Introduction to Employment Practices Liability Insurance

Employment practices liability insurance (EPLI) offers critical protection for businesses against increasing employee lawsuits over workplace issues like discrimination, wrongful termination, and sexual harassment. While large corporations often have extensive EPLI coverage, many small and mid-sized companies lack adequate protection, leaving them vulnerable to potentially costly claims. This article provides an overview of EPLI and key considerations for businesses evaluating their need for coverage.

As an experienced independent insurance agency serving clients across Connecticut, Branco Insurance Group recognizes the value of EPLI to protect both large and small enterprises. We have assisted numerous clients in securing customized EPLI policies appropriate for their risk profiles and budgets from highly-rated insurers. Our team stays current on the evolving legal environment to best advise clients on securing employment practices liability coverage.

What is Covered by EPLI?

EPLI policies provide coverage against administrative claims and lawsuits involving a wide spectrum of employment law and labor law violations. Some of the most common areas include:

- Discrimination claims based on protected characteristics like age, gender, race, religion or disability

- Sexual harassment and hostile work environment allegations

- Wrongful termination and retaliation lawsuits

- Breach of employment contract

- Negligent hiring or supervision

- Whistleblower complaints

- Violations of statutes like Title VII, the Americans with Disabilities Act (ADA), and the Fair Labor Standards Act

EPLI covers both defense costs and any settlements or judgments up to the policy limits. Policies can sometimes be expanded to cover third-party claims from customers, vendors, and other non-employees.

Having strong employment policies and practices is the best defense, but even well-run companies face employment claims. EPLI provides an essential financial safeguard for employers striving to foster healthy and compliant workplaces while avoiding costly litigation.

Why Businesses Need Employment Practices Liability Insurance

With the rise in employee lawsuits and regulatory claims over the past decade, employment practices liability has become a key risk exposure for most businesses. There are several reasons why companies today need EPLI coverage:

