The Vital Role of Annual Visits for Seniors on Medicare

As we age, prioritizing our health becomes increasingly crucial. For seniors enrolled in Medicare, annual visits hold immense significance in maintaining well-being and detecting health

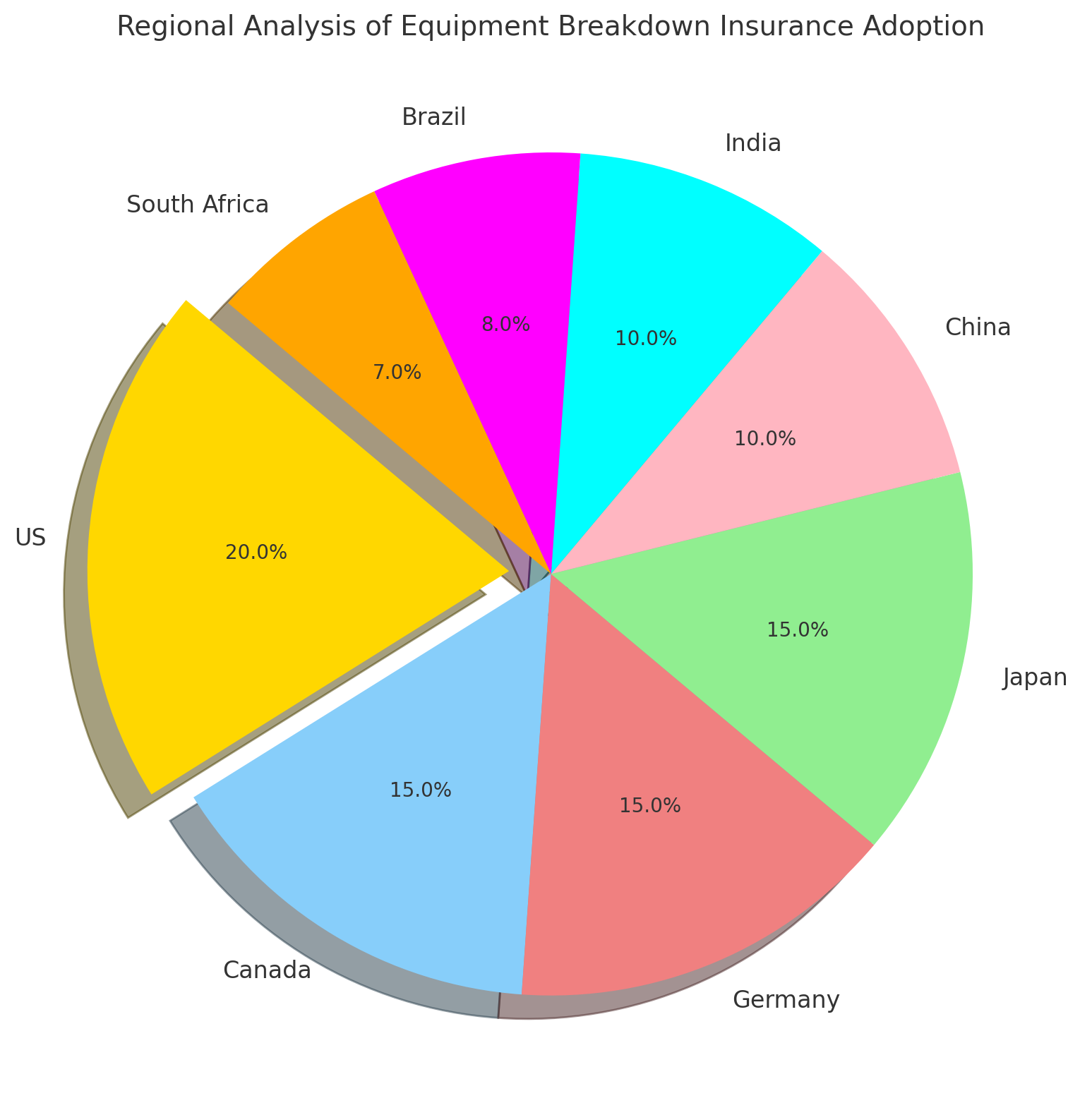

Equipment breakdown insurance provides critical financial protection for businesses relying on mechanical, electrical, and other types of equipment to operate efficiently. When important commercial or industrial equipment unexpectedly breaks down, this specialized type of commercial property insurance helps cover the costs of repairs and replacement, as well as income losses and property damage.

