:

Insurance allows real estate investors to safeguard their properties and financial interests. It's a crucial risk management element.

There are a few ways life insurance enables real estate investing:

So, life insurance can facilitate real estate acquisitions through its financial benefits if structured properly.

As we age, prioritizing our health becomes increasingly crucial. For seniors enrolled in Medicare, annual visits hold immense significance in maintaining well-being and detecting health

Your roof is your home’s first line of defense against the elements, and it’s essential to keep it in good condition to ensure the safety