Employee Lawsuits Are Increasing

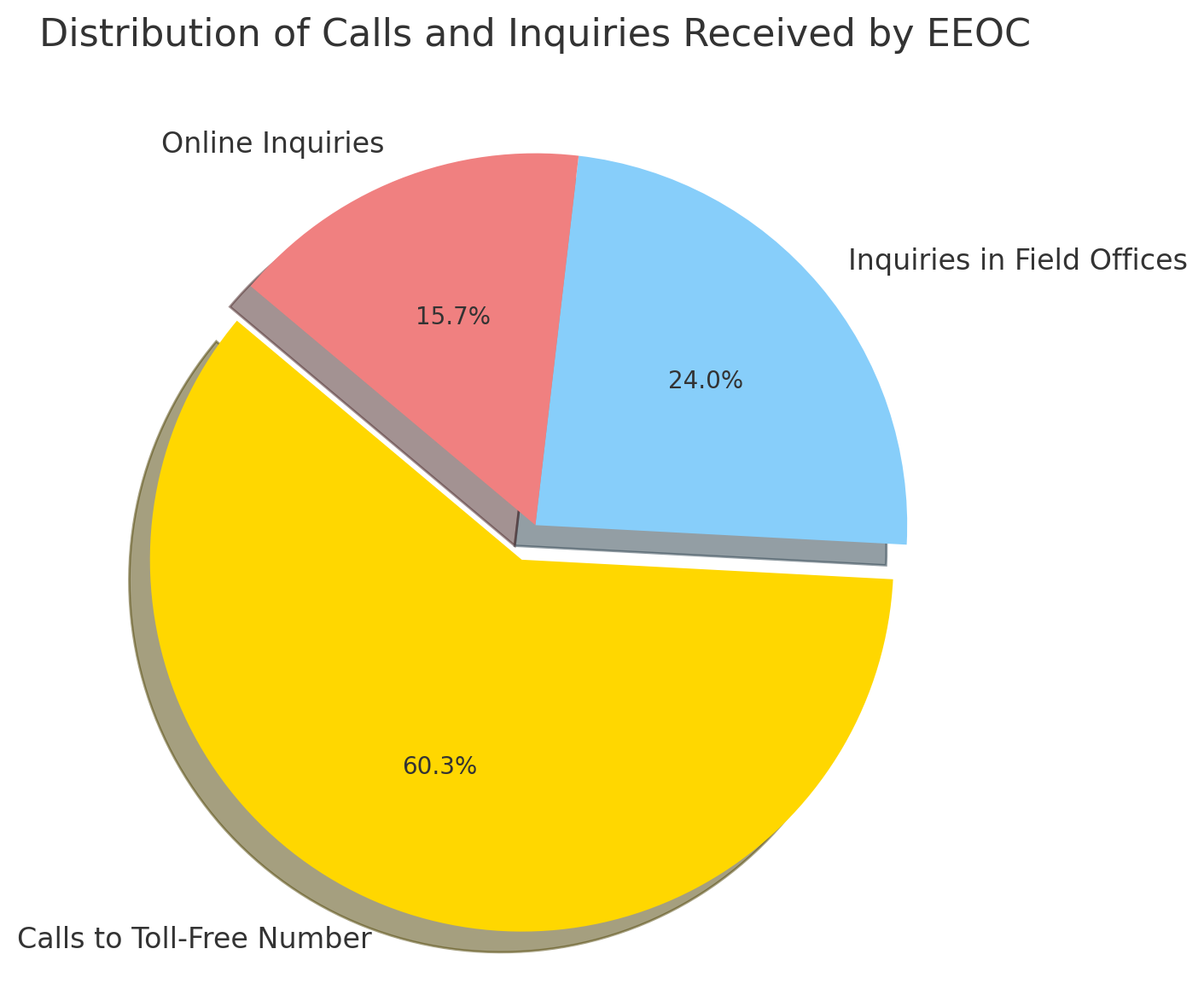

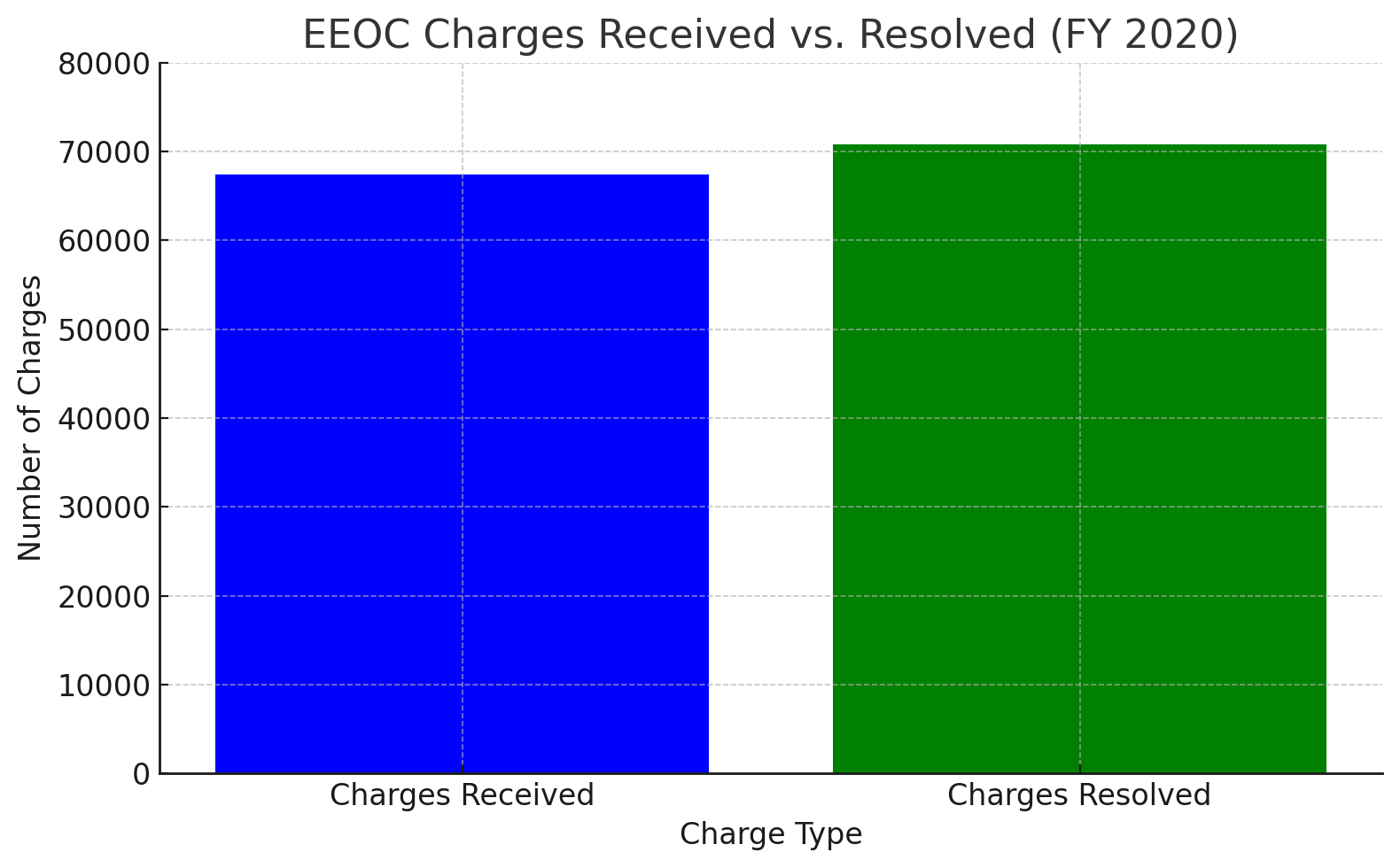

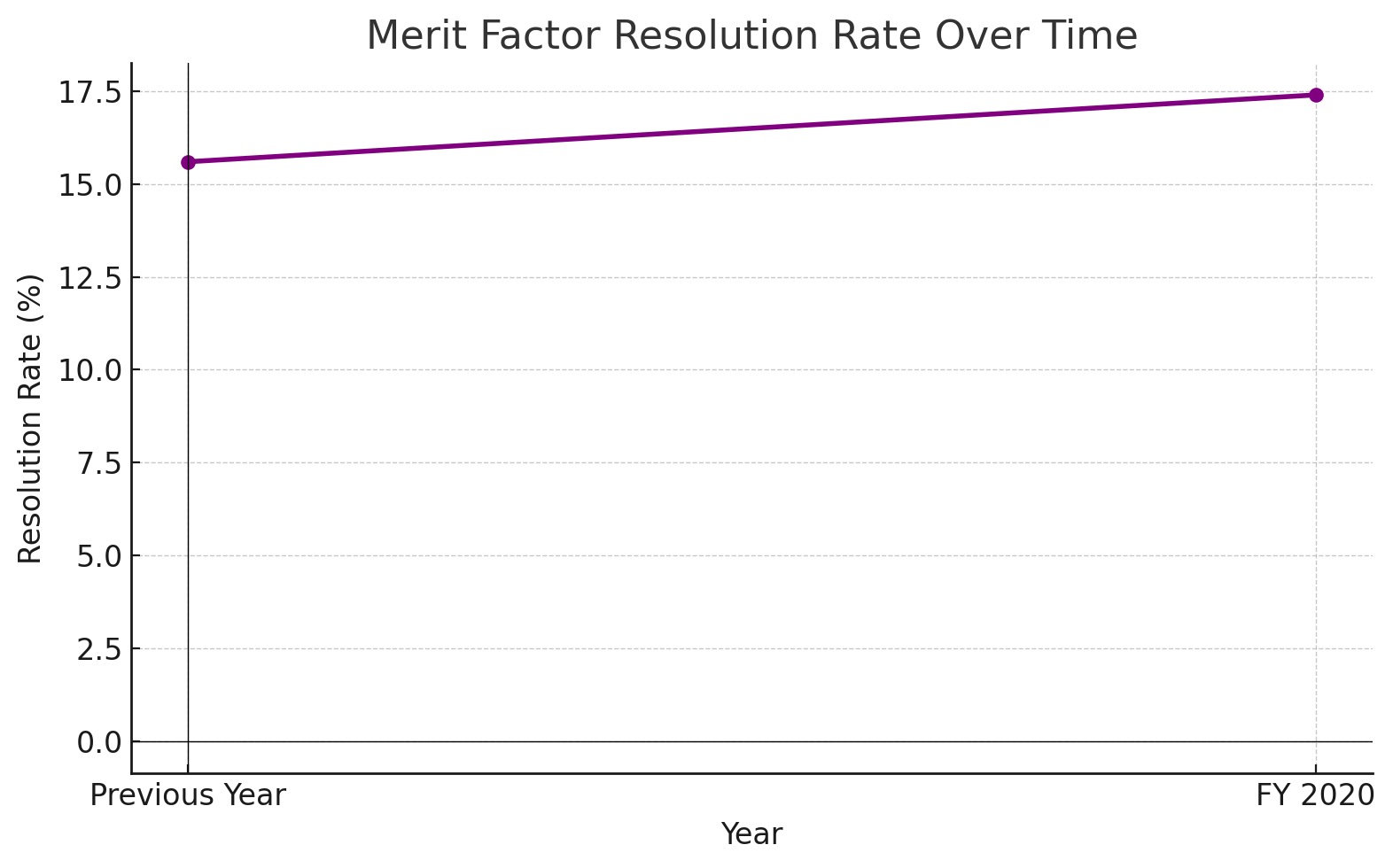