For businesses that depend on equipment like HVAC systems, industrial machines, computers, or heavy-duty appliances, the sudden failure of these assets can severely disrupt normal business operations. Not only are repairs and replacements expensive, but downtime and loss of income can also have major financial implications. Equipment breakdown insurance helps minimize the losses.

Equipment breakdown policies cover both the direct costs of equipment repairs and property damage, as well as the indirect costs of business interruption when critical equipment goes offline. This is extremely valuable for mitigating financial risks.

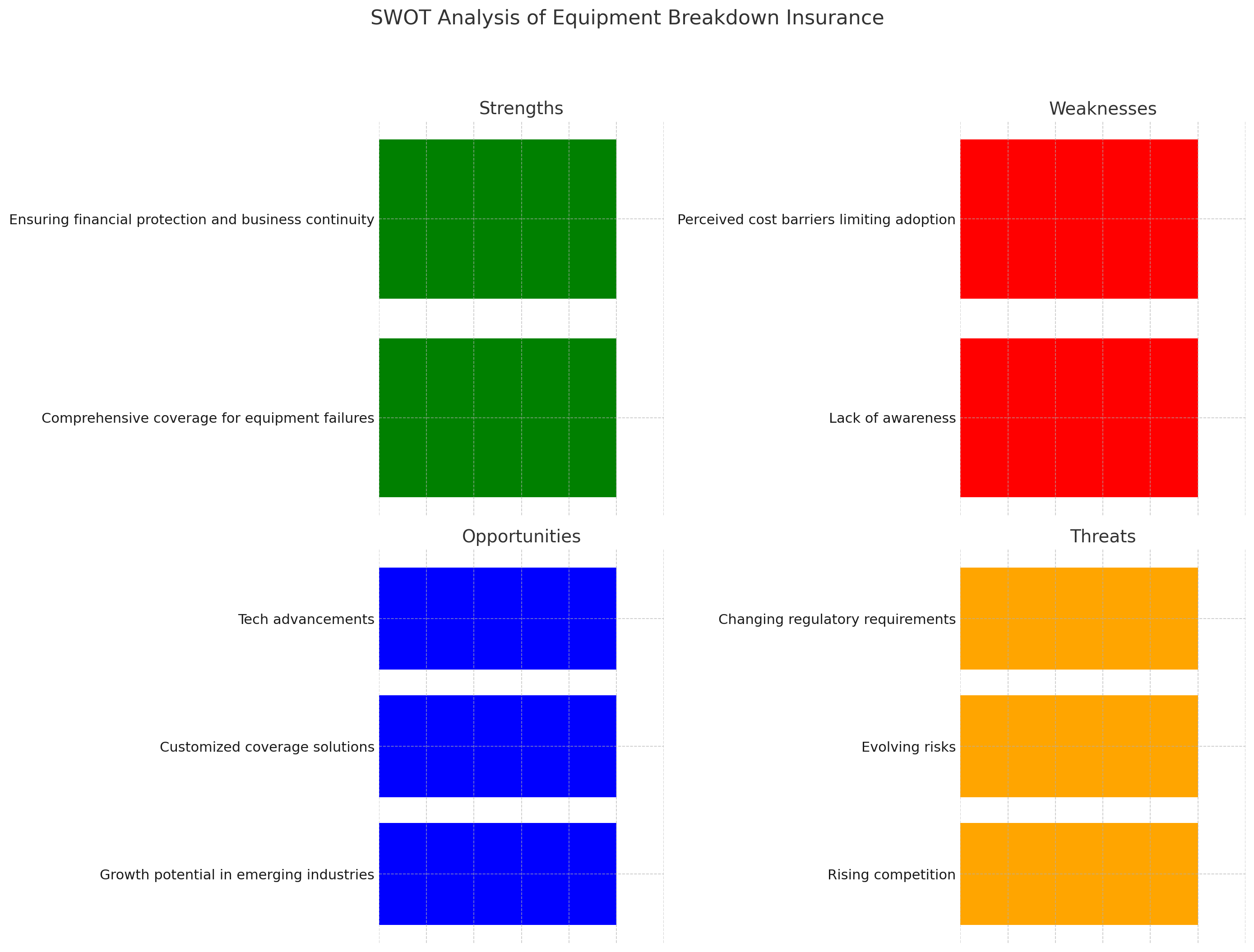

Some key advantages of equipment breakdown insurance include:

While coverage options and costs vary between providers, most policies are relatively affordable. For example, $1 million in equipment breakdown coverage may cost around $500 – $1000 annually.

Equipment breakdown insurance provides essential protection against equipment failure risks for businesses relying on electrical, mechanical, and computer systems. Understanding what’s covered and comparing provider options is important for securing this critical coverage.

Equipment breakdown insurance policies cover the costs to repair or replace damaged equipment, as well as expenses and losses that result from the equipment failure. The specifics will vary between policies, but some of the main coverages include:

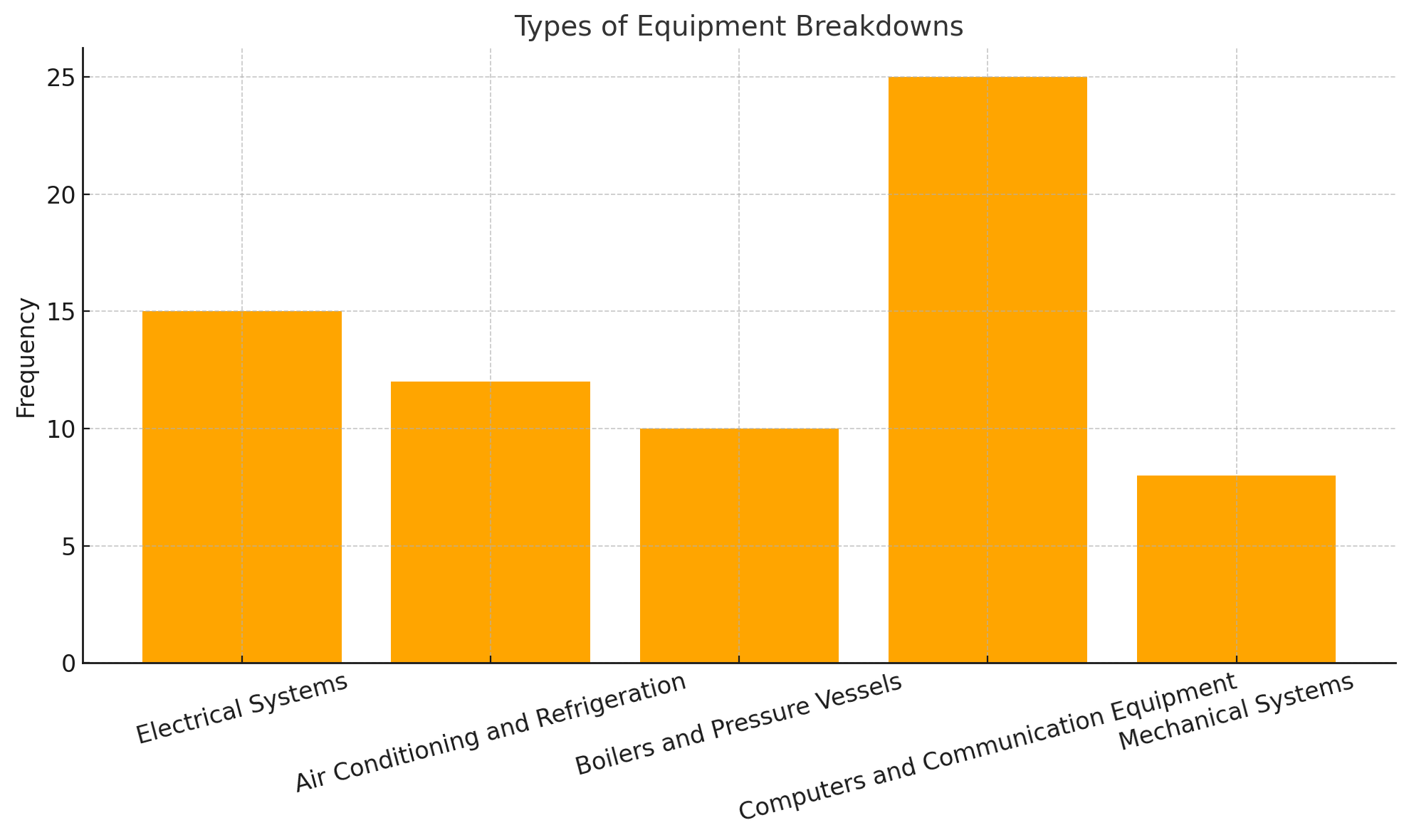

Equipment breakdown insurance covers a wide range of electrical, mechanical, and digital equipment used in commercial and industrial facilities. Some of the main types include:

Also covered are utility interruption losses when equipment owned by the utility fails.

For coverage to apply, the equipment breakdown must result from specific covered events, such as:

Normal wear and tear leading to failure is not covered.

The main expenses covered by equipment breakdown insurance include:

Being properly insured for all resulting costs is critical when essential equipment unexpectedly fails.

Equipment breakdown insurance can be purchased as a standalone policy or added to an existing commercial property policy. Here’s an overview of how this coverage works:

Equipment breakdown insurance is typically offered in two main forms:

Standalone policies may provide more customized or extensive equipment breakdown protection. Adding it to an existing policy can save money on premiums.

Equipment breakdown coverage is usually structured as named perils coverage rather than all risks. This means it only covers losses specifically listed in the policy, rather than covering all risks except those excluded.

Typical named causes covered include power surges, short circuits, motor burnout, and specific mechanical failures. Make sure to understand the breakdown causes covered.

Policies have a deductible that must be paid before coverage kicks in. Deductibles are usually applied per equipment breakdown event. Common types include:

Choosing an appropriate deductible amount is important during the policy selection process.

If equipment breakdown occurs:

Thoroughly documenting losses is essential for effectively submitting and resolving claims.