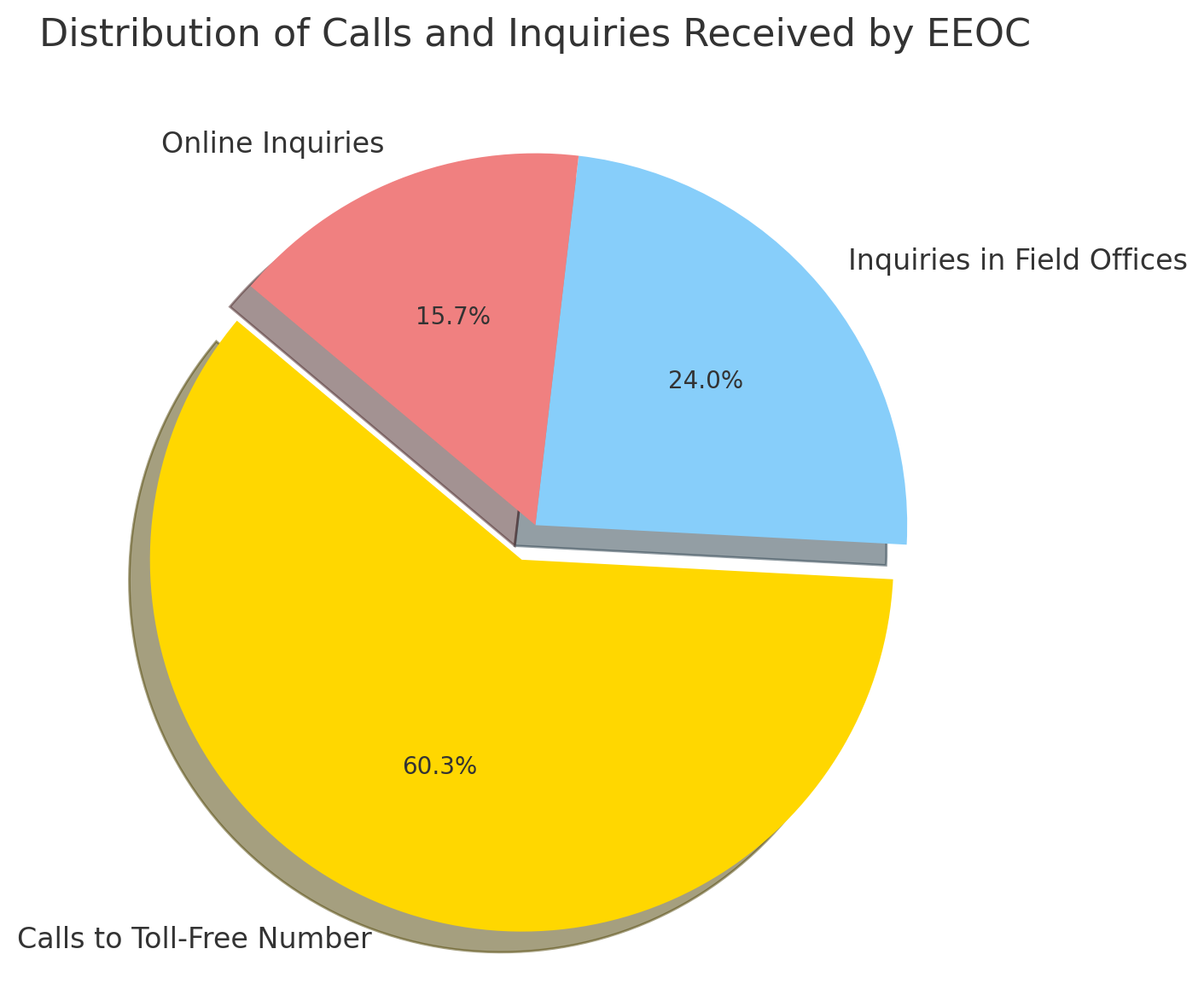

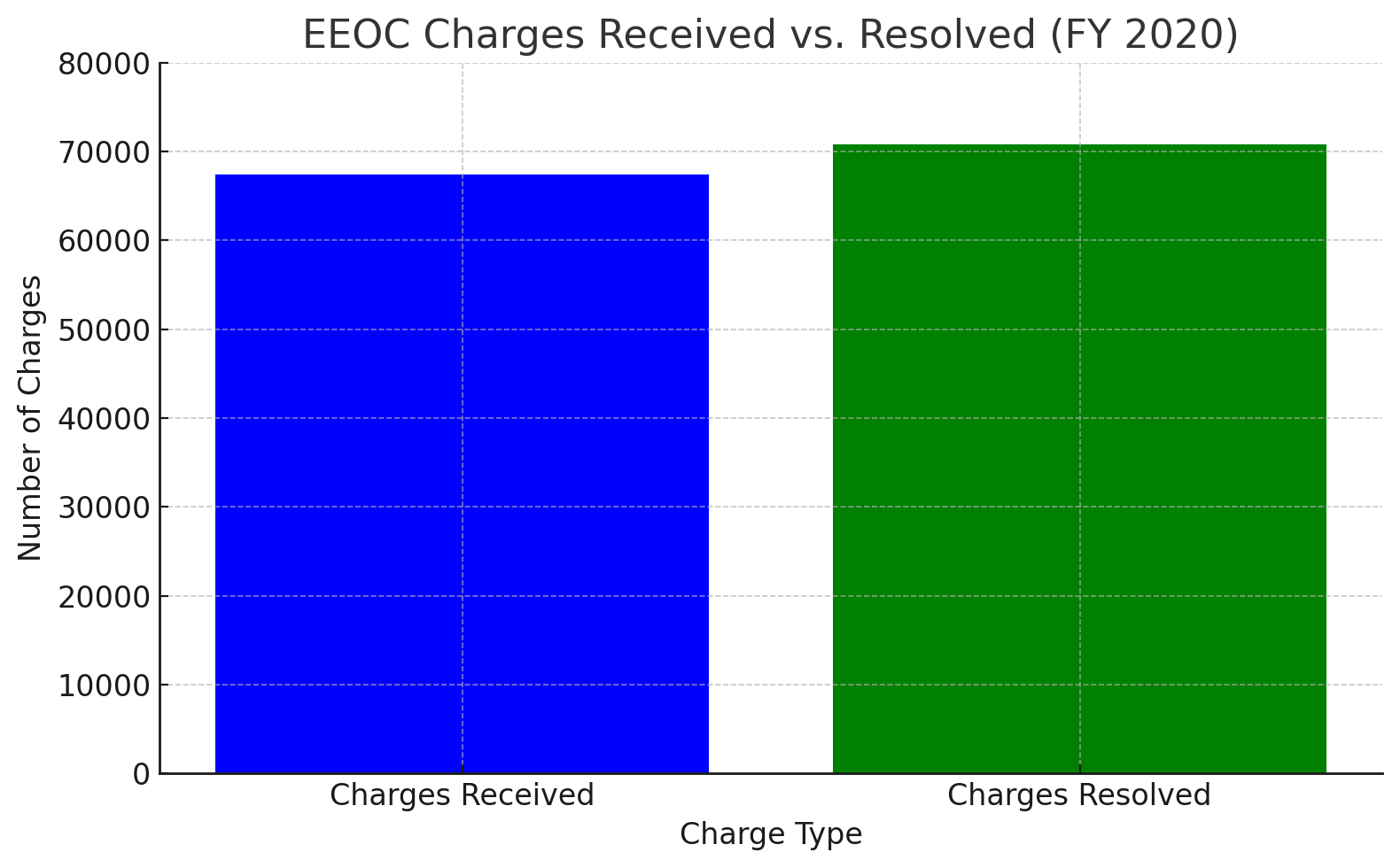

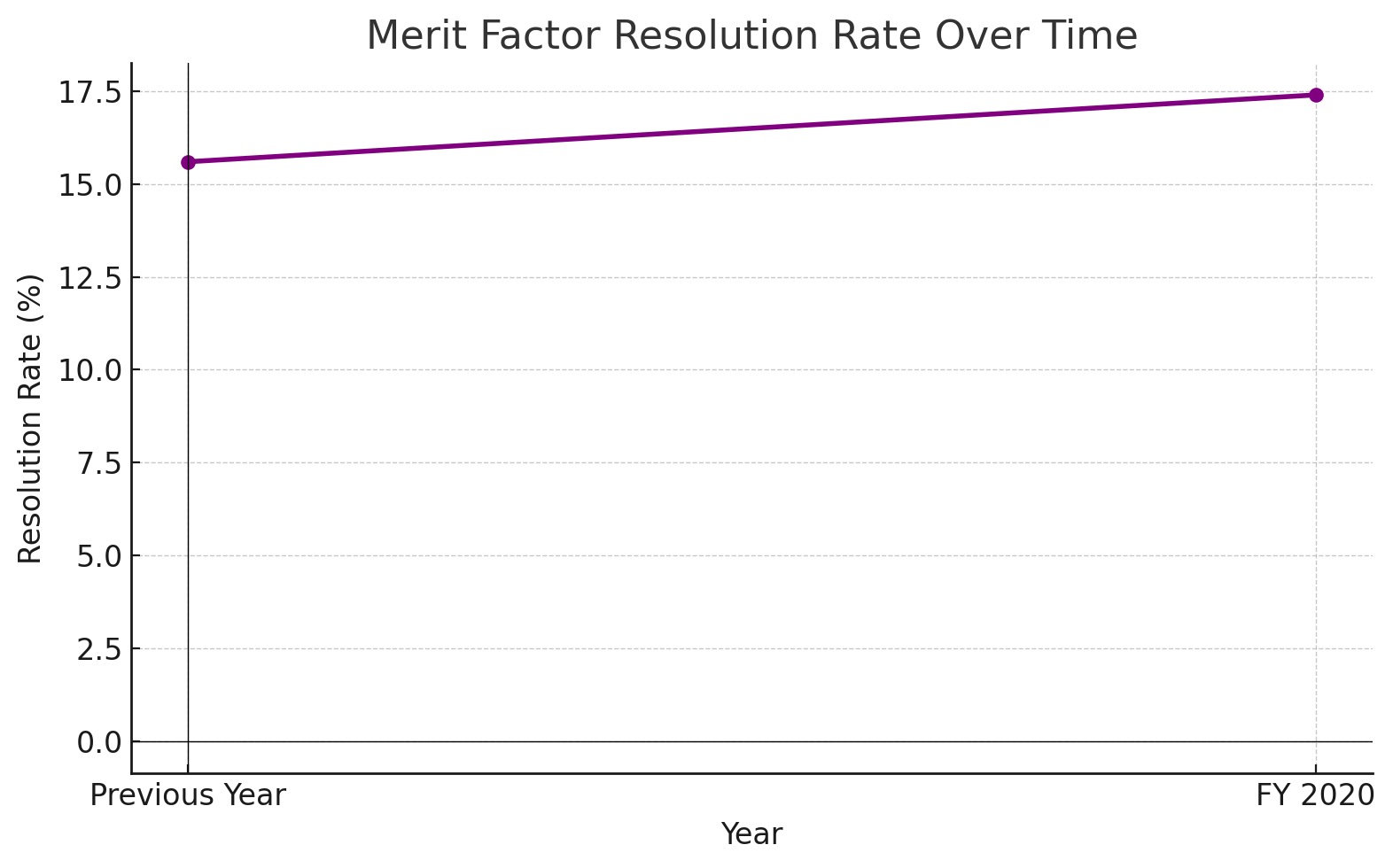

According to the EEOC, over 67,000 employment discrimination charges were filed in 2020 alone. Complaints related to issues like discrimination, retaliation, sexual harassment and wrongful termination continue to climb each year. Jury awards and settlements are also increasing in size, compounding the financial impact. No business wants to end up embroiled in lengthy, expensive employment litigation.