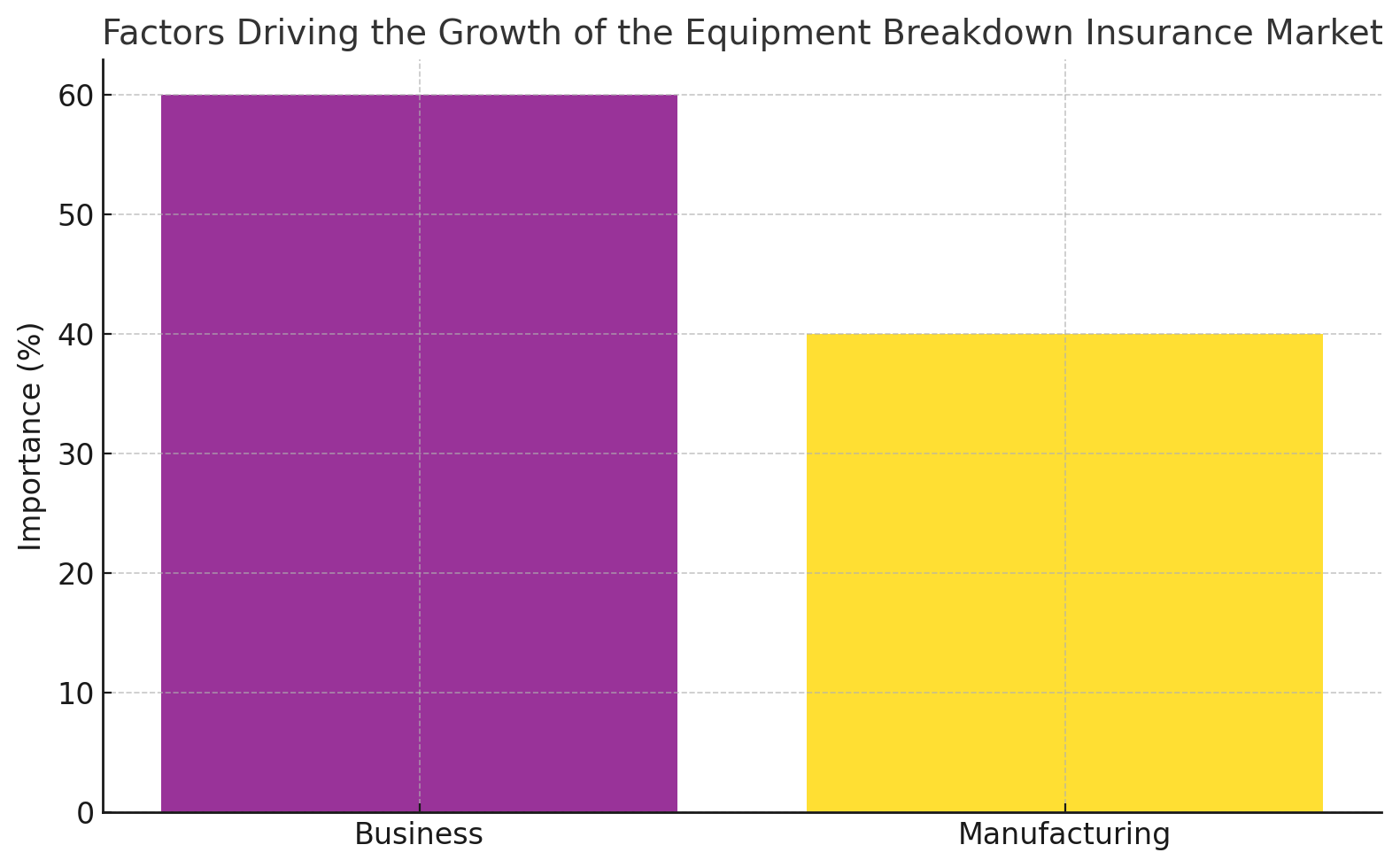

Any business that relies on electrical, mechanical, or computer equipment for normal operations should consider equipment breakdown insurance. However, it’s especially essential for facilities like:

Manufacturers depend on heavy machinery and specialized equipment to produce goods. If a critical machine like a conveyor belt or compressor breaks down, it can bring the entire assembly line to a halt. Equipment breakdown insurance helps cover:

Without coverage, a single mechanical breakdown could be financially devastating for manufacturers.

Commercial kitchen equipment like ovens, refrigerators, and dishwashers are essential for restaurants and grocery stores. If these suddenly fail, it could spoil inventory and make it impossible to prepare food. Equipment breakdown insurance can cover:

Refrigeration failures are especially problematic in these facilities, making equipment breakdown coverage critical.

Modern offices rely on electrical and HVAC systems to function. If the AC fails during summer heat, or a short circuit knocks out power, the building may need to close down. Equipment breakdown insurance helps cover:

Any facility housing multiple tenants should strongly consider this coverage.

Equipment breakdown insurance provides essential protection for a wide range of businesses relying on critical electrical, mechanical, and digital systems. Assessing your exposures is key when evaluating your coverage needs.

Equipment breakdown insurance is relatively affordable for most businesses compared to the protection it provides. Here’s an overview of typical costs:

The average cost for equipment breakdown insurance is $25 – $50 annually per $50,000 in coverage. So, a $1 million policy would cost approximately $500 – $1,000 per year.

Of course, exact premiums vary based on factors like:

But in general, expect premiums around 1% of the total coverage amount.

Key factors impacting your equipment breakdown premiums include:

Coverage Amount | Low-Risk Industry | High-Risk Industry |

$500,000 | $800/year | $1,500/year |

$1 Million | $1,600/year | $3,000/year |

$2 Million | $3,200/year | $6,000/year |

Choosing appropriate coverage levels and risk-mitigation steps can help optimize costs. Comparing insurer pricing is also advised.

When selecting equipment breakdown coverage, it’s important to compare policies across providers. Key factors to evaluate include:

Inadequate limits or gaps in coverage can leave you exposed.

Getting the most coverage per premium dollar is ideal.