Defense Costs Are High

Just defending against an employment claim can cost tens or hundreds of thousands of dollars in legal fees regardless of the outcome. Many small businesses simply cannot afford this financial burden. EPLI policies cover these costs so businesses can fight unfounded claims without compromising operations.

General Liability Policies May Not Cover Employment Claims

Standard general liability policies often exclude coverage for employment practices liability. D&O policies cover individuals, not the company itself. As a result, businesses face major coverage gaps without a dedicated EPLI policy.

Small Businesses Are Vulnerable

Federal laws like Title VII apply to companies with just 15 employees. State laws often have lower thresholds. With fewer HR resources, small businesses are most exposed to employment claims yet often lack EPLI protection.

While no company wants to believe it could face an employment claim, the reality is that any business with even one employee is vulnerable. An EPLI policy brings essential financial protection to defend and resolve such claims.

What Employment Practices Liability Insurance Covers

A well-structured EPLI policy provides coverage for both defense costs and any settlements or judgments related to employment claims. Here are some of the key areas of coverage:

Defense Costs

This covers legal fees, expenses, and court costs starting from the initial investigation and through the full litigation process. For employers, avoiding high legal bills is often the top priority and this is the main benefit of EPLI. Defense coverage applies even if claims are groundless.

Settlements and Judgments

In addition to defense costs, EPLI policies pay for any settlements reached or court judgments awarded to plaintiffs up to the policy limits. This protects the bottom line from massive damage awards. Many policies also cover back pay owed.

Broad Definition of Claims

EPLI policies define covered claims broadly to include administrative proceedings by the EEOC, lawsuits, and pre-litigation demands or charges. Claims don’t have to reach full litigation to trigger coverage.

Third Party Claims

While most EPLI claims originate from employees, endorsements can add protection for third-party claims made by customers, vendors, business invitees, and other non-employees alleging issues like discrimination or harassment.

Wage and Hour Claims

Recent policies may offer sub-limits or optional coverage to help defend some Fair Labor Standards Act claims around overtime, wages, or misclassification. This area represents major and increasing exposure.

While exclusions apply, the scope of coverage is designed to be comprehensive for the full range of employment law and labor law liabilities private sector employers realistically face today.

Exclusions and Limitations of EPLI Policies

While employment practices liability insurance provides very broad coverage, there are some standard exclusions and limitations to be aware of:

Intentional Acts

Most EPLI policies exclude coverage for willful or intentional discrimination, harassment, or other violations by the insured. However, negligent employment claims would still be covered.

Punitive Damages

Coverage often excludes punitive or exemplary damages which are meant to punish the employer versus just making the claimant whole. Compensatory damages are still covered.

Prior Claims

Any claims that occurred prior to the policy inception or that the insured was aware of before purchasing coverage may be excluded.

Wage and Hour Violations

Full coverage for FLSA or state wage/hour laws may be limited or require additional endorsements. But defense costs are often included.

Workers Compensation

Claims that fall under workers comp laws for on-the-job illness or injury are excluded since that coverage already exists.

Bodily Injury

EPLI does not cover physical workplace injuries, which are handled through general liability and worker’s compensation policies.

ADA Accommodations

The costs of providing accommodations under the Americans with Disabilities Act may be excluded and fall under general liability.

While scope limitations apply, EPLI policies still cover the majority of common employment law claims like discrimination, harassment, and wrongful termination that pose the greatest liability risk to employers today.

| Coverage Areas | Impact on Client | Benefits of Insurance | Risks Without Insurance |

|---|

| Discrimination claims based on protected characteristics | Protects against claims related to any form of discrimination, ensuring a safe and inclusive work environment. | Comprehensive protection against discrimination claims, reducing legal risks. | High legal costs, reputational damage, and potential financial distress. |

| Sexual harassment and hostile work environment allegations | Protects the business against potential lawsuits related to harassment, ensuring a respectful workplace. | Financial and reputational protection against harassment allegations. | Potential legal actions, reputational damage, and financial losses. |

| Wrongful termination and retaliation lawsuits | Ensures that any termination or retaliation claims are covered, safeguarding against potential legal complications. | Coverage for legal costs associated with wrongful termination claims. | Potential legal complications and financial implications. |

| Breach of employment contract | Protection against claims related to contract disputes with employees. | Protection against financial losses from contract disputes. | Financial losses and legal complications. |

| Negligent hiring or supervision | Protection against claims stemming from hiring or supervisory practices. | Coverage against potential hiring or supervisory mistakes. | Legal actions from hiring/supervisory mistakes. |

| Whistleblower complaints | Protection against claims from employees reporting misconduct. | Safeguarding against whistleblower-related legal complications. | Legal implications and potential financial distress. |

| Violations of statutes (Title VII, ADA, Fair Labor Standards Act) | Ensures compliance with various employment-related statutes, reducing legal risks. | Ensures compliance, reducing potential legal pitfalls. | Non-compliance with employment statutes leading to legal actions. |

| Defense costs, settlements, judgments (up to policy limits) | Provides financial coverage for legal defense, settlements, or judgments, preventing potential financial distress. | Financial security against potential legal actions. | High financial costs associated with legal defense and judgments. |

| Possible third-party claims (customers, vendors, non-employees) | Expands protection beyond employees, safeguarding the company’s reputation and financial well-being. | Broadened protection encompassing third-party claims. | Potential legal actions from third parties leading to financial distress. |

Table 1: Coverage Areas of EPLI:

Costs and Factors Affecting EPLI Premiums

The cost of an employment practices liability insurance policy depends on several factors:

Number of Employees

Generally, the more employees a business has, the higher the premiums. More employees mean increased exposure. Minimum eligibility can be as few as 1 employee.