You want an insurer that will be there if you need to file a claim.

Good service quality provides peace of mind.

Factor | What to Evaluate |

Coverage | Named perils, limits |

Cost | Premiums, deductibles |

Ratings | A.M. Best, S&P, etc. |

Service | Complaints, reputation |

Taking time to compare equipment breakdown policies across these key factors helps ensure you get both robust protection and an excellent customer experience.

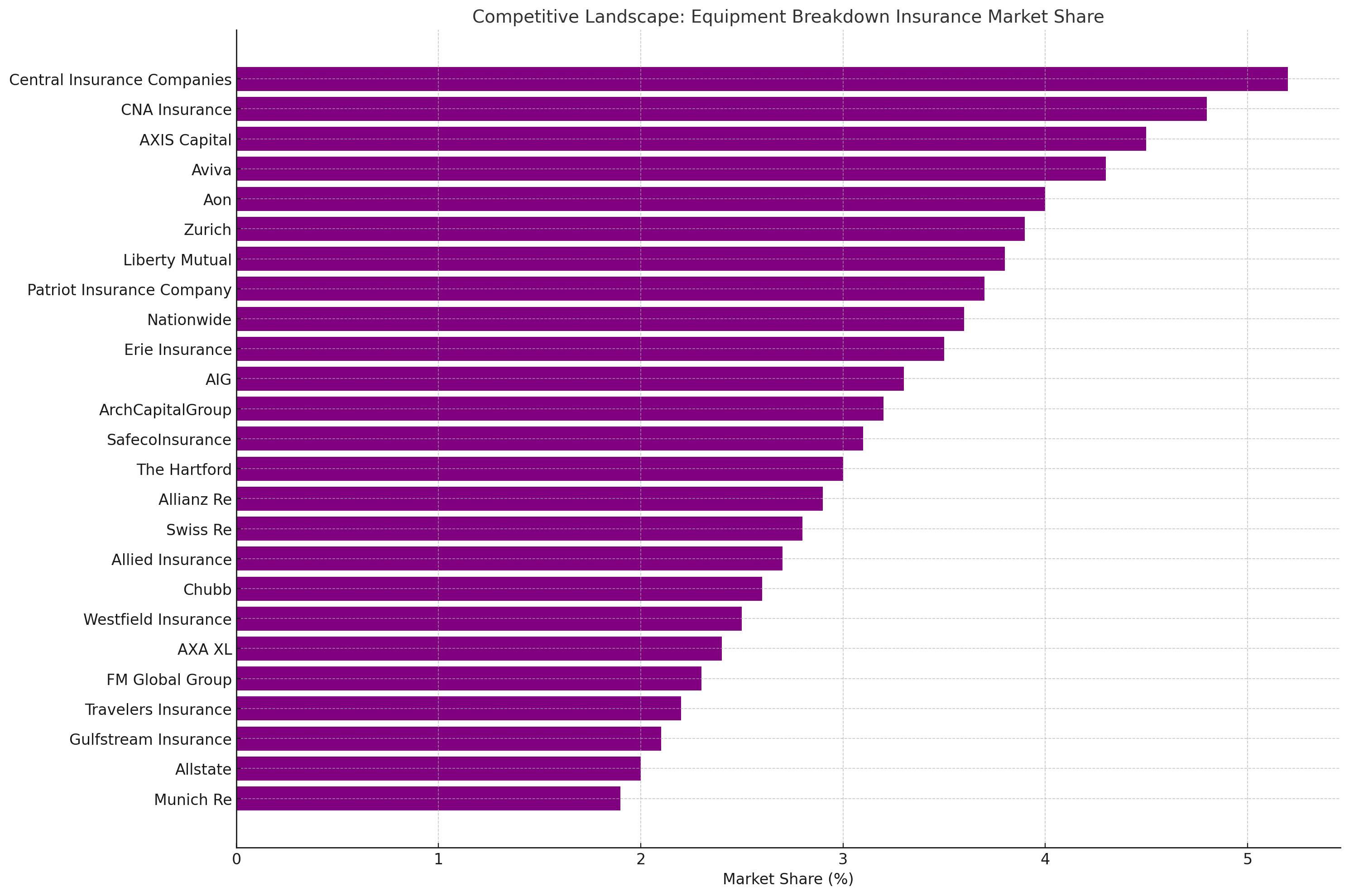

When purchasing equipment breakdown coverage, partnering with a leading insurance provider is advised. Here are some of the top options to consider:

Travelers

Travelers is a great overall choice for robust equipment breakdown protection.