Industry and Location

Certain industries like technology, media, and healthcare face more frequent claims. California and New York tend to have the highest rates based on their litigation rates and employee-friendly laws.

Revenue

Higher revenue companies tend to purchase higher limits, so premiums correlate to some degree with revenue. But lower revenue companies still need coverage.

Claims History

Any previous employment lawsuits or EEOC/state agency charges will be factored in. A clean history will result in lower premiums in most cases.

Deductible Amount

Like other policies, selecting a higher deductible lowers the base premium. But a lower deductible makes sense for most small businesses.

Coverage Limits

Higher limits equal higher premiums. But lower limits may be exhausted quickly by defense costs. Limits of $500K to $1M are common among small to mid-size companies.

While premiums vary based on these criteria, EPLI pricing has become very competitive in recent years. Cost should not be a barrier to obtaining adequate coverage levels. Working with an independent agency like Branco Insurance Group can help find the most competitive EPLI rate for your business profile. We provide free quotes with no obligations.

Risk Management Tips to Prevent Employment Claims

While employment practices liability insurance provides critical protection, there are also steps companies can take to prevent claims and reduce risks:

Strong Written Employment Policies

A comprehensive employee handbook that clearly defines behavioral expectations, anti-discrimination policies, complaint procedures, and other standards is one of the best defenses against claims.

HR Training

Providing regular sexual harassment and diversity training to human resources staff and people managers ensures awareness of laws and best practices.

Employee Training

All employees should complete anti-harassment and code of conduct training upon hiring and annually. This establishes expectations.

Effective Hiring Practices

Pre-employment screening, background checks, and fair interview practices help avoid negligent hiring allegations. Using an employment application with appropriate disclaimers is also advised.

Clear Documentation Procedures

Documenting performance issues objectively along with any disciplinary steps taken can help defend wrongful termination or discrimination suits.

Multiple Reporting Channels

Having open-door policies, anonymous tip lines and multiple reporting paths for suspected violations encourages early awareness and resolution.

Responsive Investigation Procedures

Promptly investigating any reported incidents or employee concerns shows enforcement of policies against illegal practices.

While claims can happen in any workplace, companies that demonstrate commitment to compliance through documentation, training, and accessible policies put themselves in the best position to defend against allegations and avoid liability.

| Recommendation | Impact on Client | Benefits of Insurance | Risks Without Insurance |

|---|

| Evaluate EPLI needs based on company size, industry, and location. | Ensures that clients choose the right policy tailored to their business needs, preventing over- or under-insuring. | Tailored coverage ensures comprehensive protection. | Risk of being underinsured or overpaying for unnecessary coverage. |

| Consider a higher deductible to lower premiums. | Allows clients to manage costs while ensuring coverage. | Cost-effective coverage. | Higher premium costs. |

| Train management and employees on employment law compliance. | Reduces the chance of employment-related incidents that could lead to claims. | Educated staff leading to a reduced risk of claims. | Increased risk of employee-related incidents. |

| Document all employment actions and decisions. | Provides a paper trail that can be vital for defense in case of claims. | Strong defense in the event of claims. | Weak defense in the event of claims. |

| Review policies annually and after significant company changes. | Ensures that insurance policies remain relevant and comprehensive. | Updated coverage that matches the business’s current status. | Outdated coverage leading to potential gaps in protection. |

| Small businesses can get coverage for under $1,500/year. | Affordable coverage option for smaller businesses. | Cost-effective solution for small businesses. | High financial risk in the event of claims. |

| Work with a qualified insurance advisor to structure optimal coverage. | Ensures that clients get the most suitable policy for their needs. | Optimal coverage based on expert advice. | Suboptimal coverage that might not fully protect the business. |

| Promptly report any potential claims and seek legal guidance. | Minimizes the risk of claim rejection and ensures timely legal intervention. | Timely and efficient claims processing. | Potential claim rejection or delays. |

| Focus on building a compliant, well-documented workplace culture. | Promotes a compliant work environment, reducing the chance of employment-related incidents. | Reduced risk of employment-related incidents leading to claims. | Increased risk of claims due to non-compliance. |

Table 2: EPLI Tips for Employers

How to Obtain Employment Practices Liability Insurance

If you own or manage a business and want to protect against employment claims, here are some tips on obtaining coverage:

Determine Eligibility

- Nearly all for-profit, private-sector employers are eligible for EPLI regardless of size. Certain high-risk industries may face restrictions. Public entities and non-profits can also get coverage.

Understand Your Needs

- Consider your headcount, locations, HR resources, and legal compliance risks to determine appropriate coverage limits and deductibles. Enlist an insurance advisor to provide guidance if needed.

Find an Independent Insurance Agent

- Independent agents have relationships with multiple insurers and can shop for the best EPLI policy and rate for your business profile. Captive agents may be limited to one carrier.

Compare Multiple Quotes

- Be sure to get quotes from several insurers before selecting a policy. Rates and coverage can vary widely between insurance companies. An independent agent like Branco Insurance Group can quickly provide multiple EPLI quote comparisons.

Consider Policy Endorsements

- Endorsements like third-party coverage, wage and hour sub-limits, or added retaliation protection can customize the policy to your specific risks. Discuss options with an agent.

Analyze Exclusions and Limits

- Review the fine print to understand any exclusions like prior acts or intentional conduct that can limit coverage. Ensure the limits are adequate for potential liability.

Report Claims Promptly

- Notify your agent and carrier about any potential claims immediately upon becoming aware. Prompt notice is required to trigger coverage.

With the right EPLI partner, getting tailored and affordable employment practices liability protection for your business is straightforward.

Alternatives to Standalone EPLI Policies

For some smaller businesses, a standalone employment practices liability insurance policy may not be feasible or cost-effective. Here are two alternatives to consider:

EPLI Endorsements on BOP Policies

Many insurers offer EPLI coverage as an optional endorsement on Business Owner’s Policies (BOPs). While limits are usually capped at $100K or $250K, it provides basic protection and defense coverage at a lower cost. Make sure the insurer offers broad-form EPLI endorsements to avoid gaps.

Directors & Officers (D&O) Liability Insurance

D&O policies cover claims against individual directors and officers for wrongful acts like employment discrimination. While this does not directly cover the corporate entity, it helps protect leadership from personal liability. Adding the optional “Entity vs. Insured” coverage helps cover defense costs when claims are filed against both individual executives and the company.

Standalone EPLI policies remain the best option for comprehensive protection. But these alternatives allow smaller entities to secure coverage at lower premiums. Discuss all available options with a qualified agent to identify the most suitable solution for your current budget and risks. The EPLI experts at Branco Insurance Group provide guidance tailored specifically to your situation.

The Importance of EPLI for Small Businesses

Given their limited resources, small businesses under 50 employees have the most to gain from employment practices liability insurance. Here’s why EPLI is so critical for smaller companies:

Higher Claim Frequency

Small businesses account for the majority of EEOC charges filed. Lack of dedicated HR staff and formal policies contribute to increased lawsuit risk.

Lower Legal Budgets

Without sizable legal departments, small businesses can least afford the average $125,000 cost to defend an employment suit. EPLI fills this gap.

Fewer Cash Reserves

The average employment lawsuit settlement exceeds $40,000. Many small businesses lack the reserves to absorb judgments without serious financial damage.

Brand and Reputation Exposure

The negative publicity from an employment lawsuit can be a major blow for a small business without an established brand presence.

Key Person Impacts

Losing or having to fire a key employee due to a dispute can disproportionately impact operations when compared to large employers.

Owner Personal Liability

Unlike large corporations, small business owners often have personal assets at risk if sued directly for employment practices violations.

While every company should view EPLI as essential, the risks amplified by size and resources make a compelling case for small business owners to secure coverage.

Protect Your Connecticut Business with Employment Practices Liability Insurance

In today’s litigious environment, securing employment practices liability insurance is no longer an optional extra for employers. The risks and costs associated with employment lawsuits, discrimination claims, sexual harassment allegations, and other employee disputes make EPLI a necessity.

As an independent insurance agency serving Connecticut businesses for over a decade, Branco Insurance Group has the experience, carrier relationships, and resources to provide tailored EPLI solutions for organizations of any size. We offer complimentary policy reviews and quotes with no obligations. Contact us today to discuss:

- Your current HR policies, procedures, and training

- Past employee complaints or wrongful discharge issues

- Exposure concerns related to recent hires or terminations

- Coverage gaps under current insurance plans

- Budget considerations and premium options

- Policy limits and deductible recommendations

- Risk management strategies to reduce liability

Defending your business against potentially frivolous or malicious employee allegations can ruin your finances. Don’t leave yourself exposed without the right protection. Our Connecticut insurance experts are here to answer any questions and provide guidance on securing affordable EPLI tailored to your specific business needs and risks.

Key Takeaways on Employment Practices Liability Insurance

- EPLI covers defense costs and damages for claims like discrimination, wrongful termination, and harassment.

- Even small employers are at risk for costly employee lawsuits.

- Many standard policies exclude employment practices liability risks.

- Strong HR policies and training help reduce risks but claims can still occur.

- EPLI pricing is competitive, with policies starting under $1,500/year.

- Work with a qualified insurance advisor to structure optimal coverage.

- Promptly report any potential claims and seek legal guidance.

- Focus on building a compliant, well-documented workplace culture.