Liberty Mutual

Liberty Mutual offers customizable equipment breakdown insurance.

Chubb

Chubb specializes in tailored coverage for large businesses.

CNA Insurance

CNA provides affordable integrated coverage.

Nationwide

Nationwide offers endorsement options for current policyholders.

Insurer | Best For | Rating |

Travelers | Overall Coverage | A++ |

Liberty Mutual | Flexible Options | A |

Chubb | Large Businesses | A++ |

CNA | Cost Savings | A |

Nationwide | Current Customers | A+ |

Evaluating your specific coverage needs and risk profile will help determine the right provider match.

While equipment breakdown insurance is essential for many businesses, there are other types of insurance that protect related exposures.

Business interruption insurance covers income losses and extra expenses when business operations are suspended due to a covered peril like natural disasters or fires. Equipment breakdown insurance is triggered by mechanical or electrical failure specifically.

Commercial property insurance covers direct physical damage to buildings and business property caused by covered perils like theft and storms. Equipment breakdown insurance covers equipment failures only.

Boiler and machinery insurance is the predecessor to modern equipment breakdown insurance. While the terms are sometimes used interchangeably, equipment breakdown coverage is broader.

Tools and equipment insurance covers small equipment and tools used by mobile businesses like contractors. Equipment breakdown insurance focuses on large stationary equipment necessary for business operations.

While equipment breakdown coverage is essential, partnering it with related policies can provide complete protection. Key gaps to avoid include income losses from natural disasters or fires, and damage to small tools and equipment.

Consulting with an experienced agent allows you to design a custom insurance portfolio specific to your business’s operations and exposures. Make sure to discuss equipment breakdown insurance as a central component.

Equipment breakdown insurance provides critical protection for businesses that rely on electrical, mechanical, and digital systems. When essential equipment unexpectedly fails, this coverage helps pay for costly repairs, property damage, income losses, and liability expenses.

Key policy components include covering a wide range of equipment types, specific covered events leading to breakdowns, expenses incurred due to failures, deductible options, and claims processes. Assessing your equipment exposures, comparing policies, and partnering with reputable insurers ensures your business is properly protected.

While equipment breakdown insurance is specialized, it may be one of the most important coverages for facilities with substantial machinery, computer networks, appliances, and other systems essential for smooth operations. Don’t wait until a critical failure occurs to evaluate your existing protections or supplement with robust equipment breakdown insurance tailored to your needs.

Equipment breakdown insurance covers the cost to repair or replace damaged equipment caused by events like power surges, short circuits, and motor burnout. It also covers resulting expenses like income losses, property damage, and spoiled inventory. Key equipment covered includes electrical systems, HVAC, mechanical equipment, and computer networks.

Equipment breakdown policies do not cover normal wear and tear or externally caused damage from sources like floods or theft. Also excluded are losses during intentional equipment testing and damages from computer viruses or software issues.

Sudden equipment failure can severely disrupt business operations and cause expensive property damage and income losses. Equipment breakdown insurance provides affordable protection that can minimize the financial impacts of these unpredictable events.

Equipment breakdown refers to an electrical, mechanical, or other equipment failure caused by internal problems like an electrical surge or motor burnout. It is an unexpected failure, not gradual wear and tear.

Example equipment breakdown incidents include:

Wear and tear refers to the expected decline in equipment over time with regular use. Equipment breakdown is an unexpected failure of equipment due to internal electrical, mechanical, or digital causes. Insurance covers breakdowns but excludes normal wear and tear.

As we age, prioritizing our health becomes increasingly crucial. For seniors enrolled in Medicare, annual visits hold immense significance in maintaining well-being and detecting health

Your roof is your home’s first line of defense against the elements, and it’s essential to keep it in good condition to ensure the safety